High-Yield Divergence

by Anthony Valeri, Investment Strategist, LPL Financial

High-yield bonds bounced back after a weak start to October 2014 but underperformed their stock counterparts. High-yield bonds typically lag stocks in a rising market, but while stocks made new highs for the year, high-yield bonds failed to match their prior 2014 peaks. High-yield bonds are still enjoying a good year of performance, up 4.7% year to date through October 31, 2014; yet they remain about 1% below the total-return peak made in June 2014 and again in early September.

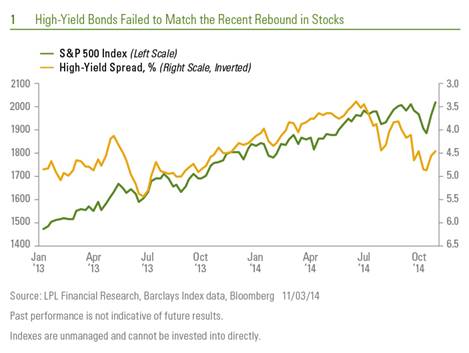

High-yield bond spreads, a measure of valuation, illustrate how the sector has failed to recoup to prior levels while the stock market, as measured by the S&P 500 Index, reached new highs last week (October 27 – 31, 2014) [Figure 1]. The lower the yield spread, the more expensive high-yield bonds are (and vice versa). Normally, stock prices and high-yield bond spreads track closely as both are economically sensitive assets. High-yield bonds rebounded along with stocks but failed to match the magnitude of the recent increase.

Factors Driving the Divergence

We do not think the recent divergence signals a red flag for high-yield bond investors. The taper-tantrum sell-off of mid-2013 witnessed a high-yield bond pullback that outpaced that of stocks on a relative basis. High-yield bonds eventually recouped losses later in 2013.

Specific market factors can often be behind such differentials, and in the current period include:

· Increasing new issuance. As earnings reporting season winds down, high-yield bond issuers return to the market. Normally, corporate issuers avoid issuing new debt during periods of earnings releases as uncertainty around corporate details can limit demand. Issuance for the two weeks ending October 31, 2014, increased above the weekly average. This increase was due in part to earnings season winding down, but also aided by the return of postponed supply due to volatile markets in early October. Market participants often hesitate ahead of new supply to see how it will be absorbed before committing funds. This can cause market momentum to slow, or in the case of a weak market, to accelerate to the downside.

· Rising high-quality bond yields. High-yield bonds can certainly diverge from their high-quality counterparts, but in a low-yield world, the absolute level of yields takes on added importance. Buyers emerged in force as the average yield of high-yield bonds rose to nearly 6.5% in early October 2014, but at 5.8%, as of November 3, 2014, demand has moderated. Since mid-October, the five-year Treasury yield has increased by more than 0.3%, creating headwinds for high-yield investors as competition from high-quality counterparts increased. High-yield bonds are generally much less sensitive to rising interest rates, but such a sharp rise in intermediate Treasury yields over a brief period can have an impact.

Maintaining a Positive Outlook

Still, with an average yield spread of 4.5% to comparable Treasuries, we believe the outlook for high-yield bonds remains favorable. Economic expansion, earnings growth, and low defaults continue to drive our positive outlook. Economic growth as measured by gross domestic product (GDP) increased at a preliminary 3.5% for the third quarter of 2014 and follows a 4.6% reading for the second quarter. Our analysis indicates economic growth is on track for a 3% gain during the current quarter. Monday’s Institute for Supply Management (ISM) Manufacturing Survey was much stronger than expected with a reading of 59 that has historically coincided with 3.5 – 4.0% GDP growth.

Third quarter earnings reporting season is more than 75% complete and profits are on track to grow 9% year over year following a 10% gain during the second quarter of 2014. Top-line revenue is on pace to increase at a nearly 4% rate. Although profit growth may likely slow, such gains further support high-yield issuers’ ability to repay debt obligations.

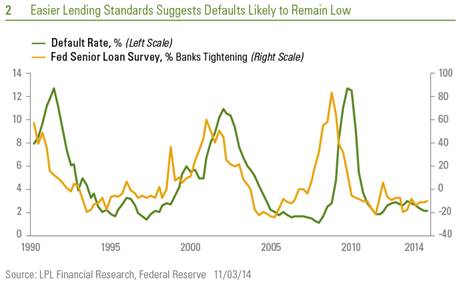

Defaults, a key driver of high-yield bond prices, remain benign and are likely to stay low. The Federal Reserve’s (Fed) Senior Loan Officer Survey showed banks, on average, continue to ease lending terms. The survey has been a reliable leading indicator of defaults and continues to point to a low-default environment [Figure 2]. A rise in the number of banks tightening credit lending standards has preceded a rise in defaults by about one year.

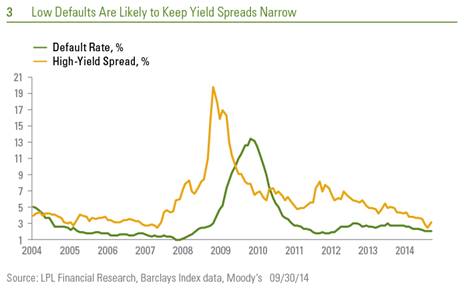

Moody’s global speculative default rate declined to 2.1% over the third quarter of 2014, down from 2.2%. On a dollar volume basis, the default rate was slightly lower at 1.8%. Although the average yield spread of 4.5% remains below the long-term historic average of 5.8%, yield spreads will likely remain narrow (and valuations more expensive) given the low-default environment [Figure 3]. Default rates and yield spreads are closely correlated. We believe it is premature to expect a meaningful increase in the default rate over the coming months given the pace of economic data and lack of near-term maturities.

On the negative side, the lack of a stronger follow-through in the high-yield bond market may reflect concern over future economic growth or fears over the end of the Fed’s bond purchase program. As we discussed in the September 29, 2014, Bond Market Perspectives, some of these fears may not be driven by fundamental data, which as noted above continue to point to a healthy U.S. economy. Friday’s release of the monthly employment report will be the next key data point to track the economy’s progress. And as mentioned in last week’s commentary (“Breaking Up”), the Fed remains accommodative with ongoing mortgage-backed securities (MBS) reinvestment despite the end of outright purchases.

The headwinds of rising high-quality bond yields and increasing new issuance have slowed the advance of high-yield bonds in late October relative to stock market gains. Nonetheless, we expect high-yield bonds may improve as economic growth remains near 3% and continued profit growth supports underlying credit quality. Alternatively, the pause may also reflect investors’ resignation that mid-single-digit returns are all that are likely in a positive scenario for high-yield bond investors over the coming 12 months. Still, that is likely to be one of the bright spots in what is likely to be a challenging, low-return environment across the bond market.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-325487 (Exp. 11/15)