The U.S. Stock Market Resides at a Unique Global Zip Code

by James Paulsen, Chief Investment Strategist, Wells Capital Management

After following a similar path for much of the last 20 years, the U.S. stock market has recently dominated global stock markets moving to a unique zip code among world markets. Moreover, while both sales and earnings per share among U.S. stocks have mostly continued to rise, share earnings and sales have generally been in a declining trend in both foreign developed and emerging economies since 2011. Finally, because U.S. stock performance has led global returns in the last four years, the U.S. stock market has become increasingly expensive relative to foreign alternatives both on a price to earnings and on a price to sales basis.

The uncommonly wide divergence today between the domestic and foreign stock markets primarily reflects a significant difference in economic performances. For example, while most global economies continue to struggle with very sluggish or slowing growth and high unemployment, the U.S. economy is one of the few in the world nearing or already at full employment. We believe this rather odd and wide divergence in the performance and character of the U.S. and foreign stock markets suggest investors should be boosting equity exposures abroad. Relative to the U.S., foreign stock markets are under- owned, offer a better valuation, are surrounded by hospitable rather than hostile economic policy officials, and are comprised by companies whose earnings recovery is still in a much younger stage compared to the aging earnings cycle facing U.S. companies. Moreover, we suspect a forthcoming bounce in global economic growth will soon shift interest toward foreign stocks initiating a period of outperformance by international stocks. Consequently, investors who have been solidly rewarded in recent years from overweighting U.S. stocks, may want to consider a new zip code for some of their assets during the balance of this recovery.

U.S. stock market diverges

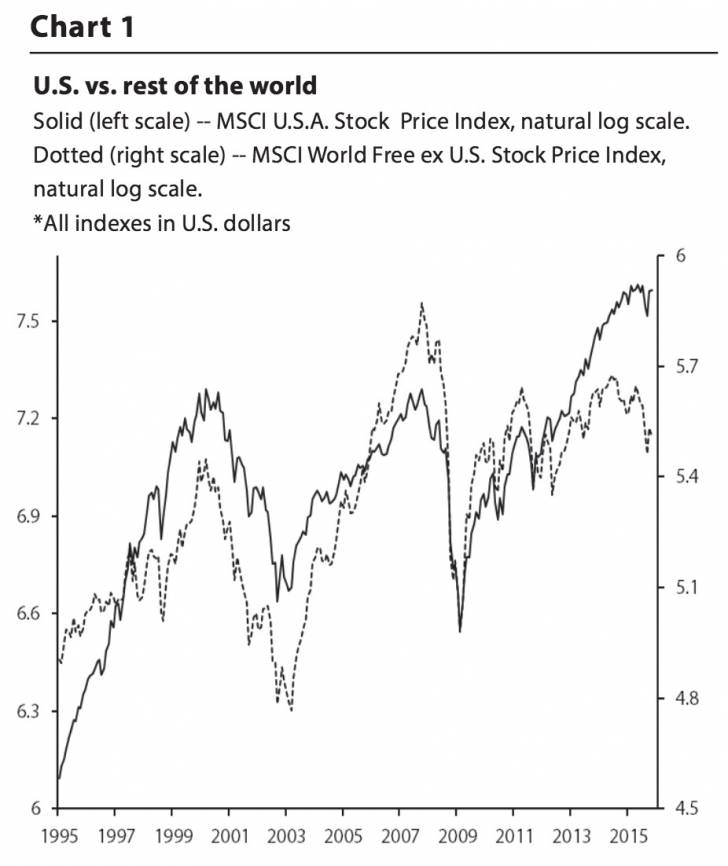

Exhibit 1 compares the U.S. stock market to foreign stock markets since 1995. Chart 1 compares the U.S. market to the global stock market excluding U.S. stocks and Charts 2 and 3 overlay the U.S. stock market with the global developed world and with the emerging world stock markets.

Until 2013, as shown in Chart 1, although the magnitude of their respective movements differed, the U.S. and foreign stock markets moved very closely directionally. For example, both rose between 1995 until 2000, both then declined until 2003, both rose again until 2007, both then collapsed in 2008 and both rose again in tandem between 2009 until 2012. However, since 2013, the U.S. stock market has diverged directionally with foreign markets by the largest amount and for the longest time since at least 1995. Since 2012, the U.S. stock market is up by about 50% while the ex USA stock market has been essentially flat.

Chart 2 shows a similar divergence between the U.S. stock market and the foreign developed world stock market. In this case, the directional relationship remained quite close until 2014 when U.S. stocks continued to rise and foreign developed markets declined. Indeed, since the end of 2013, foreign developed stocks have declined by about 11% while U.S. stocks have climbed an additional 12%.

Read/Download the complete report below:

Copyright © James Paulsen, Chief Investment Strategist, Wells Capital Management