by William Smead, Smead Capital Management

At Smead Capital Management, we like to combine the qualitative aspects of a meritorious company with the temporary contentiousness of deeply out-of-favor psychology. We have found in our research that using qualitative attributes alone can be very expensive. Additionally, we feel that just buying stocks off of the out-of-favor junk pile can lead you to bankruptcy court if the companies fail to turnaround.

A much better approach, in our opinion, is to look for historically successful businesses which are deeply out-of-favor for temporary reasons. To get a feel for historical success, we simply look at the history of a company’s operating results and its long-term common stock returns. Since these pictures are so important to the early stages of our analysis, we are reminded of the adage “one picture is worth a thousand words.”

In Aflac’s (AFL) case, two pictures appear to paint two thousand words. The first chart to look at is the total return of Aflac versus the S&P 500 Index over the last fifteen years.

As you can see, Aflac’s common stock has been a stellar performer during this time period. The stock gained over 180% in price and 265% counting dividends. In the same period, the S&P 500 Index gained 37.99% in price and had a total return of 83.91%. The stock beat the index by 4.88% compounded per year over the time period. This was not an unusual occurrence for Aflac, as its performance over the last 35 years was even more stellar.

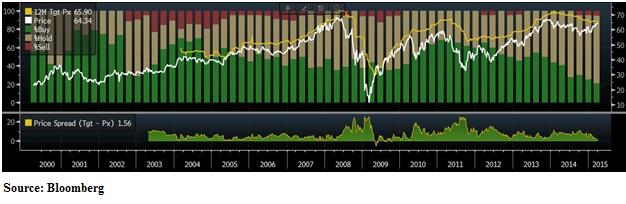

The second picture tracks Wall Street analysts’ ratings on Aflac by color:

Aflac is followed by 19 analysts. The four buy ratings (in green) are the lowest number of buy ratings in the last fifteen years. The hold ratings (in taupe) are the highest in the fifteen years, but the sell ratings (in red) were much higher from the end of 2002 to the middle of 2005. Why would a company which has been such a great long-term common stock performer be held in such low esteem among Wall Street analysts?

Plenty of research and evidence exists which show that the most hated stocks outperform more popular securities. In a column at Marketwatch.com, writer Brett Arends shared the following statistics:

A portfolio of the stocks most hated by Wall Street analysts beat the overall stock market by a wide margin in 2014. Again.

The 10 stocks rated the worst investments on Wall Streets by analysts at the start of 2014 produced an overall return of 19% during the year, including reinvested dividends, according to my analysis using FactSet data.

And that isn’t a one-off. I’ve been looking at this data every year for the past seven years, and over that time the stocks the analysts liked the least have outperformed both the stock market index, and the stocks the analysts like the most, by a country mile.

How did a meritorious company like Aflac get into a deeply out-of-favor position? First, Aflac gets 73% of its profits from their insurance business in Japan. The Japanese Yen has dropped in value from 80 yen per dollar to 120 from October of 2012 to today. As earnings get repatriated back to the U.S., those results from Japan get penalized by dollar strength. It seems that analysts don’t want to fight that headwind, even though Aflac is—by our estimation—the most efficient and effective insurance company in Japan.

Second, the Affordable Care Act robbed Aflac’s sales force the attention of human resource professionals at small to medium-sized companies. These companies are Aflac’s bread and butter in America. In their most recent quarter, Aflac offered a ray of hope for long-term investors by describing improvement in the U.S. voluntary benefit market.

Third, analysts have very low expectations for Aflac’s earnings in Japan and in the U.S. The First Call consensus of five-year earnings growth for Aflac has dropped from 6% one year ago to 1% today. Ben Graham concluded from many years of research that a company which has flat earnings for the next 10 years is worth 8.5 times its after-tax profits. Therefore, Aflac’s P/E multiple of 10.7 is probably very appropriate if the long-term earnings picture turns out to be 1%. Is a company with a strong record of historical earnings growth likely to prove these pessimists wrong?

As a long-duration common stock picking organization, we lean heavily on a few important premises. We believe that valuation matters dearly in common stock selection. Numerous academic studies led by Fama-French; Bauman, Conover and Miller; David Dreman; and Francis Nicholson show that buying the cheapest stocks in the index (by price-to-book value, price-to-earnings, etc.) outperform the index on both a static portfolio and an annual rebalancing basis. We don’t view this as analysis, but merely screening for securities in a way which makes no effort to differentiate businesses on the cheapest list. Aflac is the 30th cheapest stock in the S&P 500 Index on a trailing P/E-ratio basis and the 31st on 2015’s First Call consensus estimate. This puts Aflac deep into the lowest/most attractive quintile according to the academic studies.

We also believe that certain qualitative characteristics generate alpha over long stretches of time. Companies that have had consistently high profitability, low earnings variability and strong balance sheets outperformed from 1980-2004 in a study by Ben Inker at Grantham, Mayo, Van Otterloo & Co. Aflac had a return on equity of 15% in 2014 and has been consistently in the 15-20% area the last ten years. It has cash and equivalents of $4.7 billion and total debts of $5 billion. Earnings grew from $1.00 per share in 1999 to $6.16 per share in 2014 and were consistent until the Yen’s weakness became a stiff headwind in 2013.

Lastly, we love very contentious psychology in common stock ownership. We believe the majority of analysts are scaring folks away from this company, which has clearly made people wealthier who owned it the last fifteen years. Its cheapness screams for contrary thinking and we like to take our risks on the companies which have succeeded in the past. If and when the success resumes, investors in Aflac would get the double whammy of earnings growth and P/E-ratio expansion. To us, that is a risk worth taking.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © William Smead, Smead Capital Management