The “Three S’s” For Strength Into Year End

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

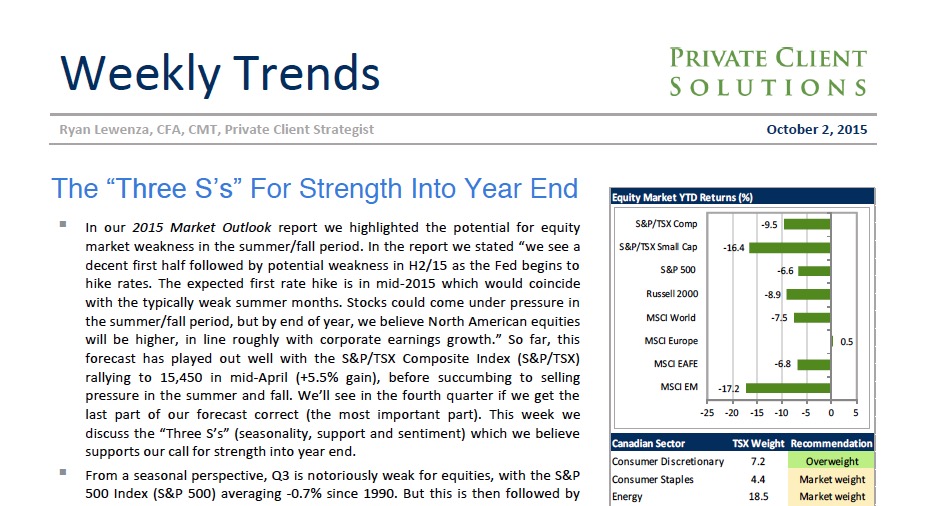

• In our 2015 Market Outlook report we highlighted the potential for equity market weakness in the summer/fall period. In the report we stated “we see a decent first half followed by potential weakness in H2/15 as the Fed begins to hike rates. The expected first rate hike is in mid-2015 which would coincide with the typically weak summer months. Stocks could come under pressure in the summer/fall period, but by end of year, we believe North American equities will be higher, in line roughly with corporate earnings growth.” So far, this forecast has played out well with the S&P/TSX Composite Index (S&P/TSX) rallying to 15,450 in mid-April (+5.5% gain), before succumbing to selling pressure in the summer and fall. We’ll see in the fourth quarter if we get the last part of our forecast correct (the most important part). This week we discuss the “Three S’s” (seasonality, support and sentiment) which we believe supports our call for strength into year end.

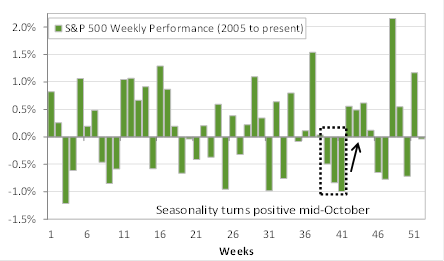

• From a seasonal perspective, Q3 is notoriously weak for equities, with the S&P 500 Index (S&P 500) averaging -0.7% since 1990. But this is then followed by the strongest quarter of the year, with Q4 averaging +4.9%.

• Another factor that keeps us bullish is the fact that the S&P 500 has held technical support, and by definition, remains in a sideways range.

• Numerous investor sentiment surveys point to very bearish sentiment for equities, which from a contrarian perspective is bullish for the markets.

• Putting it all together, with the S&P 500 still above key technical support, seasonality turning bullish in mid-October, and sentiment at extreme bearish readings, we believe the equity markets are set to move higher into year end.

Read/Download the complete report below: