by Michael Batnick, The Irrelevant Investor

Everybody who holds a balanced portfolio believes in the efficacy of diversification. Simply put, investors expect that bonds will decrease the overall volatility of a portfolio, especially when stocks are performing poorly.

One of the tenets of diversification is that adding less than perfectly correlated assets to a portfolio is one of the only free lunches available. Let’s look at how this works for a 60/40 portfolio. The annualized standard deviation of stocks is 15.33 and for bonds it’s 5.45. A simple weighted average of the two ((.6*15.33)+(.4*5.45)) comes up with a standard deviation of 11.38%. However, the actual standard deviation of a 60/40 portfolio is 9.84. This is the power of diversification; it’s more about reducing risk than it is maximizing return.

But how long do investors have to wait for the benefits of diversification to show up? Patience is crucial .

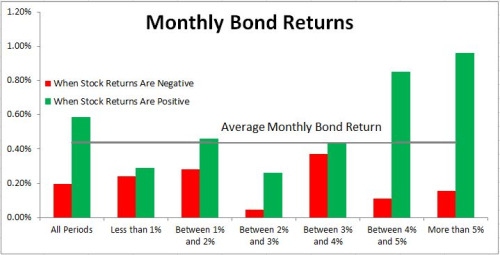

I was surprised to find out that when stocks fall in any given month since 1926 (405 of the 1072 months), *bond returns have been significantly lower than average. The average monthly bond return for the entire period is 0.44%. When stocks rise the average return is 0.59% and when stocks fall, the average monthly bond return is just 0.20%. Anybody counting on bonds to ease the pain in any given month will often be sorely disappointed.

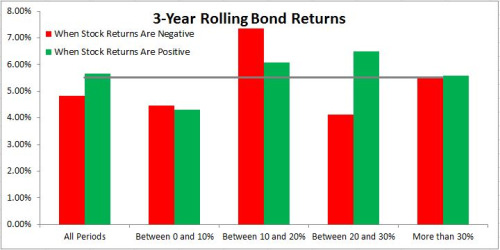

Here is the good news for investors who are able to see past the month-to-month. When stock returns have been lousy over a three-year period, bonds have done quite well, acting as the ballast on a balanced portfolio.

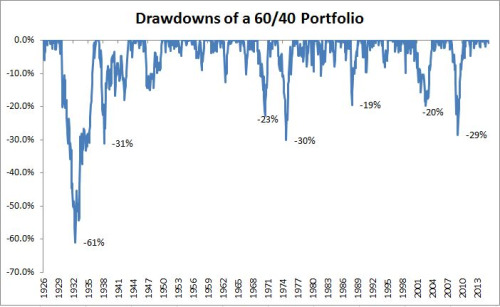

Although bonds have helped to weather the storm, even still there are periods where diversification simply cannot save you from unpleasant drawdowns. If you think a diversified portfolio makes sense, you must be prepared to experience a few of these in your lifetime, it’s just the reality. The key to drawing the benefits from a diversified portfolio is patience, and mental and emotional fortitude. It’s not easy, but whoever said investing was supposed to be?

One of the most important things an investor can learn is that every strategy comes loaded with warts. Unfortunately this often only becomes clear to investors after the fact, which leads them in a dangerous search for an investment strategy that simply does not exist. Do yourself a favor and avoid the search for the holy grail. You’ll be much better served in the long run if you find something you can live with, warts and all.

*Bonds: 7.5% one-month t-bills, 12.5% five-year notes, 30% long-term corporate bonds, 50% long-term government bonds.

Follow me on Twitter and Stocktwits

Copyright © The Irrelevant Investor