by Jeff Hirsch, The Almanac Trader

Alright, so the S&P 500 declined 1.1% today. That is the worst daily decline since March 25, 2015 when it fell 1.46%. Within this context, today’s loss seems far less worrisome than you probably heard today. But, with the current bull market well above average duration and performance since 1949 some jitteriness is to be expected. Plus it has been nearly four years since S&P 500 started its last 10% correction.

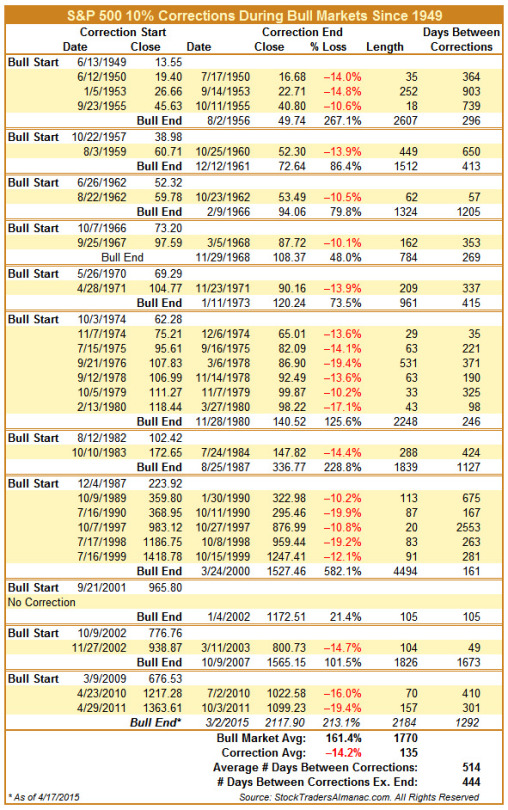

Using a 20% decline as the definition of a bear market, there have been 11 bull markets including the current one and 10 bear markets since 1949. The previous ten bull markets lasted an average of 1770 calendar days and produced gains of 161.4%. Within these 11 bull markets there were 22 corrections ranging from 10% to 19.9% for an average of two corrections per bull market. The current bull market, at 2184 days old and 213.1% gain is above average in duration and magnitude, but average when it comes to number of corrections.

In the following table, each bull market has been broken down and includes the corrections that occurred within it. The bull markets beginning and end dates and closing prices are included and are used to calculate the “Days Between Corrections.” In each row labeled “Bull End,” that bull market’s duration and gain is calculated.

Click here to view full size in new window…

The quickest correction was 18 calendar days in 1955 while the longest was 531 from September 1976 to March 1978. The longest the S&P 500 went without a 10% correction was 2553 calendar days from October 1990 until October 1997. The second longest streak without a correction occurred in the last bull market that ended in 2007 when the S&P 500 went 1673 days. The fewest number of days between corrections was 35 in 1974.

The S&P 500’s current streak of 1292 days is nearly twice the average number of days between past corrections, but unlike past streaks of similar or greater length, the current streak is most likely the result of unprecedented monetary policy actions rather than robust economic performance.