The Earbud Stock Market

by William Smead, Smead Capital Management

The earbud is nothing new, but it seems to be everywhere. The first implication of wearing earbuds is the solitary nature it creates. People signal through earbuds that they want to be left alone. Second, earbuds represent a willingness to disengage from the moment—a willful non-participation in society. This seems true in a world that is tied at the hip to technology and dominated by the largest population group between 20 and 36 years of age. This seems even truer for the markets, which greatly matters to long-duration stock owners like us.

The big winners of the past two years have been the companies which make money from those with ears plugged. You can pay Apple (AAPL) to hear music from a download on a device Apple made. You can buy things from Amazon (AMZN) online without ever interacting with a human. Starbucks (SBUX) will let you order online and all you have to do is call out your name when you get to the store. You don’t even need to take out your ear plugs to do any of these activities. Netflix (NFLX) will let you watch a movie or TV show without mixing with others at the theatre or tuning in at the time of the original broadcast. Facebook (FB), Tinder and others help those who wear earbuds find dates, because they operate in solitude much of the time. Stocks which benefit from the earbud mentality have soared in value the last two years.

Social solitude leads to the second implication of having the earbuds in. It is the unlikelihood of you sharing your life with someone else. The irony of today is that some have dubbed this the era of the “sharing” economy. You can ride an Uber, a Zipcar, rent a bike, share an apartment building, rent from Airbnb, participate in Lending Club (LC) or have a TaskRabbit come and assemble a piece of furniture at your house. Therefore, what they mean by “sharing” is sharing the ownership of things and or using things someone else owns.

We have argued adamantly that millennials are about to share their lives with others. The last five years has seen the lowest percentage of 25-34 year old Americans married, bearing children and purchasing homes in the last 50 years. Sharing your life with a spouse, with children, with neighbors and with your community drives the U.S. economy and allows businesses to thrive. It is hard to pull all of these things off in a solitary position with your earbuds in and effectively walled off from those around you.

When you marry, have or adopt children and buy a house, you share an interest in your life with the businesses which get compensated for making those events happen. The seamstress who makes the wedding dress, the florist and caterer who make the wedding day a success are the first beneficiaries. Hospitals, doctors, nurses and a wide group of product producers make money from the birth process.

Once children are in the game, the home builder and seller, the furniture maker and seller, the paint company and the security company find their business on the upswing. I haven’t even mentioned the blue-collar trade people who sub-contract on the building of the homes like carpenters, electricians and plumbers. All of this is domestic in nature and would hugely stimulate the U.S. economy.

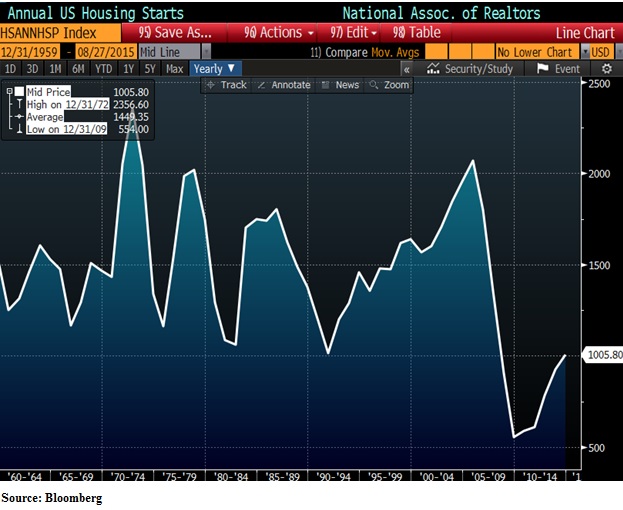

Look at the U.S. housing starts chart going back to 1960. The chart shows that we are coming out of a housing depression and could easily see housing production grow more than 50% in the next five years. Remember, the chart is not adjusted for population. Therefore, 1.0058 million housing starts in a 325 million person society is way worse than the same numbers were in the 1960s when we started with 180 million people. Housing could lead to the one thing that few investors are prepared for—real GDP growth exceeding 3-4% for years. It means that the U.S. economy could hit escape velocity and interest rates could normalize.

We are not making the case that these technology devices won’t have a good business going forward or that the low cost providers won’t dominate their market niches. Other than Apple, most of the companies which have benefitted from millennial solitude sell for nose-bleed prices and all the academic studies we’ve seen prove that expensive stocks underperform average and cheap stocks.

So who wins from the earbuds coming out and meets our eight criteria for stock selection? We like NVR (NVR) as the fifth-largest homebuilder in the U.S. Their business caters to first-time buyers via their Ryan Homes subsidiary. Berkshire Hathaway (BRK.B) is what Warren Buffett has called, “an all-in bet on the U.S. economy.” He owns numerous direct participations in housing like Berkshire Hathaway Home Services, Clayton Homes, Shaw Carpet and Benjamin Moore Paint.

Escape velocity in the U.S. economy could trigger higher interest rates and increase circulation of money. As organized, this could cause immense earnings growth for the major financial institutions over the next five years. They are beginning this phase among the cheaper stocks on both a P/E ratio and a price-to-book ratio basis. That’s why we favor companies like Wells Fargo (WFC), Bank of America (BAC) and American Express (AXP)—Berkshire happens to be the largest shareholder of all three.

Finally, we suspect that the creators of content associated with community safety, schools and local politics will benefit from the “sharing economy” becoming the “owning economy.” We like owning local network-affiliated TV stations and local newspapers. We don’t necessarily know which distribution method (newspaper, TV, streaming, etc.) will rule the day, but we believe the demand for local content, regardless of delivery, will continue to grow as millennials age.

We own Tegna (TGNA) which owns 46 network-affiliated TV stations, Cars.com and Careerbuilder.com. Gannett (GCI) owns USA Today and 92 local newspapers with zero indebtedness and copious free cash flow. It trades at a microscopic P/E ratio of 6.8 times the consensus estimate of the next 12 months and pays a 5% dividend. They have publicly stated that they want to consolidate the newspaper industry in the U.S.

Charlie Munger says, “Competition is the enemy of competence.” Those who seek to make money while our 25-34 year old Americans have the earbuds in their ears have a great number of brilliant software engineers trying to invent a mouse trap which ruins their business. The stock market capitalization of the entire publicly-traded local TV and newspaper industry adds up to less than the capitalization of Chipotle (CMG). Did we mention that they are the favorite restaurant of those who walk around with earbuds in?

Warm Regards,

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com