by Patrick O'Shaughnessy, Millenial Invest

Expensive stocks suck. Cheap stocks are great. If you had followed these basic concepts through history, your results would have been incredible. Look below at the disastrous returns you’d missed by avoiding expensive stocks! And the huge returns you would have earned buying cheap stocks! On paper these results are enticing. But achieving results like this in the future would require a resilient and contrary mindset. Do you have what it takes?

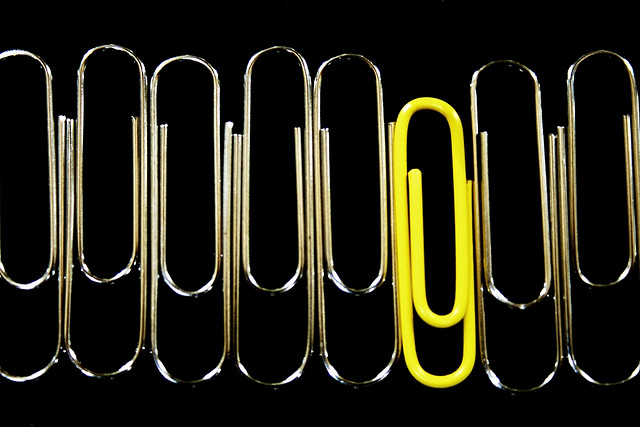

These results are for the cheapest and most expensive large, non-financial stocks in the U.S. based on their EBITDA/EV ratios (rebalanced on a rolling annual basis). But “expensive” and “cheap” are not really the right words to be using to describe these two types of stocks. More accurate would be “exciting” and “terrifying.” Stocks at these market extremes are those for which the market has the greatest consensus—both positive and negative.

In the case of exciting stocks, the consensus opinion is that the future is bright. It helps to replace the word “valuation” with “expectation.” High expectations—for companies like Tesla—lead to “exciting” prices. In the case of terrifying stocks, the consensus opinion is that the future is bleak or non-existent. Again using “expectation” instead of “valuation,” low consensus expectations lead to “terrifying” prices.

To buy into a terrifying portfolio, you need to have a contrary mindset. This mindset is almost sociopathic, because it requires not just ignoring the crowd, but actively trading against it. This flow chart below illustrates the counter-flow required to be a successful contrarian investor:

Case in point: today, 12 of the cheapest (most terrifying) 25 large stocks are large energy stocks. Would you buy a portfolio that was 50% energy right now? Oil has been in free fall. Because the energy sector has gotten more and more capital intensive over time, it requires higher energy prices to be very profitable. These companies may not be able to pay dividends in the future. If energy prices continue to fall, who knows what will happen to these stocks. It is easy to build a bleak narrative for energy stocks.

Let’s say you can stomach lots of energy stocks today. Would you then be able face similarly scary portfolios every year for the rest of your investing career? Remember, this isn’t a one-and-done trade. It is a constant cycling into the most hated stocks out there. This is not easy stuff.

One of the best books I’ve ever read is The Tiger by John Vaillant, which chronicles the search for a man-eating tiger in the Russian wilderness. This passage from the book (with my emphasis added) highlights aspects of the mental fortitude it takes to be a truly contrarian investor.

“The most terrifying and important test for a human being is to be in absolute isolation...A human being is a very social creature, and ninety percent of what he does is done only because other people are watching. Alone, with no witnesses, he starts to learn about himself—who is he really? Sometimes, this brings staggering discoveries. Because nobody’s watching, you can easily become an animal: it is not necessary to shave, or to wash, or to keep your winter quarters clean—you can live in shit and no one will see. You can shoot tigers, or choose not to shoot. You can run in fear and nobody will know. You have to have something—some force, which allows and helps you to survive without witnesses…Once you have passed the solitude test you have absolute confidence in yourself, and there is nothing that can break you afterward.”

Contrarian investing will require that you be “alone” almost all the time. The rewards can be great, but the journey is arduous. As Joesph Campbell said, "the cave you fear to enter holds the treasure you seek."

Copyright © Millenial Invest