Easy?!

by Jeffrey Saut, Chief Investment Strategist, Raymond James

“The clichés of daily life are those of routine, discouragement, tiredness; of the rat race; of a cold, the IRS. People are always complaining that there should be more good news, when there isn’t. Americans are often described as basically optimistic, when in reality it is that they are perpetually hopeful. Guys even root for dreadful teams for years – keep buying season tickets in hope that eventually they’ll own seats for the Super Bowl or World Series. And better than being a sport fan – because you can actually participate – and even better than gambling – because it is socially acceptable – playing the stock market becomes a way out of an otherwise mundane and stressful environment. It has glamour, plus the chance of improving one’s lot without being an overt bet. There’s an environment to it, along with the illusion that a successful investment is almost within reach, if one only knew how to tap it. The market seems to represent hope itself. And yet, among professionals, even those who function on the stock exchange floor, a frequently heard stock market expression is ‘No one ever said it was going to be easy’.

“When even the good news of a rising market is stressful – might not last longer than yesterday; it’s rising, but we don’t own the right stocks; and so on – no wonder we long for some security. Indeed, the market often does look easy . . . in hindsight. Tops are made as everyone rushes to buy what has been profitable already. At that point, to the astonishment of those who’ve missed it, the cliché becomes: ‘The easy money has been made.’ But while it is happening no one realizes it; investors are caught up in the classic ‘wall of worry’ instead. It never can be easy because the rule of the market is that you have to act before you know enough. Because it is a process, there is no one moment, or single point, at which one can make an obvious ‘sure’ decision.”

... The Nature of Risk, Justin Mamis

My father first introduced me to Justin Mamis’ work by giving me a few of the books he had written like When to Sell: Inside Strategies for Stock-Market Profits, How to Buy: An Insider’s Guide to Making Money in the Stock Market, and my favorite, The Nature of Risk. Justin penned his last stock market letter at the age of 85 and his work is missed to this day. He was a stock market historian, author, strategist, and a technician’s technical analyst. I quoted him this morning because the stock market this year has been anything but “easy.” Indeed, “It never can be easy because the rule of the market is that you have to act before you know enough. Because it is a process, there is no one moment, or single point, at which one can make an obvious ‘sure’ decision.” I began this year thinking it was not going to be an easy year because my models/indicators suggested the first few months of the year were going to be rocky with a lot more volatility. Last week was no exception.

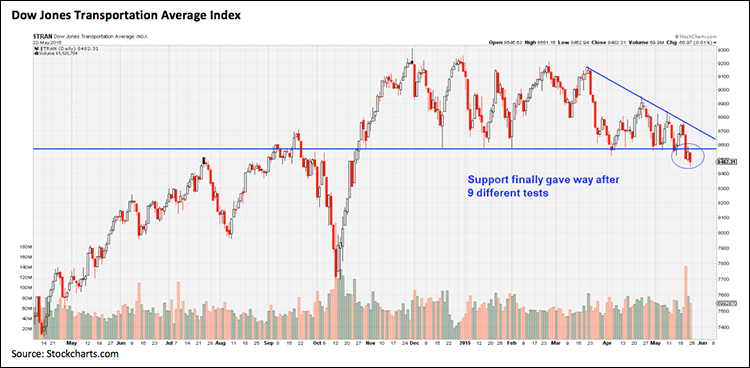

Since Mr. Mamis was a technician’s technical analyst, I will highlight some of the technical standouts of last week, at least from my perspective. First was the technical breakdown in the D-J Transportation Average (TRAN/8482.31), which fell below its 8520 – 8580 support level (see chart on page 3). That zone had contained declines seven times since last December. The persistent weakness in the Trannies has been chronicled in these missives ever since their Dow Theory upside non-confirmations began last December. That was the first time the D-J Industrial Average (INDU/18232.02) made new all-time highs, but was unconfirmed with a similar high by the Transports. Quite frankly, that upside non-confirmation didn’t mean much and I am hopeful that last week’s downside non-confirmation (the Industrials did not confirm the breakdown in the Transports) will not be all that impactful either.

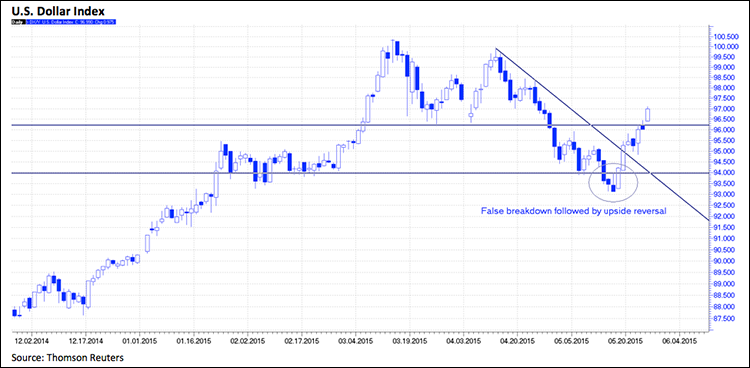

Second, as we surmised, crude oil tried to pull back last week. I had commented this might be the case since oil was extended in price on a near-term basis; and, given the potential for a nuclear deal with Iran, if that deal arrives, it implies Iran’s crude oil should come back on line (read: lower prices). If the trading call for a pullback is correct, it should arrest itself in the $52 - $55 level. While oil’s price overextension was anticipated, last week’s upside reversal in the U.S. Dollar Index (DX-Y/96.88) was not (see chart on page 3). The week’s 3.4% rally in the buck left it within striking distance of its 50-day moving average (DMA) at 97. I continue to think the dollar has topped on an intermediate basis and that last week’s rally was just a countertrend move. Therefore, it will be interesting to see how the greenback acts around the 97 level.

The fourth item of note was the new 2015 low in the Volatility Index (VIX/12.13), which on an intraday basis traded down to 11.82 (see chart on page 4). Given that roughly 50% of this year’s trading sessions have experienced triple digit moves by the Dow, it seems somewhat counter-intuitive the Volatility Index could be plumbing new yearly lows, but there you have it. Obviously, that action does not foot with my models/indicators that predicted an increase in VOL for 2015. Hereto, it will be interesting to see how the VIX acts going forward. I do recall we saw similar action last year, causing many pundits to call for an increase in volatility. But, just because VOL is low does necessarily mean it has to pick up, which is what happened last year (no volatility increase).

Last week the S&P 500 (SPX/2126.06) tagged another new all-time high as the upside breakout from the often discussed wedge formation in the charts continued, although you could draw an ascending wedge that has not broken out to the upside as of yet. Surprisingly, the American Association of Individual Investors (AAII) sentiment survey showed investors’ bullish sentiment at a two-year low and has now dropped for five contiguous weeks. Normally, such readings have had a bullish resolution, but the lack of upside oomph on this upside breakout is a head scratcher.

In conclusion, I harken back to Justin Mamis’ quote, which ends this way, “It [the stock market] never can be easy because the rule of the market is that you have to act before you know enough. Because it is a process, there is no one moment, or single point, at which one can make an obvious ‘sure’ decision.” That evokes another quote from the legendary Leon Levy: “I think a trader has to have the ability – or an investor I should say – has to have the ability to adjust to being wrong. In other words, you can’t be too stubborn. You must have a certain degree of flexibility as to what’s going on.”

The call for this week: Over the decades I have learned to “adjust to being wrong.” Accordingly, while I continue to favor the upside, if the SPX closes decisively below 2115, it will be a red flag for trading accounts on a short-term basis. Investors, however, could see the SPX pull back to 2090 – 2100 and still have no damage to the overall secular uptrend. Moreover, both Advance/Decline Lines I follow made new highs last week, the NYSE McClellan Oscillator is no longer overbought, New Highs continue to outpace New Lows, and many of the indices I follow traded to new all-time highs last week. The lack of upside follow-through is problematic, but it is more about a lack of Demand (read: buyers) than an increase in Supply (sellers). I am hopeful the balancing act between Supply and Demand will be resolved to the upside this week. Yet if it is not, I will adjust my near-term strategy. This morning, the dollar is up~1%, crude oil is down ~0.7%, and the preopening futures are off ~9 points and look to be testing my 2115 level on negative news out of Greece and Spain.

Copyright © Jeffrey Saut, Chief Investment Strategist, Raymond James