Oil….When Will It Bottom?

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

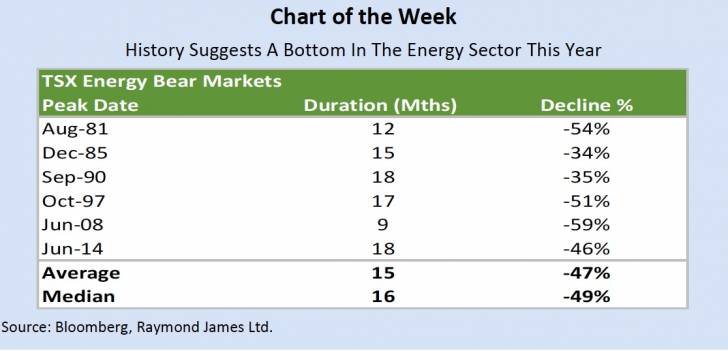

§ The WTI oil price has declined a staggering 75% since June 2014, essentially matching the 77% decline in 2008. An important contributing factor to the decline in oil prices is the sizable increase in US oil production over the last few years. This increased US production, along with record production by OPEC, has led to an oversupply of roughly 1.5 to 2 mln bpd in the global oil markets.

§ To bring the global oil markets back into balance, either demand will have to increase, or supply will have to be cut. Given our modest global growth expectations, we don’t see demand increasing meaningfully from here. Therefore, that leaves production cuts to help bring the global oil markets back into equilibrium. We are seeing early signs of this.

§ In the US, total daily oil production is down 400,000 bbl from the peak of 9.6 mln bpd last summer. We expect this to continue in the coming months, with US oil production possibly declining below 9 mln bpd.

§ More importantly, the tone from OPEC producers and Russia has changed and they are now beginning to discuss the prospect of production cuts. This week we saw further evidence of this with OPEC officials meeting with Iran to discuss a “production freeze”. Initially Iran rejected the freeze, however, following the meeting, Iran did in fact agree, which we believe could be the first steps to a future production cut.

§ We believe we are seeing early signs of producers addressing the oversupply in the oil markets, and believe that WTI will rebound later this year. This view is echoed by our US energy analyst, Pavel Molchanov, who is predicting that “oil prices should bottom in the first half (probably Q1/16), and rise substantially in the back half, averaging US$50 WTI for the year.”

Read/Download the complete report below:

Weekly Trends February 19, 2016

Copyright © Raymond James