Jeffrey Saut: "Thanksgiving dinner"

by Jeffrey Saut, Chief Investment Strategist, Raymond James

Direction: In a large bowl, combine contents with a confused investor population. Toss lightly. Just before roasting, spoon loosely into body cavity. Do not over stuff! Truss all openings so that nothing escapes. Use skewers if needed.

Ingredients: Dough, watered stock, enriched money supply, malted securities, financial sausage, derivative yeast to increase expansion, government regulations added to retard spoilage.

This recipe for Thanksgiving dinner was proffered by my friends at Comstock Partners in an era gone by. Stan Salvigsen, Michael Aronstein, and Charlie Minter (Comstock Partners) wrote some of the best stock market strategy reports ever scribed on the Street of Dreams. Stan died in his fifties, I have lost touch with Charles, but Michael still writes stunningly good stock market strategy while managing money at Marketfield Asset Management. I resurrect thoughts of Comstock Partners this morning, not just because I think their Thanksgiving recipe is appropriate, but because they were one of the first to recognize the beginning of the great bull market. It was in the early 1980s when Stan broke off from Merrill Lynch and formed Comstock. Shortly thereafter the trio was writing reports like “Banzai Pipeline,” noting that if you wanted to catch a wave you had to get into the water. The reference was that it is the start of a great secular bull market in stocks and bonds, so if you want to participate, you have to “grab a surfboard and get into the water.”

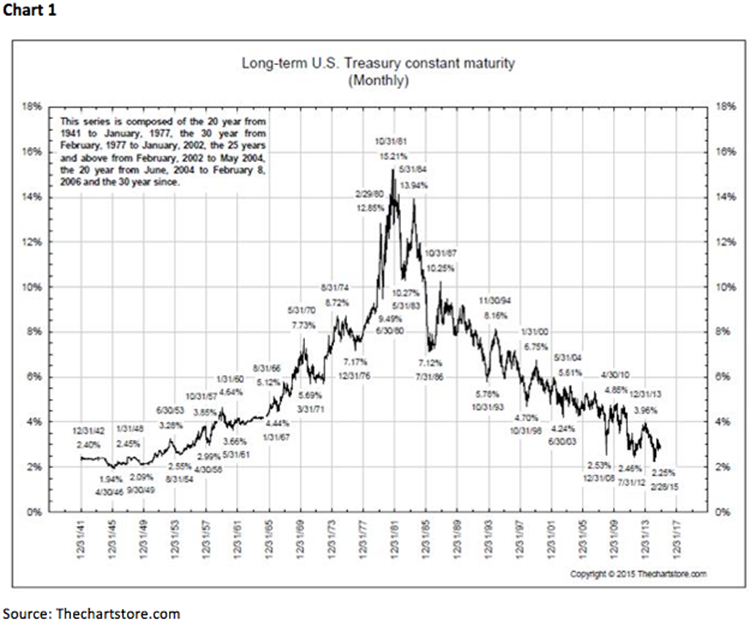

This morning I ponder whether if Comstock was still together would they be writing about a secular bear market that might be commencing in bonds? Indeed, the bond bull market began in October 1981 with the yield on the 30-year Treasury bond at 15.21%. Ladies and gentlemen, while the long bond bottomed earlier this year at ~2.2% and currently resides at about 3%, the bond bull is/was 34 years old, for one of the longest bull markets in history (see chart 1 on page 3)! The focus on bonds this morning is because my model has always said the Fed could increase interest rates in November, even though there is not an official FOMC meeting. Of course that statement has brought about “cat calls” from other pundits, but the Federal Reserve does NOT need an FOMC meeting to raise interest rates. In fact, there is actually a Federal Reserve discount rate meeting today (Monday) and there is speculation the discount rate could be raised. For the record, and according to Investopedia, “The discount rate is the interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserve Bank’s discount window.”

Much has been written about how rising interest rates always derail bull markets, but the fact of the matter is that is just not true. Since 1953 the average months from the Fed’s first interest rate hike until the equity markets peak is ~30 months. Moreover, the average performance three months after the first hike is -0.2%, six months later it is +4.1%, nine months +7.3%, and in 12 months +9.5% according to the Federal Reserve as compiled by Omega Advisors. Additionally, as scribed by my friend Peter Boockvar and quoted in Friday’s Morning Tack:

With markets about 24 hours past the release of the minutes from the September FOMC meeting that reminded all that December is highly likely when we’ll see a rate hike, the 2s/10s spread today is narrowing to the lowest level since April on a closing basis at 136 bps. It was at 141 bps before the release of the minutes. It widened to 151 bps on September 17th, the day the Fed chose not to raise rates. . . . If the bear flattening from here forward continues, it will say a lot about how the Treasury market thinks the US economy can handle rate hikes.

Plainly, I agree that the various markets can handle a 25 basis point increase in rates. Evidently, the S&P 500 (SPX/2089.17) believes it as well given its leap from last week’s swoon to ~2023 into last Friday’s close of 2089. I told Barron’s Vito Raccanelli on Friday that we have entered a seasonally very strong period for the equity markets and that performance anxiety would probably keep the pros “paying up” for stocks into year-end. To be sure, I have learned the hard way it is difficult to sell stocks off in the ebullient month of December. And while Vito used that quote, he didn’t include, “Just like the ‘lock out’ rally from September 29, 2015 to November 3rd didn’t give the ‘outs’ a chance to get ‘in,’ we may have just started a repeat of that ‘melt up’.”

Shortly after the Barron’s conversation this quip came across the transom from the invaluable Kimble Charting Solutions, with a tip of the hat to Ryan Detrick, who I have often quoted. They write:

The average year has 252 trading days. This is interesting, as Wednesday was the 223rd trading day of the year. In other words, it kicked off the final 30 trading days of the year. We’ve noted many times before how the end of the year tends to be very bullish based on seasonality. In fact, since 1950, November and December are the two strongest months. Many call this late year rally “The Santa Claus Rally.” What is worth noting though, is the first part of November can be weak – before the usual late Thanksgiving strength. Here’s a chart we’ve been sharing with Members and it shows November tends to form a low around the 12th and then has a late rally. The low this time was the 13th before the recent strength. So what happens the final 30 days? Well, what stands out to us is the last 30 days of the year haven’t been lower for an incredible 12 straight years.

Speaking of bull markets, I was on the phone with one of the best “bulls” I know, namely Ron Baron, eponymous captain of Baron Capital. Like me, Ron is bullish about the longer-term prospects for the equity markets; however, we spent more time talking about stocks than macro things. And at the risk of over featuring Iridium Communications (IRDM/$7.75/Strong Buy); yes, Ron still likes and holds Iridium shares. Despite the stock’s slide from its mid-April high of over $11, the story has never really changed. In the not too distant future, all of the company’s low orbiting satellites should be launched and our analyst believes Iridium will turn into a massive free cash flow story. Enough said! While we did discuss a number of other stocks, I thought I would rather leave you with some triple-play ideas from the Raymond James research universe. Remember, triple plays are companies that beat both earnings and revenue estimates and guided forward earnings estimates higher. They are favorably rated by our covering fundamental analysts and screen positively on our algorithms. The list includes: Cubesmart (CUBE/$28.92/Outperform); ICU Medical (ICUI/$112.75/Strong Buy); Masimo Corporation (MASI/$41.72/Strong Buy); and NVIDIA Corporation (NVDA/$31.39/Strong Buy).

The call for this week: Last week the NASDAQ 100’s 50-day moving average (DMA) crossed above its 200-DMA (Chart 2 on page 3) and the Biotech iShares ETF broke out above its downtrend line (Chart 3 on page 4). Meanwhile the S&P 500 and D-J Industrial Average continue to reside above their respective 50- and 200-DMAs (read: bullish). Also of interest is that the Paris tragedies give Mario Draghi HUGE cover for more quantitative easing (QE), implying higher European stocks and a lower euro currency. We think the way to play that is via the WisdomTree Inter Hedged ETF (HEDJ/$62.15), which is “long” Europe with the currency hedged out. Typically following a Friday option expiration the markets consolidate/pull back the next Monday. But since 1995 the SPX has been higher 60% of the time over Thanksgiving week, by an average of 0.81%. We will see if that plays this week. Happy turkey!

Copyright © Raymond James