Don't sweat the Fed

by David Merkel, Aleph Blog

This should be short. There are a lot of good reasons not to worry about the FOMC raising Fed funds or not. If they raise Fed funds:

- First, savers deserve a return. Economies work better when savers get rewarded.

- Second, investors do better on the whole when there is a risk free asset earning something to allocate money to, because otherwise investors take too much risk in an effort to generate income.

- Third, the FOMC should never have let Fed funds rates go below 1% anyway — the marginal stimulus is limited once the yield curve gets slope enough for the banks to lend. They don’t really need more than that.

- Fourth, it’s not as if monetary policy has been doing that much. Outside of the government and corporations, most entities have not shown a lot of desire to lever up after the financial crisis.

- Fifth, long Treasury yields will do what they want to do — they won’t necessarily go up… it all depends on how strong the economy is.

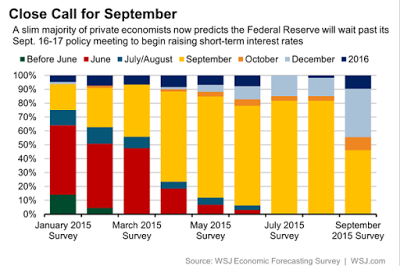

But if the they don’t raise Fed funds, no big deal. We wait a little longer. What’s the difference between having zero interest rates for 6.5 years and 7.5 years? Either one would build up enough leverage if the economy had the oomph to absorb it.

As it is, corporate borrowing has been the major place of debt expansion through both loans and bonds. Watch the debt of energy firms that are allergic to low crude oil prices. Honorable mention goes to auto, student, and agricultural lending. May as well mention that underwriting standards are slipping in some areas for consumers, but things aren’t nuts yet.

I’ve often said that the FOMC stops tightening rates when something big blows up. Can’t see what it will be this time — the energy sector will be hurt, but it isn’t big enough to impair financials as a group. Subprime lending is light at present outside of autos.

Watch and see, but in my opinion, it is a sideshow. Watch how the long end behaves, and see if the market reflates. We need more confusion and less concern over what the next crisis is, before any significant crisis comes.

Copyright © Aleph Blog