Stock Market Control

by William Smead, Smead Capital Management

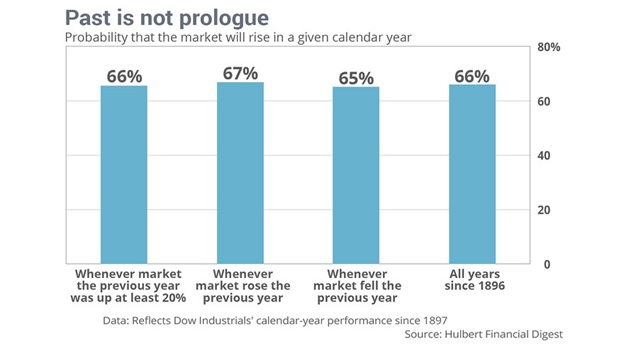

We saw the chart below in a recent Marketwatch.com column from Mark Hulbert. It shows the likelihood of the stock market going up or down in the next year, based on how it did the prior year:

This got us thinking about what you can and can’t control in the U.S. stock market. After all, the reason that stocks outperform other liquid asset classes over long stretches of time is the uncertainty and variability of returns. Here is a short list of things which can’t be controlled in the U.S. stock market:

1. Stock market results

The chart shows that there is a one in three chance that stocks will drop each year regardless of whatever happened the prior year. We don’t think investors should buy or own common stocks if they feel emotionally ill-equipped to withstand a losing year.

2. Stock Market Volatility

Even in good years, stocks can swing wildly from week to week and month to month. The average year sees a peak to trough decline of 10%, and we have seen a 20% or greater decline about once every five years on average. Twice in the last 16 years we saw the S&P 500 Index decline by more than 30%. Granted, that is an unusual occurrence, since there have been only five such declines since 1940. We remember telling common stock investors near the bottom of the stock market in March of 2009 that it would likely take about four years to get their portfolio value back to where it was before the decline in 2008-09. Those courageous and patient investors have been well rewarded by the bull market since then.

An owner of common stocks should expect gyrations as part of the price of admission and use holding periods which allow for recovery and success. The wise investor seeks to use wide, sharp and emotional price swings in their favor.

3. Stock Market Unpredictability

I am approaching my 36th year participating in the U.S. stock market and can say that nobody has proven any consistent ability to predict price moves in the indexes. I’ve read the prognostications of Joe Granville, Stan Weinstein, Marty Zweig, Comstock Partners, Robert Prechter, George Gilder, Nouriel Roubini, Meredith Whitney and numerous other very smart people in my career. The one thing they have in common is they attracted a large following after being very right on a major stock market prediction. However, doing so consistently is a bit like trying to find the pot of gold at the end of the rainbow.

We recently read the musings of a highly-respected asset-allocation firm about their seven-year predictions of asset class returns. Their prediction for the U.S. stock market is extremely negative, which would scare a normal observer and could very well end up being valid. However, we have been reading their predictions for the last ten years and have seen their consistent pessimism for U.S. stocks. We also remember their optimism about emerging markets and commodities. Surely, these predictions from the last five years must have cost someone who followed their advice some serious money.

4. Relative Performance

A study of the best stock picking disciplines of the last 60 years (Buffett, Neff, Templeton, Lynch and Carret) showed that they underperformed the S&P 500 Index 35% of the calendar years during their long and illustrious track records. We expect to be subject to those statistics at best and have very little control over which years we get beat by the index. Our goal is to beat the stock market over ten and twenty-year time periods and we believe those results would be unattainable if you try and smooth that truth.

Things We Seek to Control

We’re not about being glum or dour. We certainly believe there are things that investors can control. We’ve outlined three key tenets to consider when investing in common stocks.

1. Valuation Matters Dearly

You can control which stocks you own, and you are free to emphasize stocks which are cheap in relation to profits, free-cash flow, dividends or book value. Studies show that results are improved over both short and long-term holdings periods by constantly reemphasizing cheaper common stocks. This requires a contrarian nature, because when these common stocks are cheap their warts show easily. Therefore, you need to be lonely and courageous.

2. Activity Eats into Returns

A wise financial advisor told us in early 2012 that a stock portfolio is like a bar of soap: the more you rub it, the smaller it gets. A 2013 study in the Financial Analysts Journal showed that the average turnover among U.S. large-cap equity funds has been 62% and it costs the average equity mutual fund in the database 0.81% (81 basis points) per year in returns. We seek to own securities for an average of over seven years and attempt to save significantly on trading costs by doing so. If you can control yourself and be very patient, we think you can improve long-term results.

3. Quality Adds Alpha and Promotes Patience

Studies have shown that qualitative characteristics like strong balance sheet, consistently high profitability and low-earnings variability add to returns over long time periods. These qualities give owners more ability to stay put in bad stock market environments and/or when a company temporarily stumbles. Riding through thick and thin can be controlled and is augmented if there is no threat of one of your companies going out of business. Again, if you can control yourself, you can use long-durations to let quality help you overcome the forces you can’t control.

Conclusion

We make no effort at Smead Capital Management to have any control over stock market results, volatility, unpredictability and relative performance. We haven’t got any special ability to know what stocks will do next year or how we will fare on a relative basis. What we do try to control is what we own, how cheap it is, how often we make changes to our portfolio (we subscribe to “lethargy bordering on sloth”—Warren Buffett) and what kind of quality we demand from the companies we buy and own.

We do this based on our eight criteria for stock selection. In practicing our discipline we seek high quality companies, purchased at bargain prices and have a desire to hold them for long time periods. In other words, we try to control ourselves, our portfolio and apply long-durational and favorable probabilities.

Warm Regards,

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management