by Jesse Felder, The Felder Report

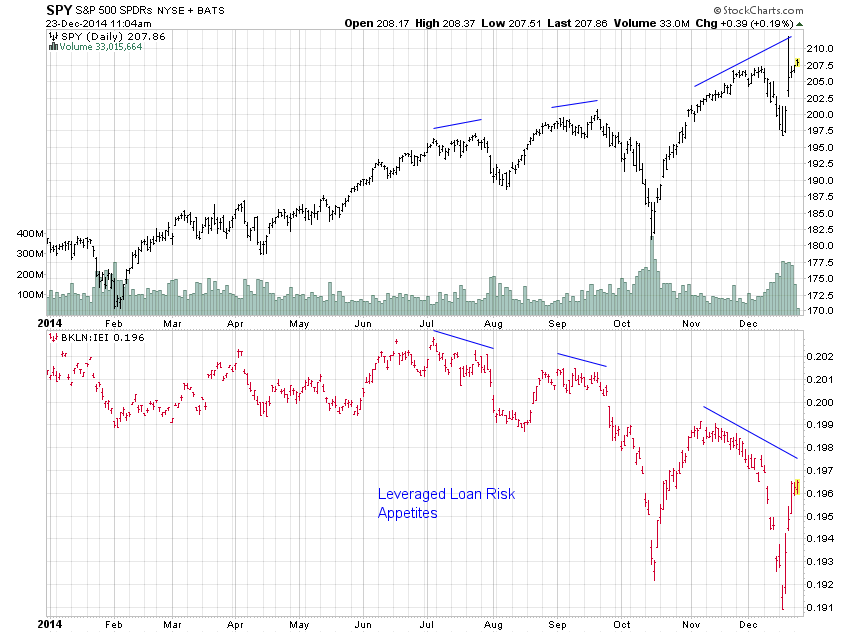

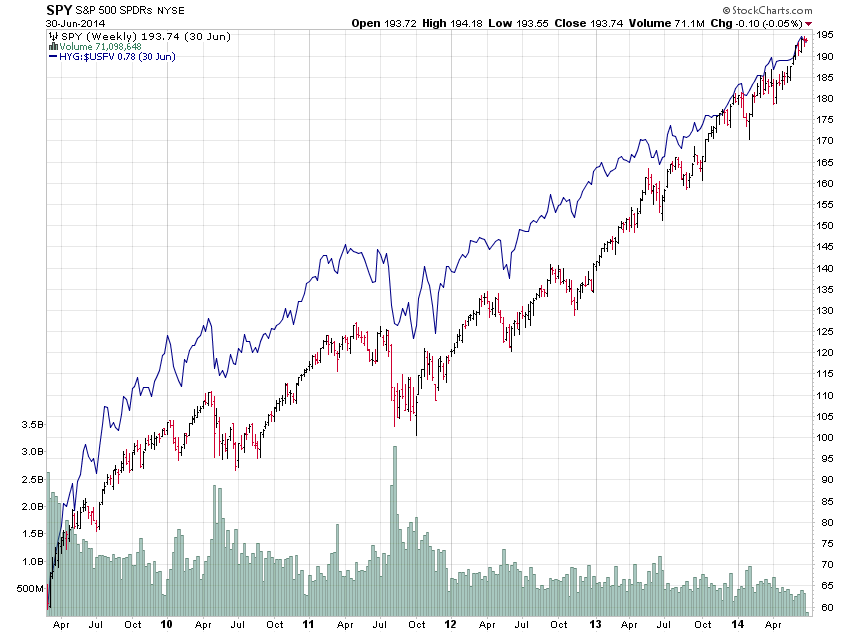

I have been watching the junk bond (and leveraged loan) market very closely over the past few months mainly because risk appetites there have been closely tied to stock prices for a very long time. In fact, since the bull market was born in March of 2009 until this summer high-yield risk appetites (as measure by the ratio of the high-yield ETF to the 5-year treasury bond) and stock prices have had a 98% correlation coefficient.

Clearly, the chart above demonstrates that the strength in junk risk appetites led stocks off the lows back in 2009. Over the past summer, however, junk bonds started to lag stocks for the first time since the bull began (or lead lower, depending on your perspective). Since then the divergence has only gotten wider with each subsequent new high in the stock market:

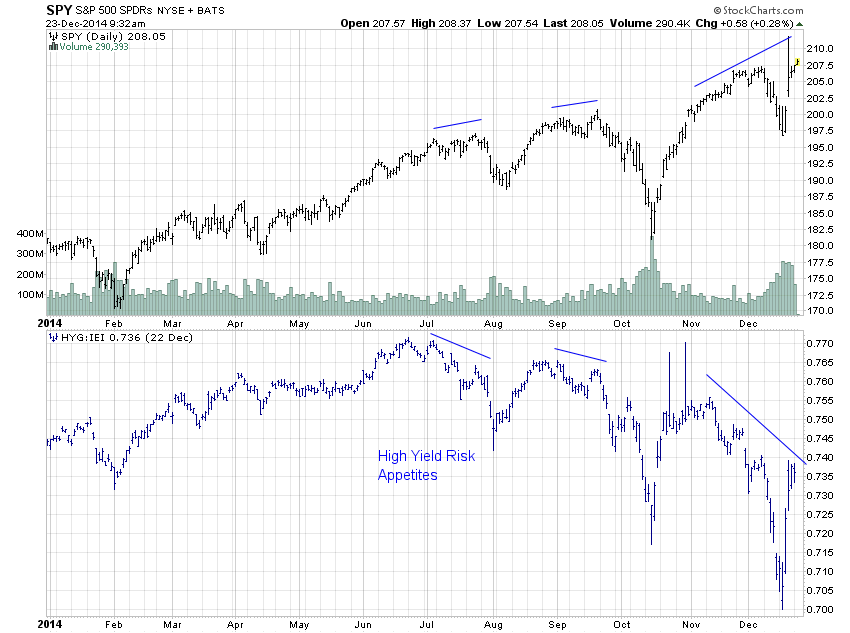

Clearly, the chart above demonstrates that the strength in junk risk appetites led stocks off the lows back in 2009. Over the past summer, however, junk bonds started to lag stocks for the first time since the bull began (or lead lower, depending on your perspective). Since then the divergence has only gotten wider with each subsequent new high in the stock market:

So what’s going on? Why the sudden shift in equity risk appetites relative to high-yield?

So what’s going on? Why the sudden shift in equity risk appetites relative to high-yield?

Well, the popular explanation has been that the junk market has a much higher exposure to energy so the oil crash will have a much larger impact. For that reason, stocks are rightly “decoupling” from the junk market, or so it goes.

To me this argument sounds more than a little specious. The energy component in junk is about 14%. This compares to an 11% weighting in the S&P 500 so there’s a difference there, to be sure, but not a very significant one.

And as Howard Marks recently wrote, “It’s historically unprecedented for the energy sector to witness this type of market downturn while the rest of the economy is operating normally. Like in 2002, we could see a scenario where the effects of this sector dislocation spread wider in a general ‘contagion.'”

The energy boom over the past few years, driven by fracking technology, has been a major boon to the overall economy. The fact that fracking is now unprofitable means that boom is likely to bust. Believing that the boom was a positive but the bust won’t be is wishful thinking at best.

Interestingly, this morning T. Boone Pickens said he believed that weak demand was more to blame for the crash in the price of oil than excess supply. If this is the case it has much greater implications for the economy than if supply were the main culprit.

But setting the energy debate aside, investors should also consider the action in investment grade yield spreads which have widened, as well. They only have 6% exposure to energy so are much less exposed to the potential bust.

Leveraged loans are only made up of 4% energy. Still, risk appetites there have been just as weak as those in high-yield:

To me, this all points to broader risk appetites responding to growing risks within AND beyond the energy sector or what Marks refers to as, “contagion.”

But why should these risks matter to equities? The answer is because high-yield bond investors and equity investors face the very same risks. What is the ultimate risk in owning a high-yield bond? It is the risk of the company falling into a situation where their income can no longer support their debt and they are forced to default.

The ultimate risk for equity investors is just the same. However, bond holders have seniority over equity investors. Equity investors, in fact, face even greater risk of loss of principal than high-yield or leveraged loan investors do because bond holders usually have some sort of covenants that hopefully ensure recuperation of their principal to some degree. This is not the case for equity investors.

You would think, then, that when bond holders begin pricing in greater risk of default equity investors should sit up and pay attention (at least some do). So I find it very fascinating that while investors in the debt markets are pricing in greater risks, equity investors feel comfortable in paying ever higher prices (accepting less and less “margin of safety”).

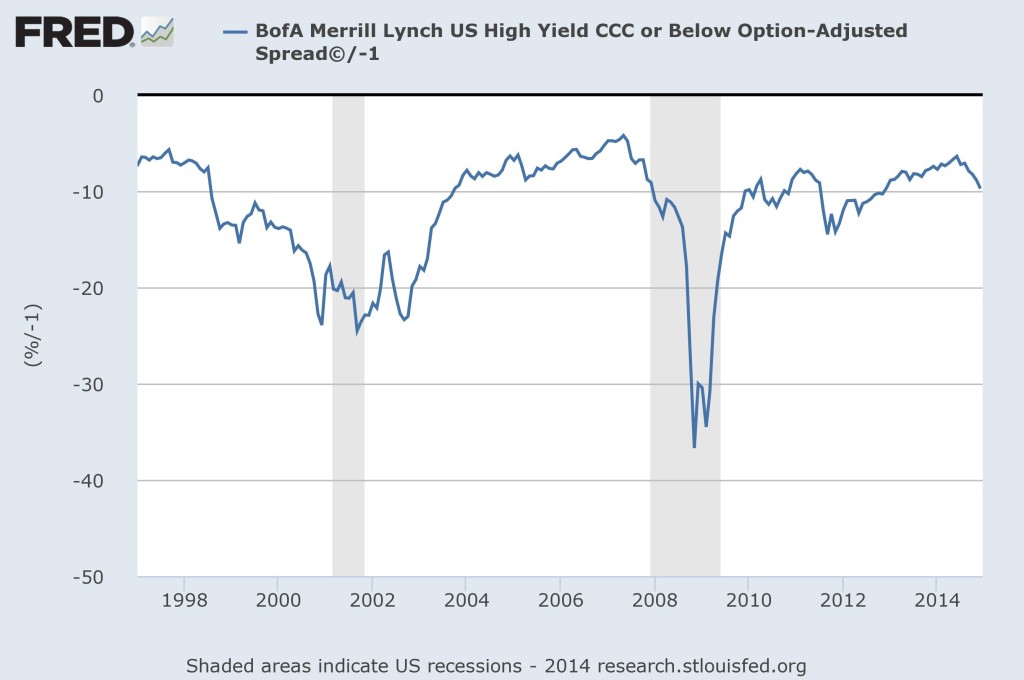

Historically, it’s equity investors that prove to be oblivious to the growing risks that high-yield investors begin to pay attention to rather than high-yield investors overreacting. As I’ve written before, high-yield spreads widened dramatically prior to equities topping in out in both 2000 and 2007 . In those cases, bond investors obviously proved to be fairly prescient. Today’s divergence between the two is even greater than those past episodes.

Given that the correlation between the two is so high and for good reason, it’s interesting to note that junk bond risk appetites now imply a level of 1800 on the S&P 500 (based on their daily correlation over the past five years of 98%), fully 13.5% below its current price. Now I don’t know how this gap will be closed, whether stocks will decline or high-yield risk appetites will recover or some combination of both. I do believe, however, that the bond markets are pricing in increasing risks that some have been warning about for quite some time and that the equity market, for the moment, is ignoring.

So who are these indiscriminate buyers in equities? It’s not retail investors. As Jason Goepfert pointed out in his letter last night, outflows from mutual funds and ETFs have been above average even for December, a month where we typically see outflows.

My guess is that it could be a various group of the dumbest of the dumb money. In that group I would include indexers who are value agnostic. (Don’t get me wrong; I’m a fan of roboadvisors but I recognize the risk their growing popularity poses.) I would also include algorithmic trading, which buys and sells stocks based on who knows what (a couple of words in the Fed statement?), certainly not any kind of traditional investment philosophy. Finally, I would point to foreign buyers who are desperate to escape the confines of their weakening economies, plunging currencies and falling equity markets at home.

Again, I’ll refer to the brilliant Howard Marks:

For the last few years, interest rates on the safest securities – brought low by central banks – have been coercing investors to move out the risk curve. Sometimes they’ve made that journey without cognizance of the risks they were taking, and without thoroughly understanding the investments they undertook. Now they find themselves questioning many of their actions, and it feels like risk tolerance is being replaced by risk aversion.

This is definitely now occurring the fixed income markets. In the equity markets I believe they are still, ‘moving out the risk curve without cognizance of the risks they are taking.’ But if Marks is right and we are now switching from a period of “risk on” to “risk off,” the widening in high-yield spreads (inverted) may have much farther to go:

And if that’s the case, 1800 on the S&P 500 may be only the beginning.

Copyright © The Felder Report