8 Potential Risks in Your Financial Advisory Practice

by Commonwealth Financial Network

Business risk is anything that threatens the continued success of your practice, and it can assume many forms. Unfortunately, many business owners overlook the potential risks that can derail a long-standing business. Why? Generally because they don’t understand the risk, don’t feel the risk is severe, or don’t believe it will happen. But what if it does?

Business risk is anything that threatens the continued success of your practice, and it can assume many forms. Unfortunately, many business owners overlook the potential risks that can derail a long-standing business. Why? Generally because they don’t understand the risk, don’t feel the risk is severe, or don’t believe it will happen. But what if it does?

Of course, you won’t always know what brand of mayhem will disrupt your business, but that doesn’t mean that you can’t prepare. To get you started, I’ve outlined eight potential risks in your financial advisory practice. By understanding and addressing these risks, you’ll be better positioned to protect your business—and your clients—before it’s too late.

According to a recent ThinkAdvisor article, some of your more financially capable competitors are enhancing their services. For example, Schwab Private Client, Merrill Edge, and Vanguard are offering more services at favorable price points. And robo-advisors such as Wealthfront and Betterment “have marched across the internet like a zombie apocalypse.”

These services have grown in response to changing client demographics and an appetite for high-tech, high-touch services for the emerging affluent market. If you want your business to change with the demographics, explore ways to reach out to millennials, and be prepared to talk about the value you provide compared with the competition (i.e., service, trustworthiness, and quality relationships).

Perhaps you’re familiar with the expression, “If you’re green, you’re growing; if you’re ripe, you’re rotting.” Although you’ve worked hard to get where you are, some growth will enable you to reinvest in more client services in this competitive market. Further, given fee compression, a sideways market, and increased competition for client dollars, finding ways to grow is even more important.

A Financial Planning article suggests a few options for managing this growth, including:

- Teaming up

- Merging

- Building infrastructure

- Segmenting services for clients

Clients with specific needs look for advisors with specialized knowledge. In fact, recent research suggests that specialist practices are more lucrative than their generalist peers. Still, only 15 percent of advisors concentrate on a niche, but these practices account for 29 percent of overall advisor assets.

So, for example, if you have knowledge of divorce and access to ancillary advisors, you may be better positioned to serve individuals going through a marriage breakup. Another option is to merge with other advisor firms with complementary services and expertise. By forming teams, you can present a more complete service offering for clients looking for that “one-stop shop.”

It’s well documented that millennials favor financial advice supported by technology. In a survey by Cisco Internet Business Solutions, a majority of wealthy under-55 clients were interested in meeting via videoconference, and many indicated they would like advisors to be technologically proactive. If possible, consider meeting virtually with younger clients. Another strategy is to use Twitter or LinkedIn to reach out to this group—just as they are using social media to learn more about you.

Technology has also affected trading tools and automation, facilitating timely trades and delivery of sophisticated investment strategies and creating more safeguards against market downturns. Your ability to use these tools may be the decisive strategic edge to attract clients. Plus, investing in technology can create efficiencies, drive profitability, and enable you to continue to thrive.

Even with the rise of technology, don’t underestimate the human touch. A survey by Capital One Investing revealed that 49 percent of millennials have a full-service investing account; of those who don’t use an advisor, 72 percent say they are likely to use one in the future. The need for skilled staff to support your practice will not diminish anytime soon.

A human resources manager can help ensure smart hires. If smart hiring practices are not used, your advisory business could face a plethora of human capital risks:

- Failure to attract employees

- Hiring of the wrong person

- Unsatisfactory performance

- Turnover

- Absenteeism

- Accident/injury

- Fraud

- Social problems

- Legal/compliance issues

Any of these risks could interrupt your business; two or three at the same time could seriously disrupt it.

You’re well aware that the SEC regulates financial firms. Yet debacles like the Enron scandal, Bernie Madoff, and the 2008 financial crisis happened—and we can expect them to continue to happen. Most advisors expect more, not fewer, regulations in the future.

It’s vital to keep abreast of what’s happening in the industry, as increased regulations would require careful planning and allocation of resources to ensure that compliance does not derail the profitability of your firm. For example, a current Department of Labor proposal would impose a fiduciary standard on advisors who sell financial products for a commission. It's not too early to think about how the cost for increased education and more business infrastructure to support this standard might pose a monetary threat to your business—and how you would handle it.

Here at Commonwealth, our Practice Management team has observed that advisors tend to experience “pain points” at predictable intervals:

- At $250,000 of production, advisors generally need to think about administrative staff to support the next spurt of growth.

- At $450,000, advisors need technical support and typically hire a paraplanner or research advisor.

- At $750,000, advisors are reaching capacity as solos and need to address efficiency within the practice by analyzing and segmenting their service model and pinpointing their growth plan.

How can you deal with these pain points? Start by creating repeatable office procedures, as well as understanding revenue distribution among clients, profitability by client, and optimal service models. These strategies may help you achieve the level of growth you need while providing the service that you want for clients.

When it comes to protecting yourself, I’m reminded of an old insurance sales question: “If you had a money machine in your basement that pumped out $600,000 a year, would you insure it?” Of course, the punch line is that you are the money machine. Are you protecting yourself against the losses that could derail your money machine? Significant loss threats include advisor death or disability, key person loss, an unexpected disaster (natural or otherwise), lawsuits, and failure to plan for business succession.

Here, best practices include insurance and continuity plans to protect those assets you cannot afford to lose. Also, be sure to perform annual reviews to update these plans in response to changing market conditions.

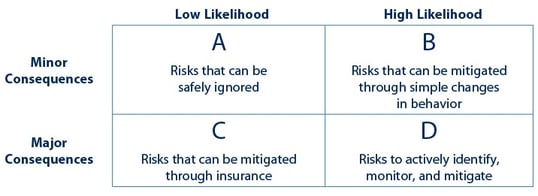

Now that we’ve covered some common risks, you’re ready to experiment. First, draw a risk matrix with four quadrants (see chart below). Next, label the row headers with the consequences of risk and the column headers with risk likelihood. It might be helpful to brainstorm the risks you perceive in your firm and categorize them.

Last but not least, build a business plan to address each quadrant until you’re satisfied that you’ve addressed the most important risks.

- Develop a vision: Where do you want to be in five years? What would you like to accomplish?

- Assess SWOT: Understand your firm’s strengths and weaknesses on the inside and opportunities and threats on the outside.

- Develop strategic directives: What actions can you take to achieve your firm’s vision while keeping risk reduction in mind?

- Create meaningful annual goals: Use SMART goals—strategic, measurable, achievable, realistic, and time-bound.

- Develop a plan of action: List tasks and timelines to achieve your goals.

- Implement: A wise person once told me, “At some point, everything degenerates to work.”

- Review annually: By building time to track goals, you’ll be able to adjust your plan accordingly.

I hope you will find that understanding these common business risks will help you better prepare for what may lie ahead. I’ll leave you with these words spoken by Warren Buffett after the 2008 financial meltdown: “You only find out who is swimming naked when the tide goes out.”

What do you consider to be the biggest risks to your financial advisory practice? Have you established a written business plan to address those risks? Please share your thoughts with us below.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network