Peking Duck (for cover)

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

· Yuan inclusion in the IMF’s SDR basket in December was a great victory that was supposed to provide Beijing with greater incentive to liberalize its capital account and commencing the initiative to make the yuan used more internationally. Beijing’s aspiration for a freer floating exchange is motivated by its objective to compete better against the US dollar’s dominance in international trade. Unfortunately, it comes with serious consequences.

· Over the past several years, China has become uncompetitive against its main trading partners. China is no longer the destination for cheap labor. Since 2001, hourly manufacturing wages have risen by 12% a year at the same time that the yuan has risen to an all-time high against a trade-weighted basket of currencies. In the past 12 months, for example, exports to Russia and Brazil have fallen by 33% and 24%, respectively. The economy is being further weighed down by enormous debts and slumps in global trade and equity and property markets.

· Today’s challenges are a hangover from the aggressive actions taken after the 2008 financial crisis. China’s debt binge has grown at the unsustainable rate of 2X GDP. Global indebtedness is now the single greatest risk to the global economy; particularly because there are less effective monetary tools (or fiscal slack) to use.

· Since 2012, China has been trying to shift its economic growth model from export and industrial investment to one based on domestic demand. This is a bold undertaking that will help China become less dependent on foreign direct investment and help eliminate excessive industrial production of steel and coal other polluting products. The shift has been difficult, as other drivers of economic growth have been elusive.

· Despite massive over-capacity of steel, the adjustment had to be slow simply because China employs millions of people in the steel manufacturing industry. Laying-off too many people too quickly would have given rise to highly undesirable bouts of social unrest. This is one example of the massive amounts over-capacity and mis-allocation of resources embedded throughout the Chinese economy - which in turn results in global deflation.

· Economic slowdown is an unavoidable outcome for China. Depreciating its currency would certainly help export competitiveness, but there is a wall of money currently looking to move offshore. Capital controls may be ratcheted up, but they seldom work over time. Fear of currency depreciation would increase outflows. In turn, capital outflows would damage asset prices in China. The huge debt that has backed building projects, real estate and other endeavors would be materially impacted. Currency devaluation is a double-edged sword.

· China has spent over $250 billion of FX reserves in the past 2 months trying to protect its exchange rate from capital outflows. Officials cannot sustain this level of support for long and may ultimately need to use those reserves for bank recapitalization. Hedge Fund manager Kyle Bass discussed this on CNBC earlier this week.

· Despite the pros and cons of devaluation, it is inevitable. Officials will likely try to defer it for a few weeks to make internal preparations and to prevent hedge fund managers and other speculators from profiting from it, but ultimately Beijing has little choice. It will be interesting to see whether officials attempt to manufacture a weaker currency gradually or surprise the market with one or two large moves (e.g., 10% at a time).

· Regardless, a big devaluation by China would have enormous repercussions that global equity markets should fear. Asset valuations globally would have to be recalibrated accordingly. A large devaluation should be viewed as an attempt to steal growth from overseas.

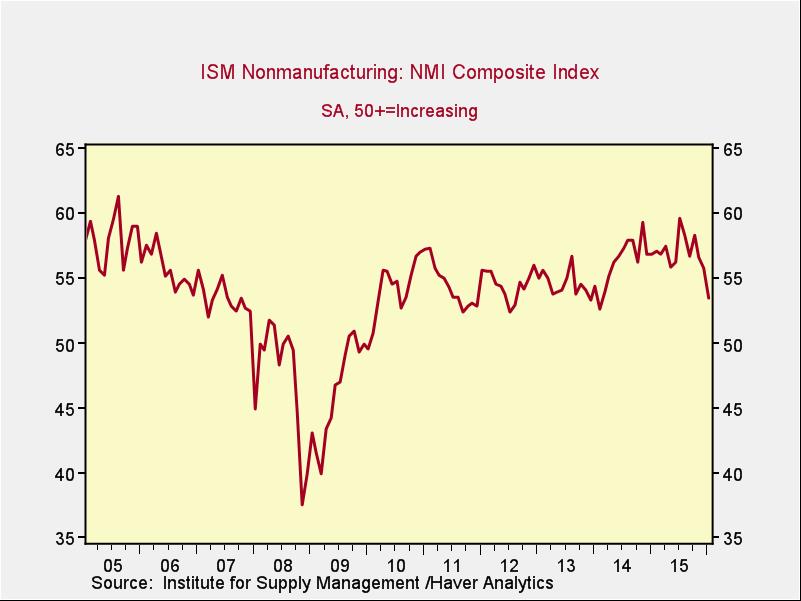

· The US dollar had a temporary rally yesterday. A decrease in the probability of further interest rate hikes by the Fed was the catalyst behind traders stopping out of dollar longs. The FOMC has no idea what the odds are of a hike at the March meeting because global uncertainties are high, so whether this persists is ambiguous.

· If the FOMC see enough economic and financial market stability and hence the window to hike, then it will do so. A hike would cause the dollar to (re)soar, and bring back all of the global and US corporate earning troubles that come with it. On the other hand, if economic and financial market conditions deteriorate (or China devalues), then the Fed will have to be on hold. Either way, long-dated Treasuries benefit.

· My January 4th note entitled, “The Bond Awakens” outlines other factors benefiting Treasuries and includes categories labeled, “Fundamental, Technical, Pension Demand, Relative Value, Fiscal, Regulatory, and Balance Sheet”. The economists calling for 3% or higher yield on the 10 year note are using the ‘off-the cuff’ stale and broken formula of: Growth + inflation (+/-) risk premium = 10 year yield. They fail to take into account the factors that I have mentioned which are powerful forces that lead to forced buying, and which give Treasuries commodity-like features.

· I maintain, All Roads Lead to Treasuries.

“And you may find yourself in another part of the world…And you may ask yourself: ‘how did I get here?’” – Talking Heads

Have a nice weekend.

Regards,

Guy

Guy Haselmann | Capital Markets Strategy

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Scotiabank | Global Banking and Markets

250 Vesey Street | New York, NY 10281

T-212.225.6686 | C-917-325-5816

guy.haselmann@scotiabank.com

Scotiabank is a business name used by The Bank of Nova Scotia

Read/Download the complete report below:

Global Macro Commentary February 5 - Peking Duck (for Cover)