The One Percent

by Jeffrey Saut, Chief Investment Strategist, Raymond James

Let me be blunt. If anyone of you out there believes that anyone in our business is going to be right all of the time, I have some news for you. Better yet, I have a few yards of swampland in the Everglades I would like to sell you. Writing your feelings, doing radio, getting on TV and just putting yourself out there is not easy . . . especially when it has to do with the markets, which are psychotic most of the time. I don’t need to defend Mr. Landry. Mr. Landry does just fine on his own. But coming from me – someone who is my own biggest critic as well as a critic of Wall Street – you best realize that Mr. Landry is in the top 1% of people on Wall Street. He is clear, he is concise, and he is right more than he is wrong. AND more importantly, when he is wrong he doesn’t just sit there and fight the tape. He adjusts unlike [many] of the bonehead strategists on Wall Street; stop reading and listening to him at your own risk.

Ladies and gentlemen, that prose came from Gary Kaltbaum back in the troubling times of early 2003, a man I consider to be one of the best and brightest on the Street of Dreams. He penned those words when someone attacked Mr. Landry (another excellent pundit) for being wrong on some short-term wiggle in a financial asset. I recalled Gary’s article titled “Why This Man Is One Of Wall Street’s Top One Percent” as I was attacked last week about my March “call” that crude oil had bottomed. The reason for the attack was because the August crude oil futures contract nudged below last March’s intraday low of $42.03 per barrel by tagging $41.35 on an intraday basis last Friday. Despite that “undercut low” (below the March low) I am still of the belief oil is bottoming. If that proves to be wrong, like Mr. Landry, I will not sit there and fight the tape. I will adjust, as I have often had to do over the years. As my father used to say, “Son if you are going to be wrong, be wrong quickly, and for a de minimis loss of capital.” According to one Wall Street icon, namely Leon Levy:

“I think a trader has to have the ability – or an investor I should say – has to have the ability to adjust to be wrong. In other words, you can’t be too stubborn. You must have a certain degree of flexibility as to what’s going on.”

“Being wrong,” what a novel concept, and as the brilliant Peter Bernstein notes:

After 28 years at this post and 22 years before this in money management, I can sum up whatever wisdom I have accumulated this way: The trick is not to be the hottest stock-picker, the winning forecaster, or the developer of the neatest model; such victories are transient. The trick is to survive. Performing that trick requires a strong stomach for being wrong, because we are all going to be wrong more often than we expect. The future is not ours to know. But it helps to know that being wrong is inevitable and normal, not some terrible tragedy, not some awful failing in reasoning, not even bad luck in most instances. Being wrong comes with the franchise of an activity whose outcome depends on an unknown future (maybe the real trick is persuading clients of that inexorable truth). Look around at the long-term survivors at this business and think of the much larger number of colorful characters who were once in the headlines, but who have since disappeared from the scene.

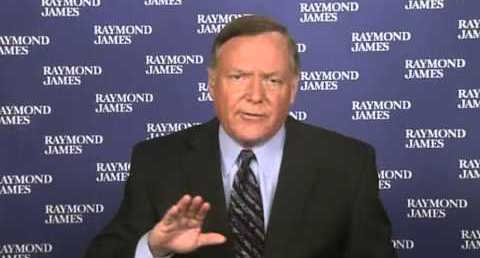

As stated, I continue to think oil is in a bottoming phase. In fact, the stocks in the energy sector are extremely oversold. Looking at the energy stocks in the D-J Industrial Average (INDU/17477.40) that are oversold, and positively rated by our fundamental analysts, shows only one: Chevron (CVX/$85.91/Outperform). Speaking to stocks that benefit from lower energy prices, it is worth noting the D-J Transportation Average (TRAN/8318.70) looks to have bottomed and has broken out to the upside of its downtrend line that has been intact all year (see chart 1 on page 3). We have written about the Trannies non-confirmation since last December when the Transports failed to make new highs along with the Industrials. Many self-proclaimed Dow Theorists termed that a Dow Theory “sell signal,” but in reality it was only an upside non-confirmation. And for the hundredth time, for me to get a Dow Theory “sell signal” would require the Industrials to close below their October 13, 2014 closing price of 16117.24 with a concurrent close by the Transports below their October 16, 2014 close of 7717.69.

So where does all of this leave us? Well, as with our now in question oil bottoming call, we are still not mincing words after telling accounts in early July the equity markets’ “internal energy” was totally used up and we were likely going into a period of contraction. At the time we stated our timing models were targeting the August 13th through August 18th, 2015 timeframe as where at least a trading bottom, if not a more significant bottom, should occur. We are about to find out if that “call” proves to be correct over the next few weeks. If not, we will adjust.

Meanwhile, all of the indices and macro sectors we monitor closed “up” last week as they turned a deaf ear to the Chinese gotcha, the Hindenburg Omen, the alleged negative cross over by the 50-day moving average below the 200-DMA in the SPX chart, the higher than expected inflation report (PPI) . . . well, you get the idea. Such action caused one of my emailers to ask, “So what does the stock market know that most investors don’t and what are the catalysts that will cause stocks to rally?” Admittedly, last quarter’s earnings season wasn’t so hot, although 60.4% of reporting companies beat estimates and 52.6% bettered revenue estimates. Yet the figure catching our attention was that the spread between the percentage of companies raising versus lowering forward earnings guidance has shown dramatic improvement. We would also note earnings comparisons year-over-year, as we get into 2016, should look pretty good, especially for the energy sector.

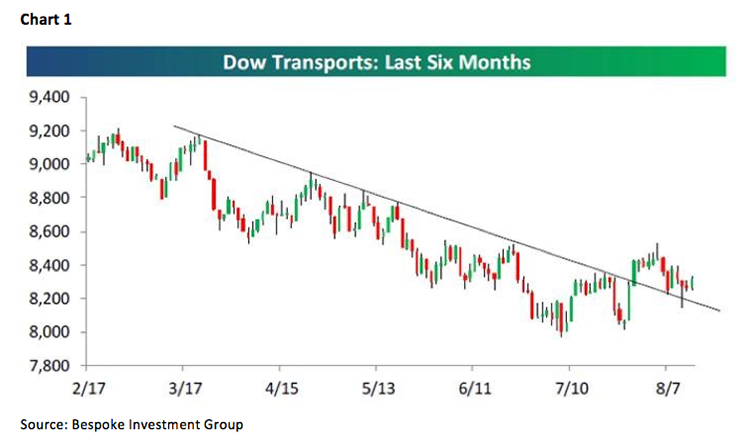

Another catalyst could be that the economy is actually getting better. Consumer spending improved in July, ditto the job market, companies are increasing production, the sale of heavy trucks has gone vertical (companies don’t buy heavy trucks unless they plan to ship more product), industrial production is revving up (chart 2), inflation is picking up at the margin, and the list goes on. As I stated on CNBC last week, “I think the economy is currently running at a 3% GDP growth rate.” And, we will find out if that is correct when the 2Q15 revised figures are released later this month.

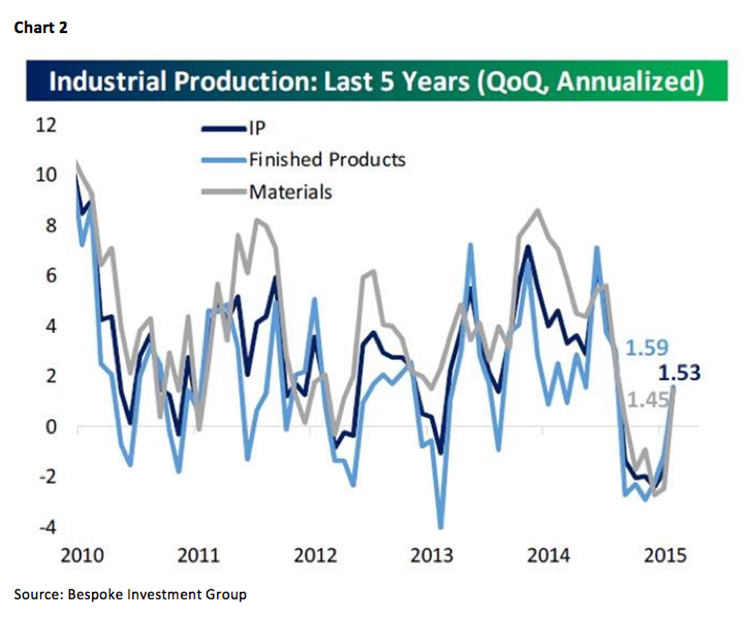

The call for this week: I am in Boston this week seeing accounts and speaking at events. As for this week’s anticipated action, according to my friend Jason Goepfert and his invaluable research firm of SentimenTrader, “Weakness in stocks, not necessarily reflected in big indexes like the S&P 500, has been weighing on bullishness, at least in many of the sentiment surveys. That has pushed the AIM Model to its 2nd-lowest reading in three years. When occurring in bull markets or near a recent high in the S&P, it has led to consistent positive returns (chart 3).” This morning, however, everything is flat on no real overnight news. Still it is a triple-witch expiration week, which tends to favor the upside. We think the contraction phase has ended and an expansion phase is beginning.