Breaking Up Is Hard To Do

by Tony Scherrer, CFA, Smead Capital Management

At Smead Capital Management we are in the business of attempting to gain a clear understanding of what we refer to as a “Well Known Fact.” A Well Known Fact is a body of economic information which is known to all market participants and has been acted on by nearly anyone with access to capital.

With that in mind, as we assess what has gone on in the back-half of 2015, we are cognizant of the question we get asked about the most. This question beats most others by a wide margin: what is our view of the commodity complex in general, and oil in particular?

It’s an understandable question given the love affair that market participants have had with the idea for the better part of the last 15 years. The recent drop in oil prices and many of the securities involved in the energy business has caused an outcry for real answers. This outcry has intensified in light of what now appears to be another seemingly attractive entry-point for value investors or speculators who view the drop in oil to be an aberrational phenomena or temporary dip.

We understand. Most difficult breakups start with denial and always include a healthy dose of drama along the way. Consider the drama involved in 2008: the spot price of West Texas Intermediate (WTI) Midland Crude Oil cratered from $145.54 to $31.66 inside of the six-month period starting in July. You would think a 78% decline in a vehicle which doesn’t pay a dividend in the first place might invoke responses more similar to victims of attempted murder rather than simply jilted lovers.

But as Neil Sedaka’s hit song from 1962 would remind us, “Breaking Up Is Hard to Do.” The jilted lovers returned around Christmas of 2008, only to bull the price of oil back above $110 by April 2011. Thereafter, the affair over the following 3 years might be described more like a dysfunctional love-hate relationship, as oil grinded in a range from $110 to $80 with plenty of emotion and commentary. But affairs based on jilted lovers desperation and dismay never last. If anything, they’re really hard for outside observers to watch.

We continue to watch from the sidelines, owning nothing in the area.

We think the dramatic drop and bounce-back in mid-2008 that oil inflicted on its fans was the worst kind of domestic abuse. Because of its brevity, the healthy reaction that might otherwise have introduced its affected addicts to the first step of any good recovery program, denial, was never required. We would argue that we are now 7.5 years away from the 2008 peak, and the jilted crowd remains as dismayed, disbelieving, and confused by oil as they have ever been. We are almost uniformly told about the inevitability of a return to more “normal levels” of $70-90 from today’s $35 spot price on WTI. We see several problems with that because it defies the psychological trajectory you would normally expect among the tortured and abused, yet they are still fundamentally in love.

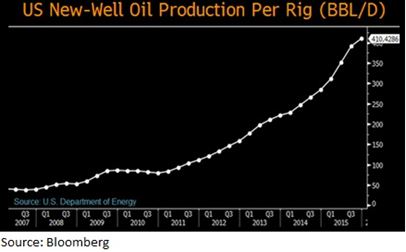

1. Oil has a new girlfriend called technology. She knows how to drill horizontally. She has learned words like hydraulic fracturing. Above all else, she has shown oil how to stretch a buck in terms of productivity. Consider the chart below, implying that a new rig produces about 10x the amount of oil today than it could just 8 years ago:

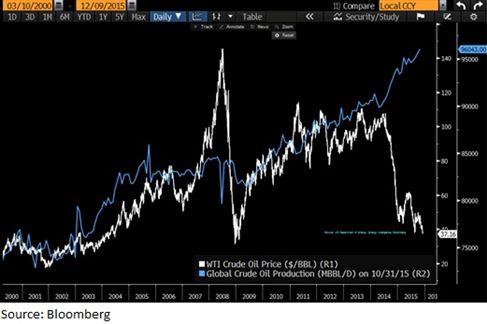

2. Oil has learned to spread its love lavishly with little regard to price. This may be partially based on the need among countries such as Russian and Saudi Arabia to play chicken with the newer wildcatters of the West, attempting to scare supply away from the global scene. All we know is the gap being created by ever increasing production in the face of a dramatic drop in price is the most extreme we have ever witnessed. Most relational psychology would view this as desperation, and we wouldn’t disagree.

3. The high-yield bond market debacle of late has largely been a commodity and energy phenomena. The chart below shows the yield spreads in the high-yield bond markets of energy related companies in comparison to the broader corporate high-yield market over the last 10 years. As of mid-December, 2015, the yield of these energy companies bond issuance hit 13.99%, or 5.53% higher than that of the high-yield corporate bond market. Clearly those looking for balance sheet and liquidity protection in this area are betting they won’t find it.

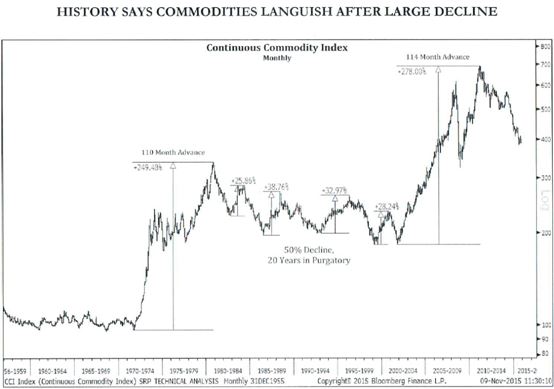

4. Commodities have a history of leaving affairs in the dust for several decades before showing any signs of life. The massive run-up in commodities during the Carter years was met with 2 decades of purgatory, peppered with several fairly sizable fits and starts for entertainment value. Very similar examples held true for the War of 1812, the U.S. Civil War, WWI and WW2. History gives us no reason to believe this time would be any different.

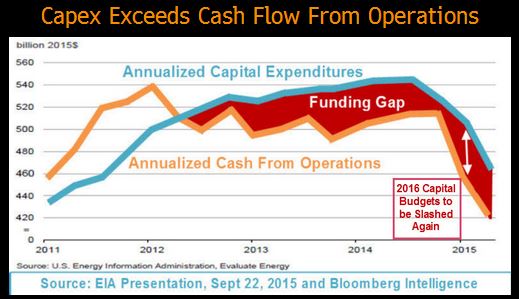

5. Cutting yearly capital expenditures is one of the few, but necessary tools needed to survive. The question will be how fast projects can be cut, and whether it’s enough to cause positive cash flow. The chart below indicates that as a group, the answer is too little too late. Further, if the FOMC moving to raise rates is any indication, the easy access to capital that has fueled the commodity boom over the last decade may be slowly coming to an end.

Remember that the opposite of love is not hate, it is indifference. Indifference takes time. Time marked well after the period of denial, fear, desperation, disgust and hatred. For oil and commodities to build its next run up, it needs absolute disregard. You’ll know we’re there when no one is talking about it, like 1999.

We consider the commodities complex to continue to have a high degree of risk associated with it. We believe it is a grave mistake to view the new and dramatic shifts in global supply and demand curves as temporary. Cutting capital expenditures is necessary, but in our view, is weak and non-sustainable as it can only marginally buffer income statements. Our goal remains long-term capital appreciation, and we think there is market risk which may be unavoidable for those who are committed to sector exposure. We thank you for your trust in our work and continued investment, and wish you the best as we begin 2016!

Sincerely,

Tony Scherrer, CFA

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. Tony Scherrer, CFA, Director of Research, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.