The market's shift back towards normal volatility levels and cyclicals

by Eddy Elfenbein, Crossing Wall Street

“Become more humble as the market goes your way.” – Bernard Baruch

Ladies and gentlemen, our “All Clear” signal has officially been triggered!

On Monday, the VIX closed below 20. That’s been my boundary marker to consider the market’s recent unpleasantness to be behind us. That ended a run of 30 consecutive days in which the VIX closed above 20. It was longest such streak in more than three years.

Fortunately, the stock market has been behaving much better recently. The S&P 500 has rallied seven times in the past eight sessions. On Thursday, the index not only broke above 2,000 for the first time in seven weeks but it also closed above its 50-day moving average, which is a key technical indicator.

But here’s a fact investors need to understand: the market’s recent uptick is quite different from what we’ve seen before. Lately, it’s been the cyclical stocks that have grabbed Wall Street’s attention. In this week’s CWS Market Review, we’ll take a closer look at what’s made traders so happy this week. I’ll also preview our first Buy List earnings report for the Q3 earnings season. Later on, I’ll bring you up to speed on our Buy List stocks. But first, let’s look at last week’s poor jobs report and how it vindicates Janet Yellen and the Federal Reserve.

Yes, the Fed Got It Right

Last Friday, the Labor Department released the September jobs report, and it wasn’t a good one. The U.S. economy created only 142,000 net new jobs last month which was well below expectations.

For some context, the economy had been churning out an average of 200,000 jobs per month for the last few years. Not only was the September report bad but the government also lowered the numbers for July and August by 59,000.

What’s more is that more folks are simply opting out of the jobs market entirely. Last month, the labor-force participation rate dropped down to 62.4% which is a 38-year low. Some of the decline, but not all, is due to demographic factors like retiring Baby Boomers.

They key takeaway from this report is that it vindicates the Federal Reserve’s decision last month to hold off on raising interest rates. Honestly, it seems like a no-brainer. How can you argue that the economy’s overheating when job growth is so slow and there’s no inflation in sight? In fact, the dominant global-economy story this year is massive commodity deflation. The Fed’s had rates at 0% for seven straight years, so what’s a few months more?

Now we have some more details on the Fed’s mindset. On Thursday, the Fed released the minutes from its September meeting, and it showed that members were concerned that the economy wasn’t strong enough for a rate hike. Broadly speaking, the Fed is still optimistic about the economy. I think they’re probably right. I don’t see a recession looming for us. Rather, the economy will likely experience more growth, but at a subdued pace.

Getting a rate increase is tricky. What’s interesting is that in 2010-11, several countries like Sweden, Norway, Australia and Israel went ahead with premature rate hikes, and then they quickly backed off when the damage became apparent. What makes the story more interesting is that at the time, Stanley Fischer was head of the Bank of Israel. Now he’s the number 2 at the Fed. We also know from history that raising rates before the economy is ready can lead to trouble. In 1937, the Fed made a similar mistake when it incorrectly thought the Great Depression was behind it. Short version: it wasn’t.

For much of this summer, the Fed sent signals to investors to expect higher rates soon. I talked a lot about that in previous issues. Now we know that “soon” isn’t quite as soon as we thought. For its part, the market is quite pleased that 0% rates will be around for a bit longer. The futures market doesn’t see a rate hike coming until March, and a second hike may come next September. Just look at the bond market: three weeks ago, the six-month Treasury was yielding 0.27%. Today that’s down to 0.07%.

The Market’s Shift Towards Cyclicals

The stock market is also happy about lower rates. (Perhaps Carl Icahn’s warning from last week was a signal to buy.) The key fact about the market’s recovery is that it’s been led by cyclical stocks. By Cyclicals, I mean businesses that are heavily tied to the business cycle. This would include areas like steel, cars and railroads.

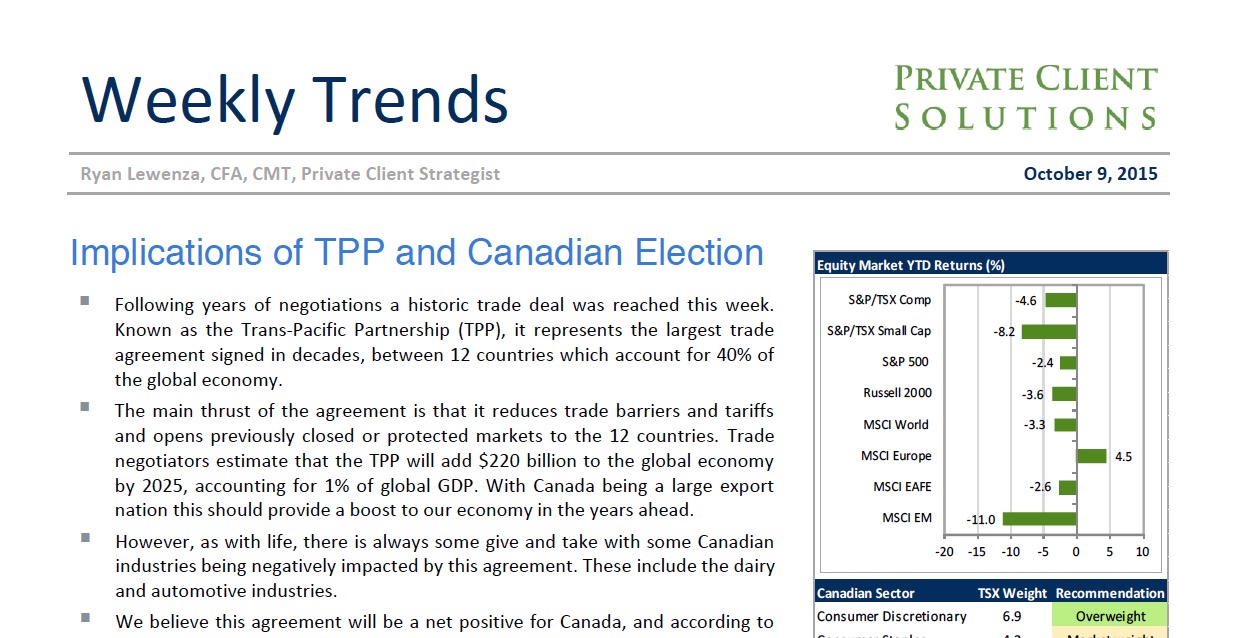

The three key cyclical sectors I like to watch are the Industrials (XLI), the Materials (XLB) and Energy (XLE). In the last eight days, the S&P 500 has gained 6.997%, but over that same time, XLI is up 9%, XLB is up 13% and XLE is up more than 15% (see below). Of course, these were the sectors hit the hardest over the past few months, so what we’re seeing is a cyclical rebound. Once a cyclical trend gets established, it tends to run on for a long time. Of course, that’s why they’re called cyclicals. The difficulty is spotting the turning points, and we may have just seen one.

One cyclical stock on our Buy List is Wabtec (WAB). In fact, I would say Wabtec is a classic cyclical. The company makes locomotives, brakes and other parts for the freight and passenger-rail industries. The shares are up 8.5% over the last eight days.

Another cyclical on our Buy List is Ford Motor (F). If you recall, the company recently announced its best September in 11 years. The shares have risen eight days in a row for a total gain of 14.2%. The stock closed Thursday one penny below $15 per share. The automaker hasn’t closed above $15 since July. I think we’ll see another solid earnings report from Ford later this month.

Another helpful sign for Cyclicals is that some commodity prices have found their feet. Oil, for example, broke $50 per barrel for the first time since July. Only a few weeks ago, oil was less than $38 per barrel. The recent rise probably reflects the actions of the Russian military in Syria. While Syria isn’t a big deal in the global oil market, it’s located in a very important neighborhood.

Mirroring the leadership in Cyclicals has been a somewhat tame performance from defensive sectors like Consumer Staples and Utilities. The Healthcare sector continues to be hurt by crumbling biotech shares. The biotech bubble has been bursting, and it’s not over.

I often say that true stock bubbles are quite rare. The problem is that market gurus love to proclaim bubbles. In reality, they don’t come along that often, and they’re usually focused in a sector.

Four years ago, right about this time, the Biotech ETF (IBB) was going for less than $88 per share. By this summer, it skyrocketed to $400 per share. Since then, it’s slowly deflated, and then Hillary’s Clinton’s tweet knocked the entire sector for a loop. Late last month, IBB dropped to $285 per share. It’s recovered a bit since then, but my advice is to stay away. This sector hasn’t hit bottom just yet.

When I say that we’ve hit our “All Clear” signal, I don’t mean to say that investors should expect a robust rally. Rather, I mean that we can expect reduced daily volatility. I doubt we’ll see as many 2% moves for the rest of the year or the hyperactive intra-day swings that characterized the past six weeks.

The midpoint of the S&P 500’s high close (2,130.82 on May 20) and low close (1,867.61 on August 25) comes to 1,999.215, and we just passed it. In other words, we’ve made back half of what we lost. It took a few weeks, but we’ve shaken off the late-summer story. Now we can focus on Q3 earnings season.

Wells Fargo Earnings Preview

Wells Fargo (WFC) is scheduled to report Q3 earnings before the market opens next Wednesday, October 14. This will be an interesting report for the big bank because the last report was decent but nothing great. Don’t be fooled—the bank is still very strong. The problem for Wells has been a weak mortgage market, and there’s not much they can do until that sector improves. For Q2, Wells’s mortgage-banking revenue fell by 1%. The bank’s net interest margin, which is a key metric for banks, has fallen below 3%. With ultra-low rates, that’s put the squeeze on all of their costs.

The stock got dinged up pretty hard in the August swoon. At one point, Wells dropped below $48 per share. The shares are still pretty cheap. Let’s look at some numbers. The bank should earn about $4.50 per share next year, give or take. If it can trade at 14 times that, which is hardly excessive, that translates to a price of $63 per share. Going by Thursday’s close, Wells would have to rally 20% to get there.

Wells has been one of the strongest large banks in the country. They’re also one of the few banks whose dividend is higher now than it was at the onset of the financial crisis. The dividend now yields 2.85%. That certainly beats 0% in short-term Treasuries. The consensus on Wall Street is for Wells to report Q3 earnings of $1.04 per share. That matches my numbers. By the way, if you want to know more about Wells Fargo, Jim Cramer recently had a good interview with John Stumpf, Wells’s CEO.

Buy List Updates

Express Scripts (ESRX) said this week that it will cover two new cholesterol-lowering drugs, Praluent from Regeneron and Sanofi, and Repatha from Amgen. Both drugs were approved this summer, and both run about $14,000 per year.

Express Scripts said that next year, it will spend $750 million on these drugs. That’s probably too low, and a lot of folks on Wall Street said Express’s math doesn’t add up. They’re obviously getting a big discount. This week’s announcement will give a lift to ESRX’s business next year. I still think the shares are going for a good value at the current price. I like this stock. Look for another good earnings report later this month.

Shares of eBay (EBAY) got knocked for a 6% loss on Thursday. But the catalyst for the loss didn’t involve eBay. Instead, it was the news that Amazon (AMZN) is going to take on Etsy (ETSY). I think it’s interesting that eBay lost more than Etsy did on the news. Etsy is a site that lets artisans sell their wares over the Internet. Amazon may not make a lot of money, or probably lost more last quarter, but they’re the undisputed giant in online retail.

That’s all for now. Early earnings reports will start to flow in next week. It won’t take long before we get an idea of how well Corporate America did during Q3. There will also be some important economic reports. On Wednesday, the Census Bureau will report on retail sales for September. The CPI report comes on Thursday. This will be an interesting CPI report because the last one showed the lowest inflation all year. It was actually deflation. You can be sure bond traders will be eyeing next week’s CPI report closely. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Copyright © Eddy Elfenbein, Crossing Wall Street

The information in this blog post represents the opinions of Eddy Elfenbein, and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.