Becoming the trusted advisor

by Patrick Noonan, CFP, Commonwealth Financial Network

Merriam-Webster defines trust as "assured reliance on the character, ability, strength, or truth of someone or something." It can mean being able to predict what other people will do and what situations may occur. If we can surround ourselves with people we trust, then we can create a safe present and an even better future.

In our fast-paced, ever-changing industry, we know advisors are working hard. You're trying to keep up with new products, software, procedures, and a ceaseless flow of information—and running your practices like businesses. But there's one aspect that remains a timeless aspiration for many advisors: becoming the trusted advisor.

So, what does this mean, and how do you get there?

What Exactly Is a Trusted Advisor?

The term trusted advisor has a relatively loose definition in our industry. Many (not surprisingly) boast that they are trusted advisors to their clients. But getting to this level is no small task. To properly define it, we need to take a closer look at where the client relationship begins.

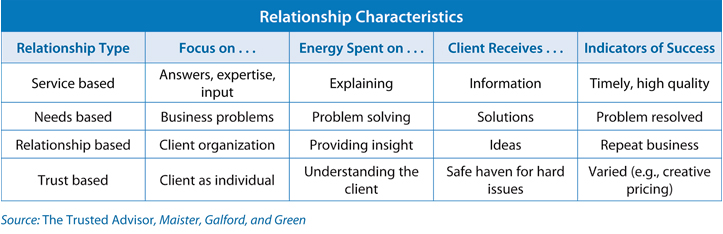

In their book The Trusted Advisor, David H. Maister, Charles H. Green, and Robert M. Galford discuss four different types of client relationships:

Type 1. At the beginning of a relationship, some clients view the advisor as a product vendor or as someone who performs one-off tasks requiring a certain technical skill. This is, of course, the stage at which most advisors begin their careers. It's the easiest type of relationship to master. More important, however, it's where you can introduce and then build upon your expertise.

Type 2. At this level, clients realize the advisor possesses capabilities beyond the technical skills related to the original task he or she was hired to perform. The advisor can focus on solving more general financial problems using few products and services. In turn, the client can start to view the advisor as a reliable resource and problem solver for more in-depth financial issues.

Type 3. This is where you're looked upon in terms of your ability to put issues into context and to provide perspective. Advice is offered and client issues are identified as part of an organizational process. At this stage, you can more easily transition to the highest level within the relationship—that of a trusted advisor.

Type 4. After becoming the trusted advisor, virtually all issues—emotional or rational, personal or professional—are on the table for discussion and exploration. The trusted advisor is the person the client turns to when issues first arise—times of great accomplishments, triumphs, defeats, and crises. This level is often the most time consuming but also the most rewarding.

The chart below shows how your relationship characteristics can vary with a broad range of business and personal issues. Focusing on these characteristics can help further define your role as you evolve from the initial service-based advisor to the ultimate goal of becoming a trusted advisor.

The Benefits of Becoming the Trusted Advisor

To state the obvious, you benefit through repeat business, as well as new referrals and introductions to your clients' other professional advisors. Often, these types of relationships aren't plagued by tedious procedural issues or inconsequential projects. You won't need to create elaborate proposals, research reports, consumer/case studies, presentations, and other documents that may be challenging for clients to understand. When you're the trusted advisor, you don't need to "sell" your products or your expertise. Instead, you can employ the most-prized skills you have—your ability to listen, reason, imagine, and proactively solve client issues.

Don't get me wrong; you still need to keep your compliance hat on, advising clients of investment risks and the like. But you're also at a place to share information and ideas comfortably with your clients, having access to their emotions and aspirations.

Becoming the trusted advisor is in everyone's best interest—but it's especially worthwhile when you cater to the high-net-worth crowd. These clients want that type of relationship, and what's more, they're willing to pay for it.

Next Steps

Start by taking another look at where you spend your time now and where you'd like to spend it in the future. Many business models are built around speed, efficiencies, and a one-size-fits-all approach, which means the individual attention required to build trust is often compromised. As you take a true accounting of your client relationships, where do you spend the greatest amount of time and effort?

- Are you focusing on quantity of clients, instead of quality? You might want to consider just the opposite.

- Have you created a business plan for the future? Setting your goals down in writing is a valuable step toward achieving them.

- Are you better at building portfolios and making product selections, or building strong client relationships? To find more time to focus on relationships, consider outsourcing your investment management.

- Are you spending too much time analyzing the cost of everything (products and services), instead of evaluating the value those services offer your clients and your practice? Cost is important, but don't let this be the only factor affecting your decision-making process.

How do you envision your practice? If you would like to focus primarily on relationships and trust, it will take time, effort, and a whole lot of wisdom. But as you grow your business and seek those quality relationships, positioning yourself as a trusted advisor is a clear path to success now and in the future.

Copyright © Commonwealth Financial Network

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.