Downgrading Financials On Half-Speed Canadian Economy

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• The Q4/14 GDP report was released this week and it showed the Canadian economy grew at 2.4% annualized. On the surface the print was solid; however, digging into the numbers, a different picture arises. First, there was a significant build-up in inventories which accounted for three-quarters of GDP growth. Second, exports declined 1.6% annualized which, given the drop in the Canadian dollar, is concerning.

• Coming into the year our view was that economic growth would improve, with exports being an important driver. We were targeting a conservative 2.5% GDP growth rate for 2015, but we now see downside risk to this forecast.

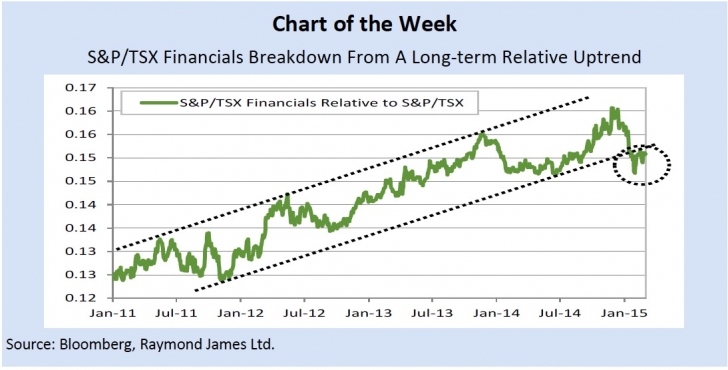

• We expect a weaker H1/15 for the Canadian economy, followed by a stronger H2/15. Overall, we now expect GDP growth closer to 2% for the full year. Given our expectations for more modest economic growth we are downgrading the financials sector to market weight.

• The key factor behind the downgrade is our trepidation over bank earnings this year, and with the large weighting of banks within the financials sector, we believe it’s prudent to tweak our sector recommendation and downgrade it to market weight. The banks remain great long-term investments given their solid long-term earnings profile and steady dividends. As such, we continue to see them as core holdings in portfolios. However, upside may be more limited this year. Within the financials sector our preference is for the insurance and asset management sub-industries for 2015.