Asset Allocation Q1/16 Outlook

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

Highlights

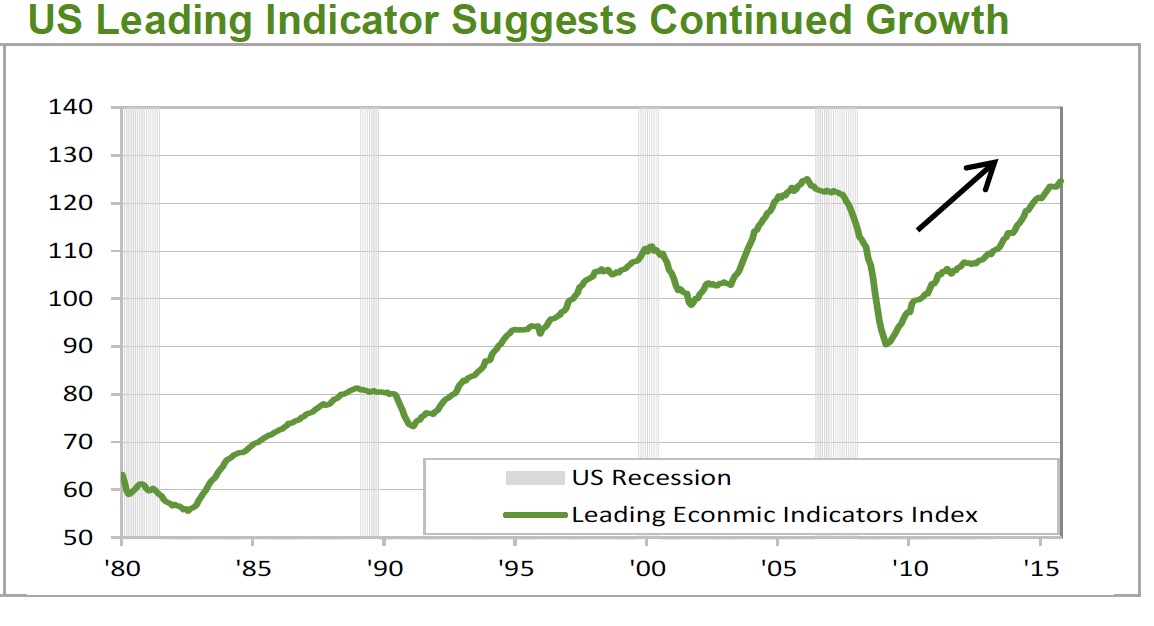

• Equity markets have come under extreme selling pressure this year on growing concerns of a global recession. Given these concerns, the focus of our quarterly asset allocation meeting was on the likelihood of a global recession, and its potential implications on asset and portfolio returns. While we believe the global economy is likely to experience subpar economic growth in 2016, the Investment Advisory Strategy Group (IASG) sees the odds of a US/global recession as low.

• Despite our view that recession odds are low, we cannot be blind to the fact that the equity markets are currently voicing a different opinion, which is one of uncertainty and concern. This can be seen in the weakening technicals of the equity markets and widening credit spreads within the fixed income markets, which are suggesting a more cautious stance.

• As such, the IASG feels it is prudent to reduce risk in portfolios by lowering equity exposure and increasing cash. We are increasing cash by 5%, taking our cash weight up to 7%. With this change, we will now be overweight cash (+2%), and will look to redeploy this cash in the future as opportunities arise (see page 5 for a breakdown of our asset allocation recommendations).

• We will be taking the proceeds from equities, particularly, US and international equities. We have been bullish and overweight US equities for some time now, which has served us well. This call worked out well last year, with the S&P 500 Index (S&P 500) up 20% in Canadian dollar terms. With CAD at our long-term target in the low $0.70s, we believe selling some US equities and converting back to Canadian dollars makes sense here.

• With these changes we will be modestly overweight equities in our moderate, growth and aggressive growth portfolios, but neutral in our conservative and capital preservation profiles. With the IASG seeing recession odds as low, we believe equities will still deliver positive returns in 2016, and with the potential for further rate hikes by the Fed, we believe bond returns will be muted, hence our continued overweight in equities.

Read/Download the complete report below: