Ryan Lewenza: Sticking With US For Now

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

Highlights

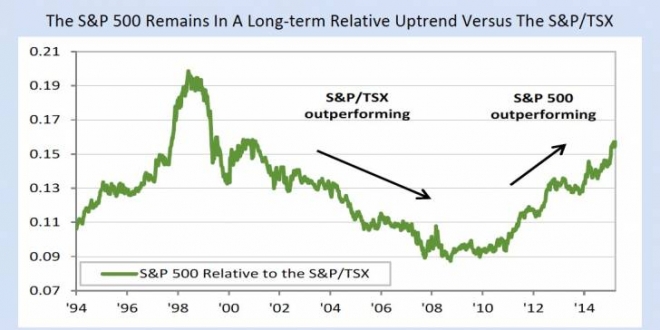

• One of our consistent investment themes during this market cycle has been our preference for international equities, particularly US stocks. Central to this thesis has been our cautious view of commodities, and the Canadian dollar. This call has been on the mark with the S&P 500 Index (S&P 500) returning 225% on a price basis since the 2009 lows in Canadian dollar terms, outperforming the S&P/TSX Composite Index (S&P/TSX) by 150%.

• As outlined in our 2016 Market Outlook report, we are projecting a year-end price of 14,220 for the S&P/TSX, which if realized would equate to a 9% price return. For the S&P 500 we are forecasting a year-end price target of 2,170, which if realized would equate to a 6% price return. With us projecting higher price returns for the S&P/TSX in 2016, why are we still recommending investors overweight US equities?

• Readers of our work know that we employ a multi-disciplined investment approach incorporating fundamentals and technical analysis into our calls. Until these trends change we will stick with our preference for US equities. Key points supporting our call include: 1) commodity prices remain in a well-established downtrend; 2) the S&P 500 has a stronger earnings trend; 3) the technicals remain stronger for the S&P 500 (see Chart of the Week); and 4) we remain bullish on the US dollar versus the CAD.

Read/Download the complete report below:

Copyright © Raymond James