Episodic volatility

by Jeffrey Saut, Chief Investment Strategist, Raymond James

February 8, 2016

“The year ahead will be one of ‘episodic volatility’ – rather than wildly veering highs and lows – an environment that will create opportunities for astute investors.”

. . . Simon Ho, Triple 3 Partners

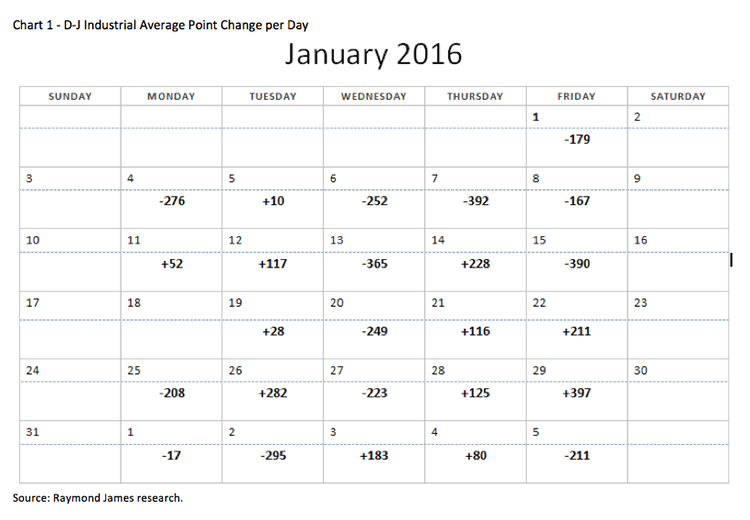

As many of you know, I was in New York City last week seeing institutional accounts and speaking at the IMCA conference (Investment Management Consultants Association). During the panel discussion between myself, Mary Ann Bartels (Merrill Lynch), and John Mackay (Morgan Stanley), I first heard the phrase “episodic volatility,” as used by Mary Ann. It was a catchy quip and is defined by Simon Ho as, “The past month is a portent of what is to come on the markets this year – bouts of volatility. It will not be calamitous as it was in 2008. It hasn’t been like that and it won’t be like that. Instead we will see small market movements of a few percent frequently, rather than any large GFC – like [big] one day falls (GFC = Global Financial Crisis).” When I Googled said phrase, the quote from Simon Ho popped up, so I don’t know if Mary Ann coined it, or someone else, but whoever did certainly captures what has been happening year-to-date! As my pal Doug Kass says, “The market has no memory from day to day,” as can be seen in the chart of the D-J Industrial Average (INDU/16204.97) so far this year. In studying the attendant chart the validity of Dougie’s statement becomes imminently apparent. Despite Mr. Market’s sociopathic attitude, the action year-to-date has leaned mainly to the downside as we surmised the first week of January and described it as a “selling stampede.” However, over the course of the stampede there have been a number of “thin reeds” we have tried to weave into an “investment basket” to determine when the stampede will subside. So let’s review.

After our fall off of the horse “rip your face off” Santa rally “call,” we got back on “the horse” and on January 6, 2016, when the major averages fell below their respective December closing lows, we surmised the S&P 500 (SPX/1880.05) was involved in a “selling stampede,” which typically lasts 17 – 25 sessions. During the current skein, the news backdrop has been brutal. To wit:

1) The Royal Bank of Scotland says to “sell everything,” which even if right is irresponsible.

2) JP Morgan is somewhat more responsible in saying “sell rallies.”

3) China devalues its currency as the economy slows.

4) North Korea sets off a hydrogen bomb.

5) Saudi Aribia executes 47 Shia enraging Iran.

6) Yemen launches numerous scud missiles at Saudi oil fields.

7) Oil crashes to $26 per barrel (oilmaggedden) and the list goes on.

More recently there have been numerous “thin reeds” suggestive of a bottoming process:

1) The highest odd lot short sales since March 2009 (small investors are bearish).

2) The most Google searches for the term “bear market” since March 2009.

3) There were no IPOs (initial public offerings) in the month of January.

4) The majority of stocks are down 20% or more from their 52-week highs.

5) Bearish sentiment is about as bleak as we have ever seen.

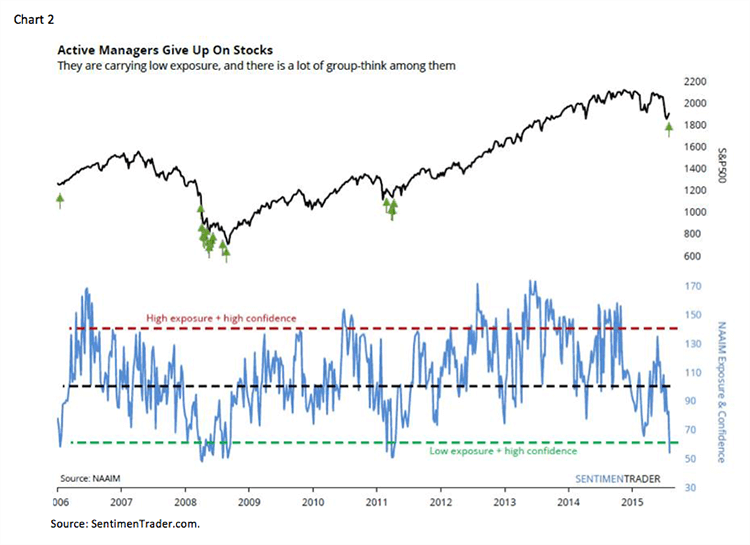

6) According to SentimenTrader, “Active investment managers are not only under-exposed to stocks, they're confident about it. This week, the average manager was only 22% exposed to stocks (see chart 2).”

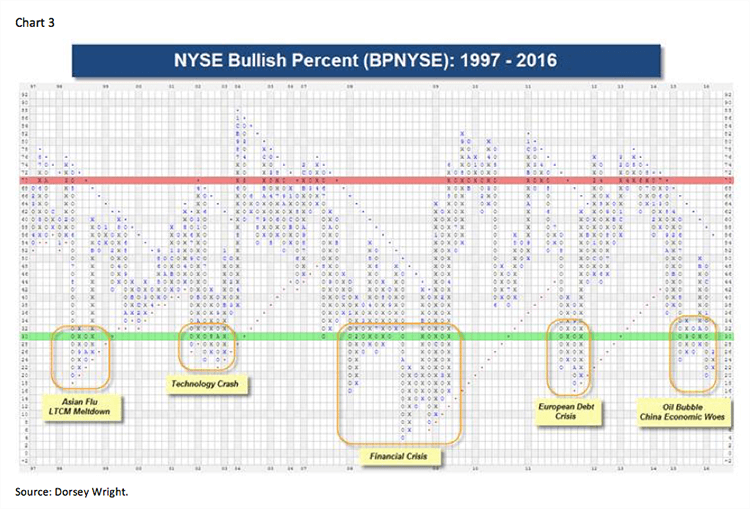

7) According to the esteemed Dorsey Wright organization, “Looking back over the last 20 years, we can easily identify four previous time frames in which the BPNYSE has fallen in to the green zone (read: bullish), below the 30% level (chart 3).

So where does all of this leave us? Well barring a “black swan” event, we should be nearing, or already at, the end of the “selling stampede.” Last week I was thinking the stampede ended on Thursday (1-28-16) at session 21. Last week, however, that view was called into question as the major indices still have not been able to string together three or more consecutive positive sessions, which is what is required to break the back of a stampede. It is also important not to commit capital until that sequence occurs. Regrettably, many have tried to catch the “falling knife” over the past five weeks only to have their fingers cut off. As for not doing “something stupid,” which is the phrase one of our financial advisors said to me last week; ladies and gentlemen, sometimes doing “something stupid” is the preferred strategy when you are trying to manage the risk in a portfolio. Take Tableau Software (DATA/$41.33) last week. It may have felt “stupid” selling it when it fell below its September 2015 lows of about $76 a week ago, but it doesn’t look “stupid” now with the shares changing hands at $41. Indeed, as Benjamin Graham wrote, “The essence of portfolio management is the management of RISKS, not the management of RETURNS.”

So what do we do here? Well for those of you that managed the risk and have some cash, I think we are close enough to a low to begin buying some select mutual funds. In my recent travels I met with a number of portfolio managers, but two of them really stood out for me. First was my friend Steve Vannelli who manages the GaveKal Knowledge Leaders Fund (GAVAX/$13.11), which I own and have written about numerous times. Second is Dan Roarty, portfolio manager (PM) of the AB Global Thematic Growth Fund (ATEYX/$79.47), which I am considering buying. I have met with Dan a few times and have become comfortable with his investment style. He took over the management of the fund a few years ago after an abysmal record by the previous PM. His fund is thematically centric, which obviously is a huge focus of mine. Themes discussed included: 1) Technological Innovation, 2) Demographic Change, 3) Sustainable Development, and 4) Emerging Market Evolution. Of particular interest, Dan showed me a chart and explained that in this turbulent market, participants are “paying up” for safety making allegedly “safe stocks” extraordinarily expensive. Plainly, I agree.

The call for this week: Last week a couple of new boogiemen arrived on the scene when Deutsche Bank shares (DB/$16.89) fell below their 2008 lows, fostering fears of a banking implosion; and Venezuela, as the Financial Times wrote, “It Could Be Too Late to Avoid Catastrophe in Venezuela.” Whatever the reason, something still feels “out of balance in the universe,” a phrase we have been repeating for many weeks. That said, we have now had one 90% Downside Day (2-2-16) and two 90% Upside Days (January 26 and 29 when 90% of total volume traded came in on the upside) reinforcing our belief that the selling stampede ended at session 21 on 1-28-16 with a “print low” for the SPX at about 1872. That intraday low has been tested twice since then. First on February 3rd and again last Friday. So far the 1872 level has contained the declines. If that level “falls,” however, it would suggest a full downside retest of the January lows between 1810 and 1820. Also if that happens, it would extend the “selling stampede,” making today session 28. As often stated, “A few stampedes have lasted 25 – 30 sessions, but it is very rare to see one go for more than 30 days.” And this morning the stampede continues, despite the Broncos’ win, as crude oil slides (-2.5%), North Korea launches ICBMs, China’s FX reserves fall to 2012 levels, Russian firepower helps Syrian forces edge toward Turkey boarder, and the U.K. considers leaving the EU; What a Wonderful World (https://www.youtube.com/watch?v=E2VCwBzGdPM). And that’s the way it is at session 28 in what is turning into a very long “selling stampede!” It is also why sometimes you do need to do something stupid to manage the risk and to NEVER try and catch a falling knife. We need three or more consecutive positive sessions before the “all clear” bell is sounded . . .