by Ben Carlson, A Wealth of Common Sense

Michael Batnick had a great post this past week about the “lost decade” for the S&P 500 in the 2000s (see What Lost Decade?). It’s a nice reminder of the benefits of global and style diversification in a portfolio after the a select group of stocks in the U.S. have performed so well over the past couple of years.

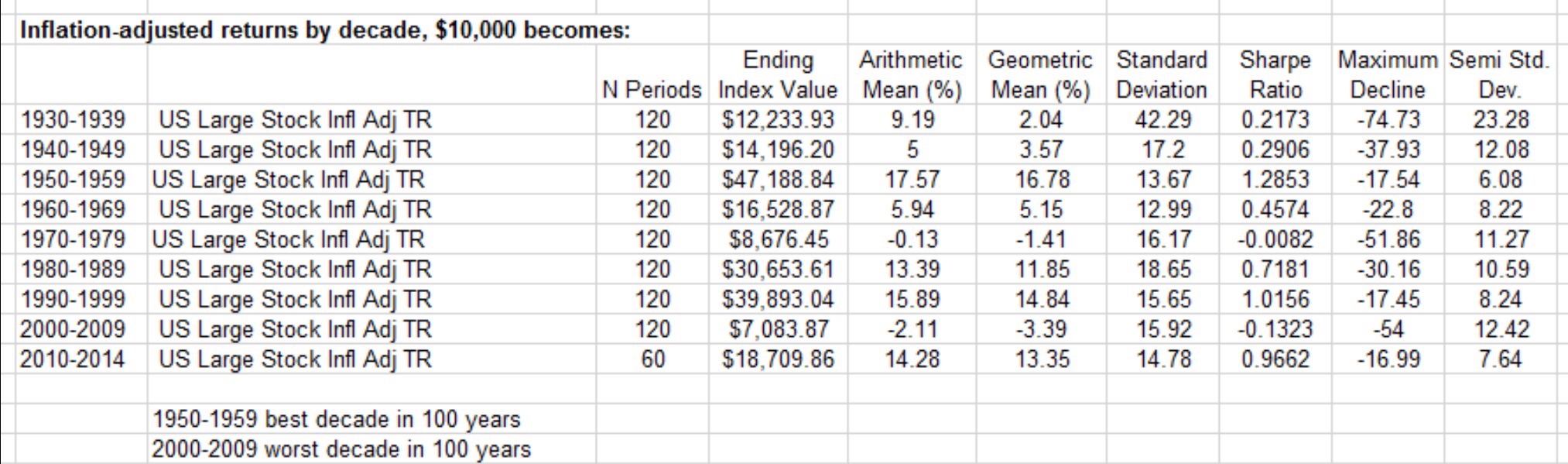

Keeping with this theme, Jim O’Shaughnessy tweeted out the follow data this week (click to enlarge):

Jim’s table shows the inflation-adjusted performance by decade for large cap U.S. stocks going all the way back to the 1930s. There were a handful of decades with fairly terrible market returns. Stock market returns are messy and sporadic, even though the volatility was relatively similar in every decade save for the disasterous 1930s.

Looking at the data from Michael and Jim actually reminded me about a story from a friend of mine that experienced their own lost decade. My friend graduated from college in the year 2000. He signed up for his company’s retirement plan right away and invested in a diversified portfolio of domestic and international stock funds. Throughout his first ten years of employment he continued to make contributions out of each and every paycheck regardless of market conditions.

By the beginning of 2009, at the depths of the financial crisis and market crash, he had reached his breaking point. When he looked at his latest 401(k) statement he found that he was basically break-even after a decade of saving and investing. The market value of his portfolio was equal to his contributions.

At that point he was ready to give up. And I could see why. It’s pretty demoralizing to realize you could have just stuck the money under your mattress and gotten the same end result.

But I gave him my pep talk by saying, “Look at it this way — You just made ten years of contributions at more or less the same average share price. You were able to buy in at lower prices consistently for the majority of the first ten years of your career — a career that will probably last 30-40 more years. Time is on your side. This is actually a good thing once the markets ever recover.”

Little did I know at the time that the U.S. markets would go onto triple from those levels. All of my friend’s contributions made during the lost decade years turned out to be worth it and then some once markets finally took off. He had to be extremely patient and disciplined, but he’s finally seen huge growth in his retirement fund’s market value since 2009.

I’m happy he’s finally seen some progress, but even if the markets hadn’t experienced the massive bull market since then, the message would have remained the same. Young investors should actually hope for market crashes or poor returns as they make periodic retirement contributions. On the other hand, retirees don’t have future savings to make up for current losses or the same level of patience to wait out a market comeback.

This is why context always matters when thinking about allocating your savings to the markets. The difference between good or bad markets can come down to where you are in your career, how much time you have remaining to save and most importantly, your level of human capital or future earnings power.

The 2000s showed that one of the largest markets in the world — the S&P 500 — can lose money over a decade long period. Yet no one would ever look at this as a good thing. Stock market crashes are synonymous with fear, volatility and pain while they should be thought of as a half-off sale and opportunities for those investors that are going to be net savers for the foreseeable future.

Take a look at the maximum drawdown column in O’Shaughnessy’s data. The average loss each decade going back to the 1930s is over 35%. Every decade has at least one market crash or bear market. If you’re investing long enough you’ll get your chance to buy at lower prices.

It’s counterintuitive to assume that poor market performance is a good thing, but that’s exactly what it can be for younger investors or those with many years to continue saving from their paychecks. A lost decade in the markets could be the best thing that ever happens to a young saver.

Further Reading:

Was the 1966-1982 Stock Market Really That Bad?

The Joy of Investing in Down Markets

Enduring Lessons from the Financial Crisis

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense