by Ben Carlson, A Wealth of Common Sense

Gold is one of those investments that attracts extreme viewpoints and ideological arguments that favor narratives over substance. I think the reason for this is because the U.S. was once on the gold standard, which was more or less replaced by the Federal Reserve as a form of monetary policy.

Anytime politics and government is involved, there are bound to be irrational people and emotional arguments made both for and against that topic. Gold has become the de facto us vs. the system investment over the years and this has only intensified as the role of central banks in the markets has grown in recent years.

It’s rare to find a simple historical account of the yellow metal that doesn’t involve highly politicized or biased points of view, so I thought I would take a look back at the history of gold’s performance as an investment over the years.

In August of 1971, when Richard Nixon ended the convertibility of the U.S. dollar to gold, the price was roughly $40 an ounce. From there it grew all the way to $850 an ounce by early 1980, for a return of more than 2000%. In a decade that saw subpar returns on both stocks and bonds in the U.S. along with sky high inflation, it was by far one of the best investments in that time. The price didn’t move much before Nixon removed the peg so it’s very possible that this was a catch-up period in terms of price.

From that point on, over the next 20 years or so, the price of gold fell over 70% until it finally bottomed in late-1999. The annualized 20 year return from 1980 to 1999 was just shy of -6% a year. From 1971 to 1999 the total return was close to 6% per year, which shows how much of the total return up to that point occurred in the 1970s.

From a price of just over $250 an ounce in late-1999, gold then grew to just over $1,900 and ounce by late-2011, for a gain of almost 650% or an annualized return of more than 18%. Gold only had a closing price above $1,900/ounce for a single day before staging a fairly quick retreat from that record price. From the peak in September of 2011, gold is now down 42%.

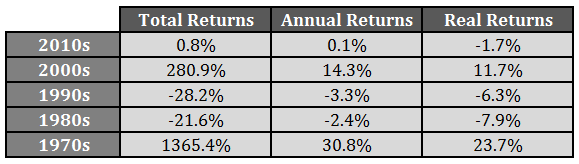

I broke down the returns into different time frames to give you a sense of how gold has performed over the different decades:

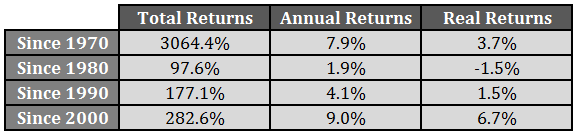

There’s still plenty of time remaining in the current decade, but if things continue as they have over the past few years, it’s possible that gold could have negative real returns in three out of the past five decades. The starting point for the performance measurement also plays a large role in the total performance numbers:

Had you invested in 1980, following the huge surge in gold in the 1970s, you would have lost money to inflation over the ensuing 35 years. Since 2000, gold has actually outperformed the S&P 500. Both of these statements are true, but you’ll be hard pressed to hear both from gold’s most ardent supporters or detractors. As with all investments, if you change the time frame, almost any argument can be made either for or against, depending on how the information is presented. Depending on your time frame gold has either been a terrible investment or a solid (no pun intended) diversifier.

Even after the most recent crash, gold is actually up around 10% per year over the past decade. But it’s unlikely many individuals actually participated in this rise unless they held physical gold. The Gold ETF (GLD) only had around $3 billion in assets in 2005. It then grew to nearly $80 billion by the peak in 2011-12, before falling back down to less than $25 billion more recently. Unfortunately that means many of the bandwagon investors got sucked in very late to the bull market and lost a lot of money in the ensuing crash.

Here’s the only thing I’m sure of after looking back on the history of the price of gold — it’s extremely volatile and cyclical. Other than that, I’m not sure I can deduce much from the yellow metal that seems to evoke such passion from certain corners. I’ve seen some strong arguments that can be made for a relationship between gold and real interest rates, but that’s the kind of thing that can come and go as it pleases.

My stance on gold has always been that I have no idea what’s going to happen with it in the future. No one else does either.

Further Reading:

What About the 1970s?

GLD’s Fall From Grace

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Copyright © A Wealth of Common Sense