Risk Marches On

by Burt White, Chief Investment Officer, LPL Financial

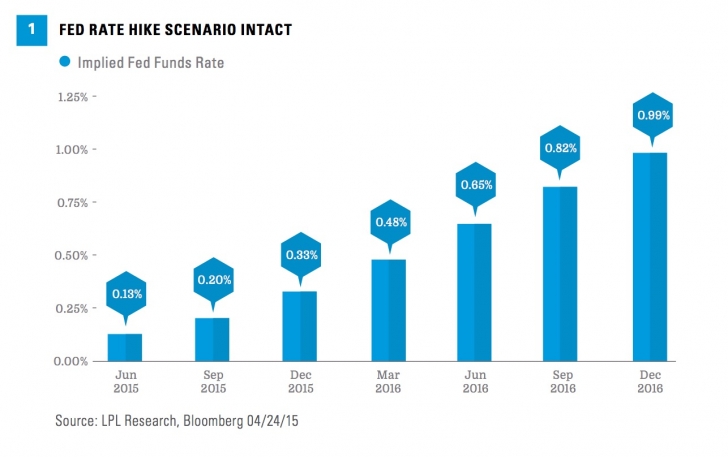

The latest data releases pointing to weak U.S. new home sales and manufacturing Purchasing Managers’ Index (PMI) have investors guessing about the possible messaging coming out of this week’s Federal Open Market Committee (FOMC) meeting. (For more on the FOMC, see today’s Weekly Economic Commentary, “A Weak Week?”). We expect a data-dependent Federal Reserve (Fed) will likely acknowledge temporary factors such as harsh winter weather and the West Coast port strike, as well as the negative impacts of a stronger dollar and a depressed energy sector on growth and employment. But the odds are against the Fed conveying a meaningful change in attitude — data from CBOE fed fund futures indicate a gradual hiking of the fed funds rate and imply a better than 50% probability of a hike later in 2015 — and our view of a September 2015 rate hike remains intact [Figure 1].

GREEK DRAMA INTERMISSION

As we expected, the April 24 Eurogroup meeting to break the latest impasse with Greece proved anticlimactic. At issue is the release of 240 billion euros in funding tied to Greek reforms and budgetary restraints. Several events leading up to the April 24 meeting took some of the focus off of the actual event: the European Central Bank (ECB) agreed to provide additional backstop funding in the event of deposit flight from Greek financial institutions; the Greek government demanded that local public entities turn over cash balances in support of government operations; and Greek Prime Minister Alex Tsipras met privately with German Chancellor Angela Merkel on Thursday, April 23, in advance of the official negotiations. In addition, investors also had to digest the latest overtures from Gazprom, the Russian state oil company, to make payments to Greece in advance of revenue from a pipeline that has yet to break ground.

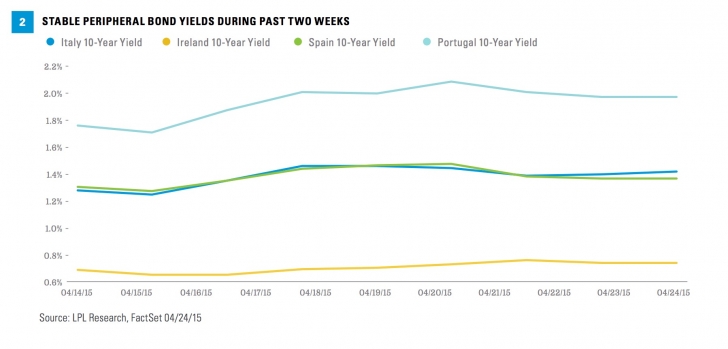

With no tangible European agreement forthcoming on Friday, April 24, it appears that the Greek government may be able to stay solvent and keep current on its debt over the next 30 days. It is critical that debt principal of 950 million euros owed to the International Monetary Fund (IMF) on May 12, 2015, be paid in order to avoid capital controls and potential systematic volatility. Our view is that regardless of outcome, ECB initiatives to date have at least partially decoupled the tight correlation between European sovereign risk and bank funding risk, mitigating a contagion scenario. Peripheral bond yields were stable throughout the week, indicating little angst over the most recent drama [Figure 2].

Notably, markets appeared less confident that Greece can keep its financial house in order as the summer progresses and the magnitude of debt repayments ratchets up, with 4.2 billion euros coming due in July 2015 followed by 3.4 billion euros in August 2015. The currency markets indicate a distinct calendar bias. Based on market expectations, currency traders expect higher euro currency volatility mid-summer — associated with mid-summer Greek debt repayments — as opposed to the more immediate term. This is fundamentally consistent with both the larger magnitude of July and August debt repayments, and a lower probability of a near-term Greek default tied to the smaller debt owed to the IMF coming due in May 2015.

RECENT ECONOMIC DATA SUGGEST MORE ACCOMODATION

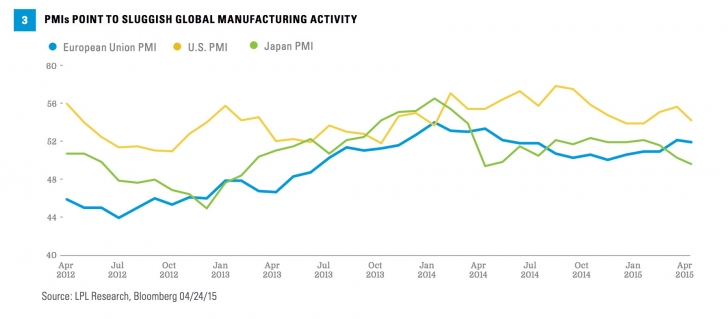

Global manufacturing activity remains sluggish, a trend confirmed by flash PMI surveys that were pulled down by weak new orders and output data across the U.S. and Asia. New export orders in the U.S. dropped to an index level of 48.6, the lowest reading since November 2014. Regional manufacturing activity, as reported by three of the five Fed districts providing the data, has fallen off, hinting at a meager second quarter of factory output. The euro area continued to stabilize, but export orders have been impacted by slowing growth in major markets, including the U.S. and China. Consumption-driven improvement in service sector performance appears intact; however, business investment remains stalled across major economies [Figure 3].

The U.S. economy has labored under a stronger dollar and the sharp fall-off in energy sector activity. A seemingly solid 4.0% increase in March durable goods orders was held up by volatile defense and transportation orders, the absence of which would reveal a flat number.

In general, central bank policies remain cautious and accommodative, with the U.S. and U.K. the exception and likely first movers on raising interest rates. Elsewhere, the money tap remains open in an attempt to promote inflation, currency competitiveness, and job growth. The People’s Bank of China, Bank of Japan, and ECB can be expected to be fairly aggressive with policies that, in turn, encourage their trading partners — with the U.S. a notable exception — to follow suit.

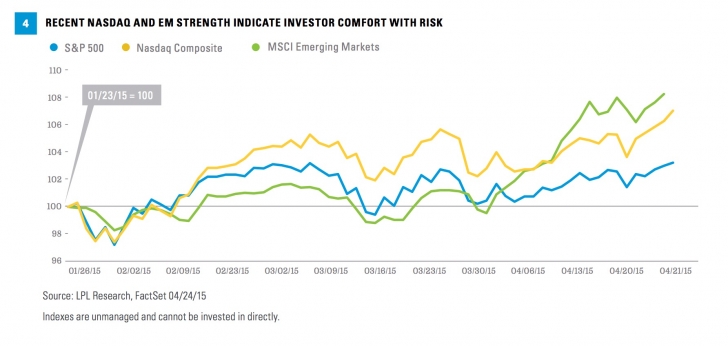

Continued central bank largess may account for some measure of investor optimism, which, despite the mix of economic data and Greek uncertainty, pushed risk assets to a good weekly showing. The Nasdaq breached a record high while emerging market equities continued their move up, both markets handily beating the S&P 500 Index year to date [Figure 4]. And as mentioned, peripheral European debt barely shuddered in the run up to the Eurogroup/Greek showdown, which did not come to pass. But large inflows to European bond funds leave little room for disappointment in the months ahead, with the May 7, 2015, U.K. elections being a potential source of volatility.

CONCLUSION

The recovery in Europe is gaining firmer ground, and systemic market risk is less likely to mushroom given central bank policy responses and institutional support. European allocations under these circumstances become more palatable, in particular when viewed in light of the early stage of a European recovery in contrast to the U.S. stance. And, despite the most recent batch of sluggish data, we see the Fed on track to potentially initiate a fed funds increase later this year.

********

IMPORTANT DISCLOSURES

All performance referenced is historical and is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for your clients. Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to affect some of the strategies.

Stock and Pooled Investment Risks

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a

falling market.

All indexes are unmanaged and cannot be invested into directly.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not ensure against market risk.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Bond and Debt Equity Risks

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise and bonds are subject to availability and change in price.

Investing in foreign and emerging markets debt securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards.

Alternative Product Risks

Alternative strategies may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Currency risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ Composite Index measures all NASDAQ domestic and non-U.S.-based common stocks listed on the NASDAQ stock market. The index is market-value weighted. This means that each company’s security affects the index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index. It is not possible to invest directly in an index.

The MSCI Emerging Markets Index captures large and mid cap representation across 23 emerging markets (EM) countries. With 822 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI is based on five major indicators: new orders, inventory levels, production, supplier deliveries, and the employment environment.

Copyright © LPL Financial