Drilling for Oil on Wall Street

by William Smead, Smead Capital Management

As long-duration common stock owners and investors, we focus on our bottoms-up stock picking and seek to analyze the micro-economics of each industry involved. However, the importance of oil prices to the economy of the U.S. and its effect on inflation helps determine the intrinsic value of our companies. While we currently own no energy companies in our portfolio, we would like to pause and see what the rhymes of history can tell us about the circumstances of today.

On November 9th, 2015, Apache Corporation announced the rejection of a takeover offer from an unannounced suitor which turned out to be Anadarko Petroleum. We at Smead Capital Management believe we have entered a period of time where it might be cheaper to drill oil on Wall Street than it is to poke holes in the ground. We also think that those who track rig counts in hope of finding a bottom in oil prices need to review the prior oil boom/bust cycle.

We think a little history on 1984 and background is necessary for our readers. T. Boone Pickens ran a small-time oil and gas company in the early 1980s when oil prices peaked at $40 per barrel. By 1984, the U.S. stock market was two years into a powerful multi-decade bull market while energy stocks suffered the bust part of the boom-bust cycle. Large integrated oil stocks were on sale on Wall Street. Pickens decided that it was cheaper to drill oil on Wall Street than it was to poke holes in the ground.

Pickens was among a group of activist investors cultivated by Drexel Burnham’s Michael Milken, the junk-bond king, to use his financing muscle to buy large companies on the New York Stock Exchange (this writer was employed at Drexel Burnham from 1980 to 1989). Pickens took a 5% stake in Gulf Oil and threatened to buy the company. Chevron ultimately bought the company for $13.3 billion and Pickens made a killing.

As I remember the mid-1980s, corporate acquisitions made Pickens a celebrity in an era of vigorous and extensively reported takeover activity. His most publicized deals included attempted buyouts of Cities Service, Gulf Oil, Phillips Petroleum, and Unocal. It was during this period that Pickens led Mesa’s successful acquisitions of Pioneer Petroleum and the mid-continent assets of Tenneco.

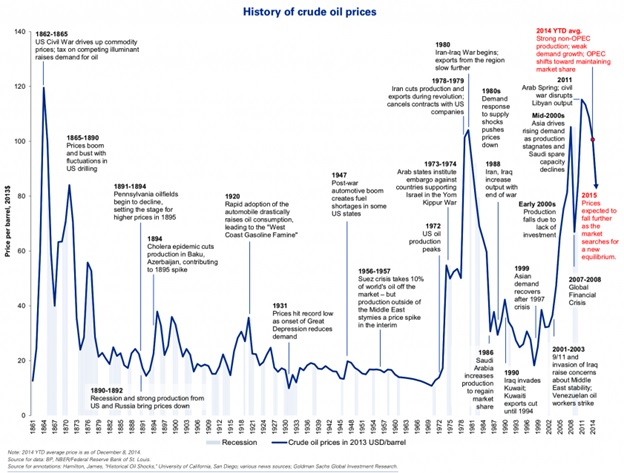

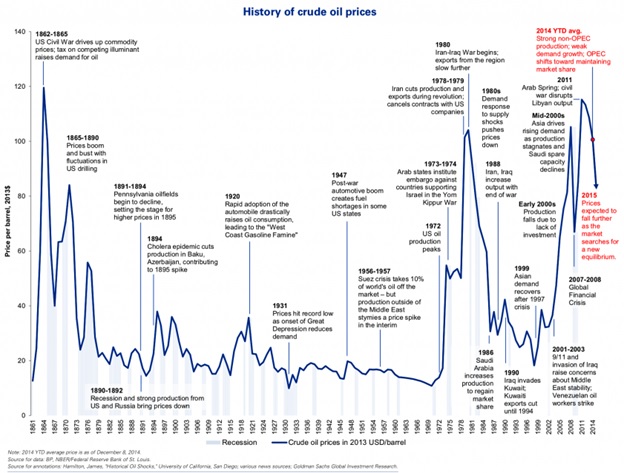

There were some very good things brewing for the U.S. stock market and the U.S. economy and some very bad things brewing for the oil and gas business at the same time in 1984. Look at the price chart of oil in 2013 dollars below:

Pickens went on to be an activist in other major oil companies as the industry consolidated. As you can see in the chart, oil prices remained in the doghouse for all but a few months in 1990, surrounding the invasion of Kuwait by Saddam Hussein, before ultimately bottoming in early 1999 at around $20 per barrel ($11 per barrel in 1999 dollars). Common stock bargain hunters in oil and gas were hard to find in 1998 and 1999, right at the time oil and gas stocks were hated the most, and offered the best ten-year forward returns. This was 14 years after Pickens’ offer to buy Gulf Oil Company!

Ironically, there are other non-oil parallels to today and 1984. Investors were sure back then that the emergence of the largest population group in the U.S., baby-boomers, would trigger a much better economy and demand for oil and gas. They were right on one side of that logic as the U.S. economy was strong until the tech bubble burst in 2000-2002 and a recession was triggered in the U.S. Unfortunately for investors in energy companies, a strong economy in America and lower rig counts did nothing for the price of oil.

We are in the same position today with the largest population group, millennials, as we foresee them contributing heavily to future economic growth via household formation, child bearing, car buying and home buying. We don’t see them bailing out the bust in oil prices and caution investors to wait for years for better underlying fundamentals.

Another irony to the rhyme is that the second most powerful nation in the world, the U.S.S.R., saw their economy decelerating fast in 1984. China’s economy is decelerating fast today, and oil investors are unlikely to get bailed out by their use of oil, gas and diesel fuel in the coming years. Lastly, T. Boone Pickens is holding 2015 seminars on how to take advantage of the bust in the oil patch. To find companies in the energy area, we are assuming a great deal of patience is going to be required, just like in 1984.

Warm Regards,

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management