Overseas Influences

by Anthony Valeri, LPL Financial

· Demand from overseas investors once again helped the bond market shrug off stronger economic data and weak Treasury auction demand.

· Favorable yield differentials between Treasuries and key overseas bond yields may provide lingering support for the domestic bond market.

· The Fed, this week’s release of Fed meeting minutes, and the European economy likely hold the keys to unlocking the low-yield environment.

Bonds shrugged off another dose of good economic data last week, which would have typically exerted greater downward pressure on bond prices. The Job Openings and Labor Turnover Survey (JOLTS) data, one of Federal Reserve (Fed) Chair Yellen’s favorite labor market indicators, showed further improvement with the percentage of workers voluntarily quitting their jobs reaching a post-recession high. The report provided another sign of labor market improvement and an indication of potential future wage gains. Monthly retail sales data were stronger than expected and showed the consumer—a key ingredient of economic health—continues to do its part in spurring the economy along.

Not only were economic data supportive of continued 3% economic growth in the United States, and potentially supportive of lower bond prices, but also weak demand at the 3-, 10-, and 30-year Treasury auctions did little to weaken bond prices. Low yields generated below-average interest for the more important 10- and 30-year auctions. Strong demand for longer-term debt would have been a vote of confidence for current bond valuations, but that did not materialize. For the week ending November 14, 2014, Treasury yields did increase, but only by a marginal 0.01% to 0.02%—a resilient result considering the one-two combination of stronger data and weak auction demand.

Wider Yield Differentials Are Providing Support for Bonds

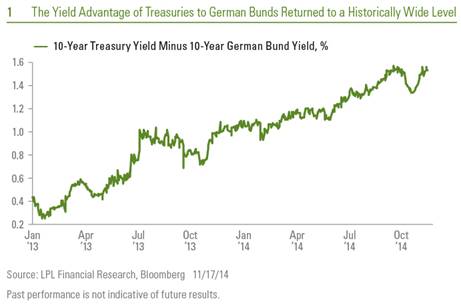

Bond resilience could be attributed to overseas influences and foreign demand taking up the slack for domestic buyers. Favorable yield advantages to key foreign bond benchmarks may have once again spurred overseas buying of Treasuries. The 10-year Treasury reached a 1.5% yield advantage to 10-year German Bunds for the second time this year [Figure 1], which also happens to match the widest disparity of the past 15 years. We have discussed foreign demand as a driver of bond strength in this commentary in the past. After narrowing in October 2014, wider yield differentials brought about foreign buying demand once again.

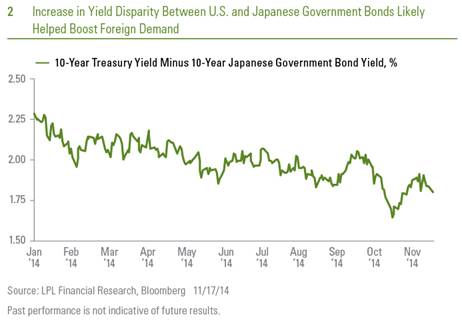

A widening yield disparity was also evident relative to Japanese government bonds (JGB). Although the yield differential between 10-year Treasuries and 10-year Japanese government bonds has declined for most of 2014, the recent increase may have sparked investor interest [Figure 2]. The yield differential between 10-year Treasuries and 10-year JGBs increased by 0.35% in recent weeks. The Bank of Japan recently surprised investors with an expansion of its bond-buying program, which led to lower JGB yields. Lower JGB yields and the presence of a large buyer motivated investors to take note of the increasing yield advantage of Treasuries, which remains considerable at nearly 2% on an absolute basis. The strength of the U.S. dollar has likely bolstered confidence among overseas buyers as currency gains provide an investment lift.

Global Economies Are Still Affecting Treasury Yields

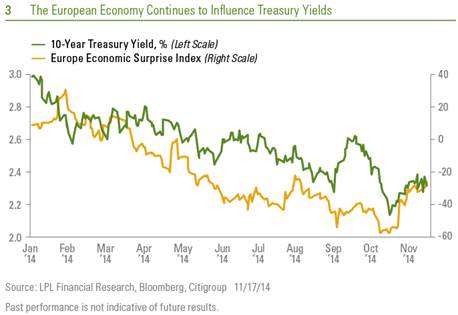

Aside from relative yield advantages overseas, the U.S. bond market continues to keep a close eye on global growth risks. The decline in Treasury yields in 2014 has disconnected from the improvement in domestic economic data since the end of the first quarter of 2014, and focused on the prospects of renewed recession in Europe. Longer-term Treasury yields have closely tracked the degree to which European economic data have missed or met expectations [Figure 3]. Note how the recent improvement in European economic data was partly responsible for the rise in yields over the latter half of October. While Treasury yields disconnected from slightly better economic data in Europe last week, the close correlation shows how Treasury bonds are influenced by foreign developments. Mere stability in economic data has even coincided with higher Treasury yields in June, July, and again in September 2014.

Monday’s (November 17, 2014) news that Japan’s economy contracted for the second consecutive quarter—the unofficial measure of recession—further bolstered Treasuries despite their low yields and expensive valuations. These foreign influences may continue to keep yields low as investors watch for potential fallout to the domestic economy. When Europe fell into recession for the second time since the Great Recession in late 2012 and early 2013, the U.S. economy managed to avoid negative impacts, but Treasury yields similarly remained very low.

Unlocking Low Yields: The Fed & Global Growth

The Fed remains one of two key drivers to unlock the low-yield environment. At the conclusion of the last Fed meeting in late October 2014, the Fed officially announced the end of outright bond purchases and made no mention of a strong dollar, slowing inflation, or weakness in Europe. Bonds weakened following the Fed announcement as it suggested the Fed did not believe these outside influences would be a risk.

This week’s release of the October 2014 Fed meeting minutes may provide additional insight as to how the Fed views a strong dollar, lower inflation, and European growth risks. The more acknowledgement Fed officials paid to the slowdown in inflation, a stronger dollar, or weaker economies in Europe, the more support it may provide to Treasuries, and vice versa.

Aside from the Fed, global economic strength, or lack of it, will continue to influence the path of domestic bond prices. Europe, whose combined economic output is roughly equal to that of the United States, will be of particular focus—and given the close correlation in 2014, may be a key to unlock low yields and expensive valuations.

We expect continued 3% economic growth in the U.S. economy, which will keep the Fed on track to raise interest rates in late 2015 or early 2016, and gradually pressure bond prices lower and yields higher. Expensive bond prices may then weaken slowly—a reason why we expect the increase in bond yields to be gradual—as overseas influences continue to support U.S. bonds.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Job Openings and Labor Turnover Survey (JOLTS) is a survey done by the United States Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers, and different offices each month. Respondents to the survey answer quantitative and qualitative questions about their business's employment, job openings, recruitment, hires, and separations. The JOLTS data are published monthly, by region and industry.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-329899 (Exp. 11/15)

Copyright © LPL Financial