This is the time of year when, in almost every American household, the tinkerer in the family eyes the recipe box. Certain venerable traditions will make it to the Thanksgiving table intact. A cousin or an in-law is sure to bring an entirely new dish. And some traditional plates could use some freshening up. That’s the case with core fixed income.

Let’s start by reviewing why we would want to tinker with our traditional US-only core-bond fare by going global.

In recent posts, we established that going global diversifies interest-rate and economic risks and increases the opportunity set, and that it should help buffer some of the downside risk that US-only portfolios are likely to experience over the near term as rates begin to rise. We made a strong case for a hedged global portfolio as having a better risk-adjusted return than either unhedged global or US-only portfolios.

We also clarified why hedging out the currency exposure is key to keeping global portfolios in the targeted “core” volatility range, and that from a tactical standpoint, there’s no time like the present to make what is otherwise a strategic shift, as the US dollar is likely to trend upward in the coming months.

How much global is just right? At this point, I expect you’re asking how much of the fixed-income core mandate should be shifted into a hedged global portfolio.

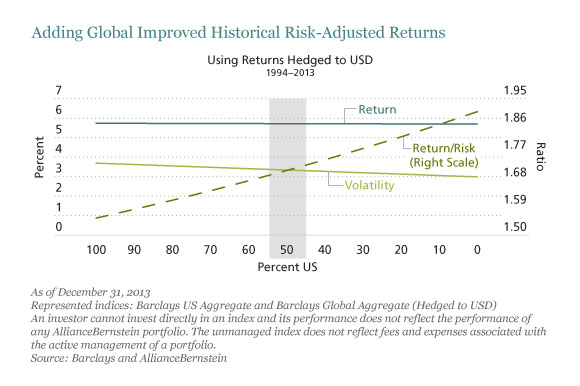

As shown in the Display below, there is no sweet spot. Any incremental addition of global bonds can be beneficial to risk-adjusted returns. We’ve plotted the risk and return of portfolios with different weightings to US bonds and global bonds, ranging from 100% in US to 100% in hedged global.

The more global the portfolio, the higher the risk-adjusted return, represented by the rising diagonal line. Simply put, it just gets better. That means that as little as a 10% allocation to global can improve outcomes. In our view, a 50% allocation is a realistic target. And a 100% commitment would be commensurately better, based on historical experience.

So whether you stir a little global into your core bond recipe or completely make it over, adding global bonds should improve outcomes over the long term—but particularly in today’s environment, where they can buffer some of the interest-rate risk inherent in traditional US-only core bond strategies. Just keep in mind that the key is hedging out the currency risk, so as to keep volatility in check.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Alison Martier is Senior Portfolio Manager of Fixed Income at AllianceBernstein (NYSE:AB).

Copyright © AllianceBernstein