The Fed Loses Patience

by Ryan Lewenza, Private Client Strategist, Raymond James

• The highly anticipated March Federal Reserve (Fed) meeting came and went with few surprises. As expected, the Fed removed the “patient” wording with respect to keeping interest rates low and their monetary policy accommodative. This move is the first step to normalizing interest rates following seven years of record low interest rates.

• While the Fed moved one step closer to hiking rates, they did however temper expectations on the timing and degree to which they may tighten. In particular, the Fed downgraded its 2015 GDP growth outlook and lowered its expectations for the Fed funds rate. In our opinion the messaging of this statement was quite brilliant in that it recognized the need to tighten, but reassured the market that they will be slow and disciplined in their policy tightening.

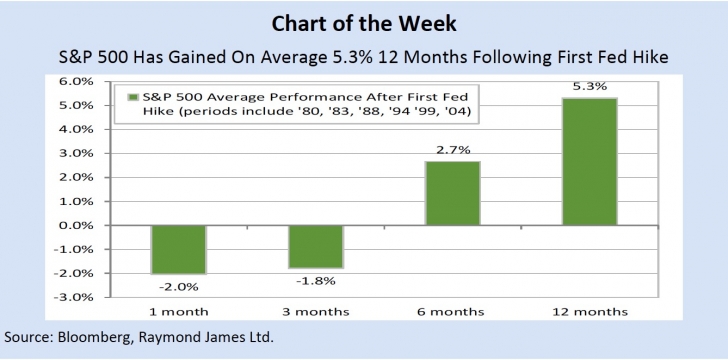

• We believe the continued strong labour gains along with improved economic momentum will lead to interest rate hikes this year. Given this view should we be worried about rate hikes derailing the economy and current bull market?

• Historically the S&P 500 Index (S&P 500) has risen in the six and 12 months following the first Fed hike. We examined S&P 500 returns following the start of each tightening cycle since 1980 and found that the S&P 500 is up on average 2.7% and 5.3% in the six and 12 months, respectively, after the first Fed hike. From our perspective, the beginning of Fed tightening is positive as it signals an improving economy, which is generally consistent with stronger corporate earnings growth, and higher equity valuations.

• Moreover, one of the best predictors of a recession and equity bear market is an inverted yield curve. Currently, the US yield curve sits at +195 bps, well above the typical zero or negative reading seen before recessions.

Read/Download the complete report below: