Prices Have Changed; Not Much Else Has Changed

by David Merkel, Aleph Blog

There is the temptation when market prices move fast after they have been at recent highs to assume that things are going to fall apart. Well, guess what? That could happen.

I don’t think it is likely though, if falling apart means a scenario like 2008-9, 2000-2 or 1973-4. In order to have a significant drawdown in the market, you have to have a lot of leverage collapse, whether that is financial or operating leverage.

Financial leverage is bad debt. We have areas of that — student loans, agricultural loans, a modest amount of subprime lending for autos, and a decent amount of lending to junk-rated corporations, but not enough to create a self-reinforcing situation where bad debts can’t be borne by lenders, and lenders then collapse.

Operating leverage is bad assets — building up too much productive capacity such that there will not be enough demand to absorb it for the foreseeable future. Or, building capacity that isn’t productive… either way, assets will have to be written down.

There have been a number of parties kvetching about a lack of investment from US corporations, but let’s take this a different direction. There hasn’t been a lot of bad investment from US corporations… and part of that may be due to dividend and buyback policies. Yes, there are some IPOs that have come out that look marginal. I’ve looked at a variety of spin-offs where the underlying business is attractive, but they loaded the spin-off with a sizable slug of debt in order to pay a final dividend to the parent company saying farewell. But on the whole, I don’t see a lot of money being wasted by corporations on investments. That is another reason why profit margins are high.

Now, a lot of the furor in the markets stems from China, and the effects that slowing growth and/or bad debts in China will have on the US economy. Personally, I don’t think this is an issue to worry about, unless you have a lot of investments in China and other emerging markets. In general, US markets don’t get deeply hurt by slowdowns or even crises in other countries. Even if it means a slowdown in revenue growth for large US corporations, it would also likely mean that US interest rates might fall, which would often make equities fall less as bonds rally.

Also, for foreign affairs to affect the US in a big way, the US would have to have a lot of lending exposure to those nations that are struggling. (Think of the LDC nations in the early ’80s.) Maybe this is one of the benefits of running current account deficits — we don’t have money to lend to foreign countries from our net export earnings.

Think of all the significant foreign crises of the last 30 years. LDC crisis, Plaza Accords leading to Japan’s lost decades, Mexico, Asian Crisis, European Union difficulties with their fringe nations, Iceland, Greece, Greece, Greece, China, etc. There was always temporary indigestion in US markets, but when did it ever weigh on the US markets for a long period? Really, it never did. So why are we concerned over China?

Regarding the Fed, I abstract from this old post, which quoted a 2005 piece on Fed policy at RealMoney.com, and what blew up at the end of each tightening cycle. I list blow-ups up to that point, and mention that I think US Housing is next:

So it moves in baby steps, wondering if the next straw will break some camel’s back where lending has been going on terms that were too favorable. The odds of this 1/4% move creating such a nonlinear change is small, but not zero. But on the bright side, the odds of a 50 basis point tightening at any point in the next year are even smaller. The markets can’t afford it.

Or, these two posts, which you can look at if you want… one suggested that housing was the next bubble (in 2004), and the other critiqued Bernanke’s reasoning on monetary policy. (Aaron Task has an interesting rejoinder to the latter of these.) — [DM: these links are dead now.] |

Some worry now about future Fed policy — what will blow up when the Fed tightens too much? I would encourage everyone to relax. First, we don’t know that the Fed will do anything soon. Second, we don’t know if they will do anything much. Third, we don’t even know if the Fed has a coherent theory of monetary policy anymore. Face it: Yellen has never tightened rates once. Bernanke never tightened rates aside from finishing out Greenspan’s plan to invert the yield curve at the beginning of his Chairmanship. Almost no one on the FOMC has any significant practical experience with tightening rates. What will guide them out of their zero interest rate policy? What will be enough?

Even so, tightening cycles usually end with something blowing up. Maybe this time it is the emerging markets. I don’t see a large concentration of US-based bad debt that the Fed might inadvertently blow up, at least not yet. (Maybe the day will come when the US Treasury might complain about rising financing rates. After all, debt is high, but affordable while rates are low.)

Valuation is the main issue as I see it at present, as I commented in my recent piece “Stocks or Bonds?” When stocks are priced at a level that discounts 4.5%/year returns over the next 10 years, you don’t have a lot of margin for error, especially when you can create a safer bond portfolio that yields the same.

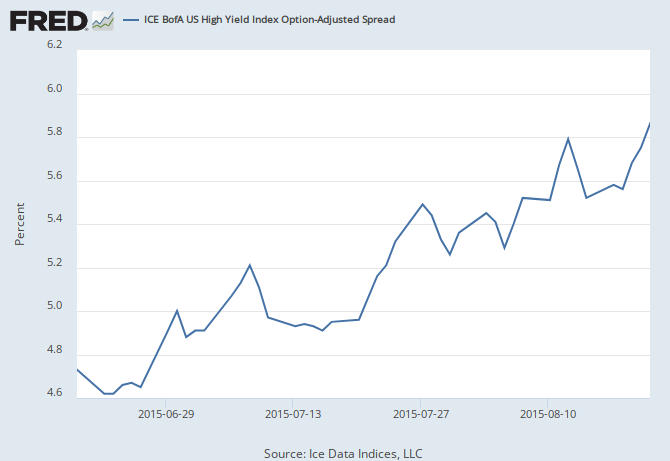

Now, since I wrote that piece, the S&P 500 is down around 10.5%. The bond portfolio is down around 4.5% (it was a risky portfolio, and some of the emerging markets bonds hurt), while the Barclays’ Aggregate is up 1%. High-yield bond spreads have widened over that time by ~1.2%.

The anticipated return on the S&P 500 has maybe risen by 1%/year over the next 10 years, to 5.5%. That said, so has the yield on the risky bond portfolio. I see the selloff as being in-line with the yields of risky debt, which at some higher level of spread, will attract buyers, given that there have been no significant defaults recently.

The US stock market could go down another 20% from here, but I think it will be less. My main point is that we shouldn’t get a big washout, but just a correction of valuation levels that got too high relative to other risky assets, like junk bonds.

So don’t panic. You could still move some assets from stocks to bonds if you want to sleep better, but don’t do anything severe.

Copyright © Aleph Blog