The Plunge in Silver is a Typical Pattern in Commodities

by Eddy Elfenbein, Crossing Wall Street

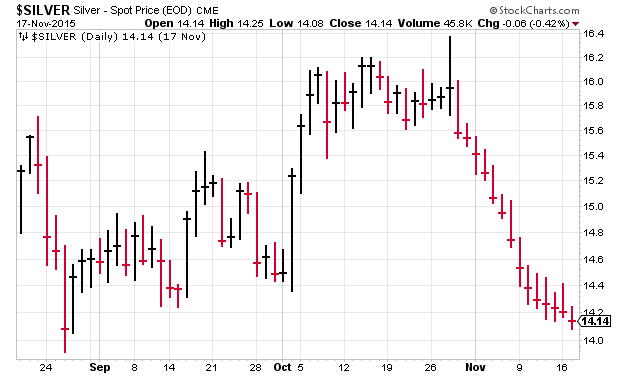

The decline in silver has managed to do something impressive — it’s gotten even worse. The price of silver has fallen for the last 15 days in a row, and it looks to make it #16 today.

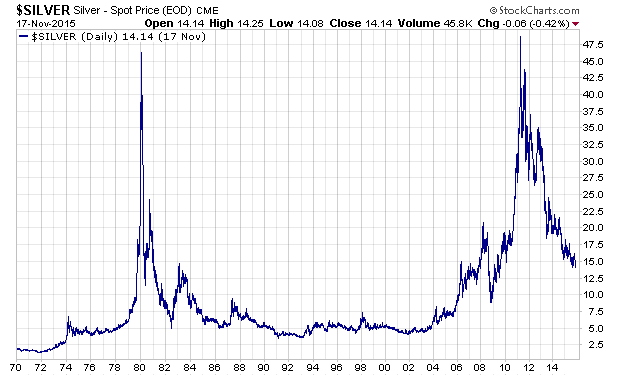

I once heard that slot machines are specifically designed to fall in the psychological sweet spot for the human brain. You win just often enough to keep playing but lose just enough to make the game a loser for you. I think commodity investing works the same way. Commodity investing seems to be defined by very large spikes followed by long, slow declines.

Check out the silver chart going back to 1970:

Thirty-five years after the Hunt brothers tried to corner the world silver market, the metal is still going for much less than it did at its peak in 1980.

This post originally appeared at Crossing Wall Street, authored by Eddy Elfenbein.

Copyright © Crossing Wall Street