Tech Talk for Friday December 11th 2015

by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @equityclock

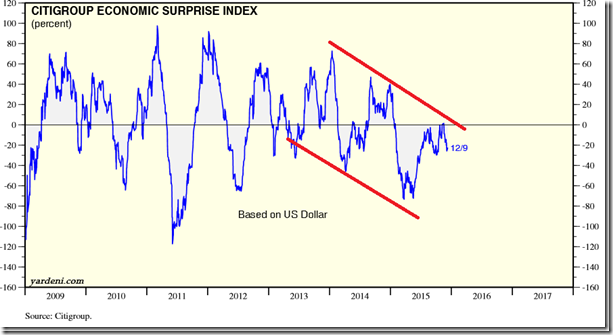

Series of economic misses has caused the Citigroup Surprise Index to roll over again.

Technical action by S&P 500 stocks to Noon: Quietly bearish. Breakout: $ABC. Breakdowns: $DISCA, $LEG, $NDAQ, $JNPR, $BLL, $SLG

Editor’s Note: After Noon, Delta Air broke intermediate resistance and Sealed Air broke intermediate support.

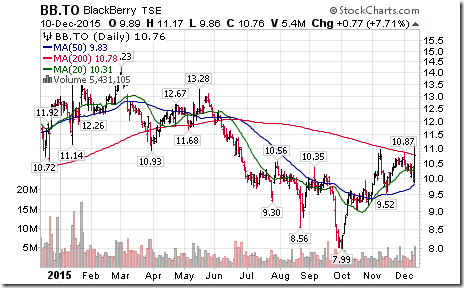

Nice breakout by Blackberry above Cdn$10.95 on higher than average volume to extend an intermediate uptrend.

Trader’s Corner

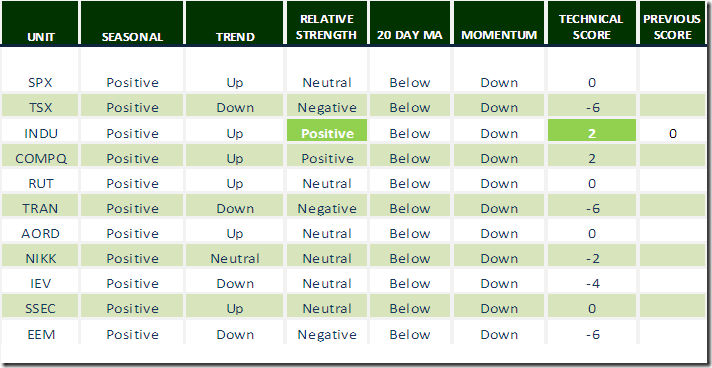

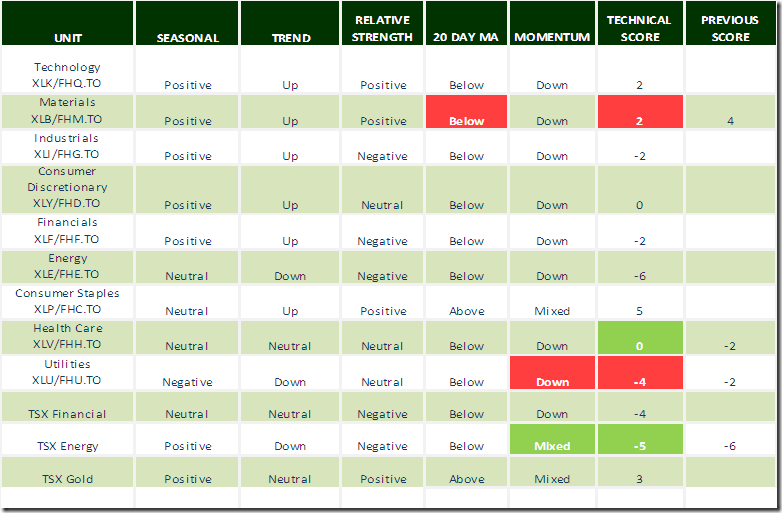

Daily Seasonal/Technical Equity Trends for December 10th 2015

Green: Increase from previous day

Red: Decrease from previous day

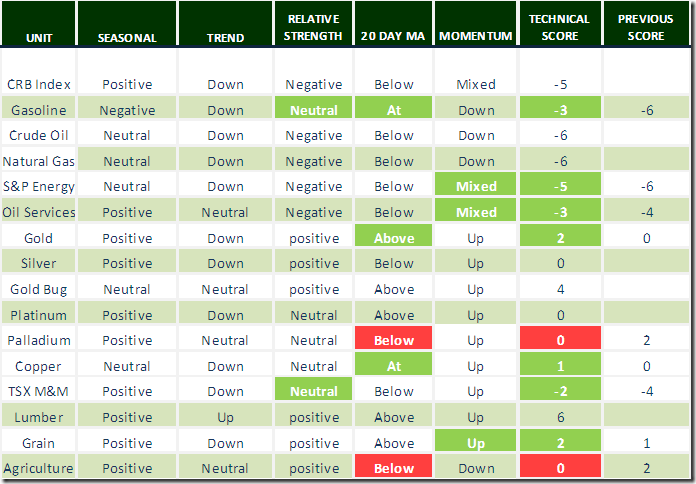

Daily Seasonal/Technical Commodities Trends for December 10th 2015

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for December 10th 2015

Green: Increase from previous day

Red: Decrease from previous day

FP Trading Desk Headline

FP Trading Desk headline reads,”Blackberry’s Priv launch seems solid as investors await initial sales figures”. Following is a link:

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Taking Things For Granted For Traders

By Adrienne Toghraie, Trader’s Success Coach

We would love to trust that the good things we know to be true are there for us to count on. From the telephone number and the area code we have used for years to being safe when we travel. For a trader who has been consistent with his strategy, he would love to believe that the markets continue to allow his strategy to work.

Every part of a trader’s life can affect his performance. As we have seen on the news and in personal experiences, all of this can change in a moment. The balance to earn money consistently in the markets is so fragile that any one thing could upset performance. The fact is that you can never take anything for granted. We would like to believe:

On the personal front:

• The relationship I have with my spouse is secure

• I will not be served food that could make me sick at a restaurant

• The drugs that are approved by the FDA will not cause me to get sick or die

• My child will never take drugs or become pregnant

• No one will find a cause to sue me unjustly

• My home is safe

On the business front:

• My co-workers will never embezzle from the company

• The company will never lay me off or fire me

• My company will never go bankrupt

On the investment front:

• This major company is secure and will always make profits

• There will never be a financial meltdown in this country

• Our lenders from other countries will never call back their loans

And, I will not go near environmental issues of concern.

If you cannot count on anything, then you will be afraid of everything and trust no one. So how do you live your life when at any moment your world can fall apart?

1. Live the best you can while appreciating what you have, looking forward to an even brighter future. You only have the moment of now in any case.

2. Contingency plan in your life and in your trading. This will give you some sense of security.

3. Make the best choices you can with what is available to you. Then you will feel more responsible.

4. Live within your means and save for the future. This will take some of the pressure off.

5. Build skills that will help you in difficult circumstances. You will have more options.

6. Keep up your health. This is vital for the best possible outcome in every circumstance.

7. See the bright side of every situation. When you lift your spirits, opportunities will more

likely present themselves.

8. Be generous with yourself and others. You only have what you give and it will come back to you in

many ways.

9. Trust the people in your life, but notice the signs of changes. When you are more sensitive to the people

in your life, you will more likely be able to head off problems before it is too late.

And, specifically for trading:

1. Keep your business plan current with market conditions and go over it whenever there are changes in

your life. Going back to basics will keep you in the game.

2. Keep a journal and notice changes in yourself and the markets. When you are aware of changes, you can

take the actions necessary to make adjustments.

3. Have a set time for a periodic review of your business plan and strategy. This will help you to not be

complacent with problems and give you an opportunity to improve your game.

The fact is that there are two truths. We cannot take anything for granted and to live life joyfully we must be able to trust. Trusting develops when we accumulate resources, plan, become honest with ourselves, take action and adjust when life throws a few curve balls.

Free Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

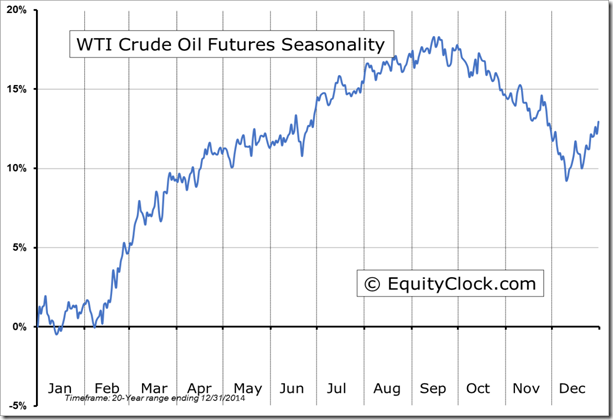

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Editor’s Note: On average during the past 20 years, crude oil reached a seasonal low today.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca