Buy Side vs. Sell Side

by Ben Carlson, A Wealth of Common Sense

“What is the reward of being right, benchmarked against the cost of being wrong?” – David Rosenberg

For a number of years David Rosenberg was one of the top dogs at one of the largest, most well-known firms on Wall Street. As he told Barry Ritholtz on a recent episode of Masters in Business, it wasn’t until he left that job that he realized how much he still had to learn:

When you’re the Chief Economist at Merrill Lynch you think you’re the starting pitcher for the New York Yankees. You have it all figured out. I realized when I got to Gluskin Sheff how much I didn’t know.

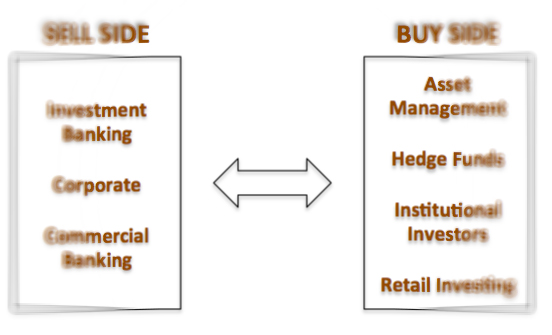

About six years ago Rosenberg made the transition from the sell side, at Merrill Lynch, to the buy side, at Gluskin Sheff. For the uninitiated, on Wall Street the sell side consists of those who produce research, forecasts and advice, but don’t manage client assets. It’s called the ‘sell side’ because they sell their research and ideas. On the other hand, the buy side consists of people who manage money — portfolio managers, hedge funds, RIAs, etc. The buy side uses those research reports and forecasts to make their investment decisions.

Both the buy side and the sell side can add or detract value from their client’s bottom line depending on who you’re working with, but as Rosenberg found out, there is a huge difference between making forecasts and managing money. He described his role with Merrill as one in which he would fly around the world and meet with the firm’s large institutional clients and make predictions about the economy and the markets. What he realized after he left is that he never attached probabilities or alternative scenarios to his forecasts. It was basically all-or-nothing.

Once he started working with portfolio managers he realized how important it was to think in terms of probabilities, not certainties:

The whole life of a portfolio manager, their brain, is one giant distribution curve of outcomes. I’ve learned more in the past six years at Gluskin Sheff on the buy side, as a strategist and economist, than the previous twenty-two combined [in various sell side roles]. Because I figured out how to produce a forecast that’s meaningful for somebody who manages money for a living.

I find this revelation to be fascinating. Here’s a guy who was in a high-ranking position at one of the top firms on the Street and it took a change of scenery to enlighten his views of the markets. Not only do you have to think in terms of probabilities when managing money, but you have to determine how much conviction you have in your ideas. Making forecast after forecast with 100% conviction is easy when you’re not making actual decisions on those predictions.

Finance is a competitive industry. People are constantly look for an edge. Many want to make a name for themselves. Rosenberg said that getting a forecast wrong at Merrill Lynch mostly meant nothing more than a bruised ego. That’s because there were thousands of others making their own forecasts within the firm. Now multiply those thousands of forecasts by the thousands of other financial firms vying for client fees.

How does someone standout when competing with tens of thousand of other people making predictions about the markets? They make unconventional forecasts that have a very small chance of ever happening, but they do so with complete certainty. Eventually some of these people are going to be right. They get their 15 minutes of fame. They go on the conference tour, maybe write a book with more off-the-wall predictions.

Being outrageous offers people in the finance industry optionality on giving them a voice. When there are no consequences attached to your actions you can say almost anything. Think about all of the so-called prophets from the financial crisis. How many of them became famous for being right once in a row?

I think this is where many individual investors run into trouble when taking advice from people in the finance industry. When you combine an intelligent-sounding narrative with strong conviction in a forecast it can be tough to ignore. So retail investors listen to people who make the most outrageous claims. People want certainty when making decisions with their life savings at stake, but it’s impossible to say anything with complete certainty about an uncertain future.

High conviction calls about the markets give us an illusion of control so these ministers without portfolio continue to find their way onto financial media platforms, regardless of their track record. The best financial advice is often boring so it’s much easier to ignore.

Making predictions is easy. Managing money is hard.

Listen to the entire interview here:

Interview with David Rosenberg (Masters in Business)

Further Reading:

My Time on the Sell Side

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Copyright © A Wealth of Common Sense