by Anthony Valeri, Fixed Income and Investment Strategist, LPL Financial

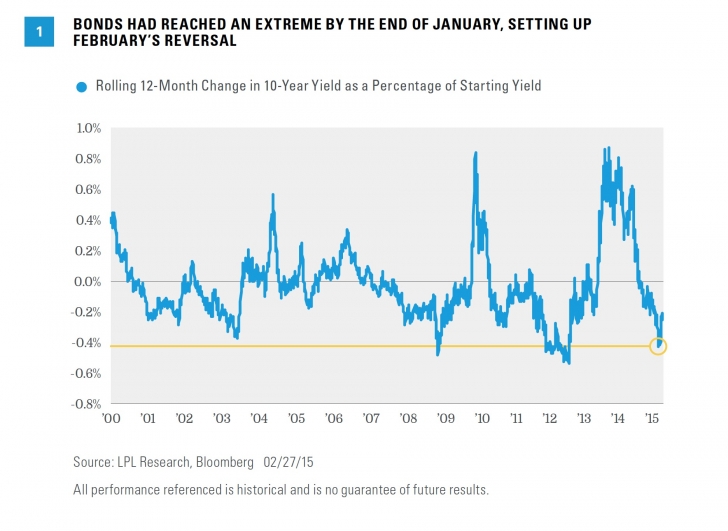

The first two months of 2015 have been a case of Dr. Jekyll and Mr. Hyde for bond investors. January was the best month for high-quality bonds, as measured by the Barclays Aggregate Bond Index, since December 2008, with an impressive total return of 2.1%. On the other hand, February erased much of those gains, as high-quality bonds posted their worst monthly performance since the taper tantrum sell-off in June 2013, declining by 0.94%. As of the end of January 2015, the yield on the 10-year had fallen by over 40% over the prior 12 months [Figure 1]. Such an extreme is rare and has happened only two other times during the last 15 years: after the 2008 financial crisis and in 2012 in response the Eurozone crisis.

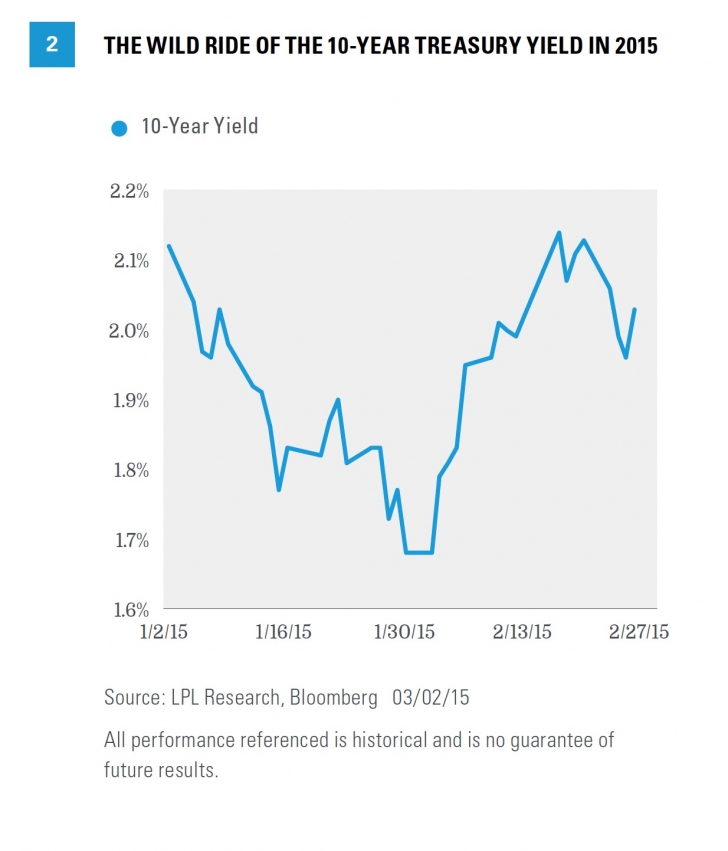

WILD RIDE

The wild ride of bonds is best illustrated by the 10-year Treasury yield [Figure 2]. When the dust settled, high-quality bonds finished up 1.14% on a year-to-date basis through the end of February, with prices still higher and yields lower for 2015.