Asset Allocation Q3/15 Update

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• It was a challenging third quarter with stocks selling off and volatility spiking. During the quarter the MSCI World Index, S&P 500 Index (S&P 500), and the S&P/TSX Composite Index (S&P/TSX) lost 8.8%, 6.9% and 8.6%, respectively in local currency terms. There were four main drivers of the sell-off which included: 1) growing concerns over China’s slowing economy and the Yuan devaluation; 2) the prospect of a US Federal Reserve (Fed) rate hike; 3) weak seasonality; and 4) the equity markets were overdue with the S&P 500 having not experienced a 10% correction since mid-2011. Since the October equity market low, global equities have recouped most of their losses with many indices back near their all-time highs.

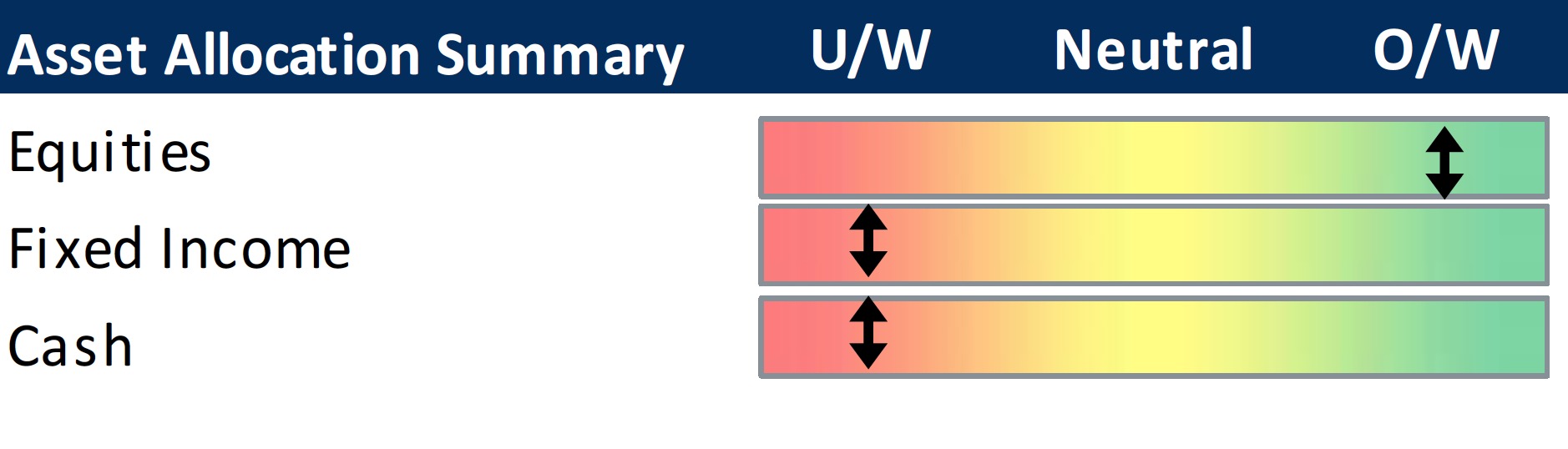

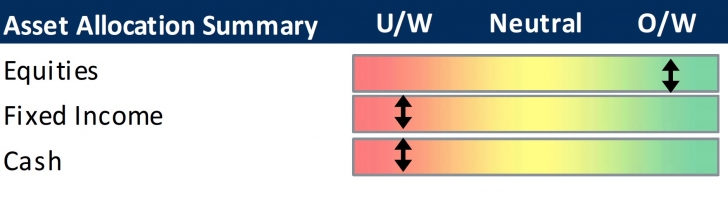

• The Investment Advisory Strategy Group (IASG) recently met to discuss the market outlook and review our recommended asset mixes. Overall, the IASG maintains its bullish outlook for equities, but has become increasingly concerned about the downside risks for equities. We believe 2016 could prove to be an important inflection point for the equity markets, and therefore stress that investors need to be vigilant and flexible in managing their portfolios.

• The IASG made no changes to our recommended asset mix and investor profiles in the quarter.

• Within bonds we continue to prefer high-quality corporate bonds, where we see better value. For example, the yield on US BBB investment grade bonds has increased from roughly 4.5% in H1/15 to 5.5% currently. On a spread basis (over government bonds), spreads have widened significantly from roughly 250 bps in H1/15 to 325 bps currently. Similarly, Canadian BBB investment grade spreads have widened by roughly 50 bps to 250 since the summer. Historically, credit spreads have averaged 200 and 220 bps respectively for US and Canadian BBB bonds. Currently, at 325 and 250 bps respectively, credit is “cheap” relative to history.

• Within equities we continue to prefer developed markets to the emerging markets, with Europe and the US being our preferred regions. For Canada/US, we continue to prefer US stocks given: 1) the continued challenging environment for commodities; 2) the stronger earnings outlook for US stocks; 3) our bullish outlook for the US dollar; and 4) the stronger technical profile of the S&P 500.

Read/Download the complete report below: