by Don Vialoux, EquityClock.com

Pre-opening Comments for Wednesday October 29th

U.S. equity index futures were lower this morning. S&P 500 futures were down 2 points in pre-opening trade. Investors are waiting for news from the FOMC meeting to be released at 2:00 PM EDT.

Third quarter reports continue to pour in. Companies that reported overnight included Eaton, Facebook, Garmin, Goodyear, Hershey, Hess, Hyatt, Praxair, Southern Companies and Waste Management

Alibaba added $0.62 to $100.30 after 10 investment dealers initiated coverage on the stock with a Buy or Outperform rating.

eBay (EBAY $50.70) is expected to open higher after Morgan Stanley initiated coverage with an Overweight rating.

Amazon.com gained $4.41 to $300.00 after Morgan Stanley initiated coverage by adding the stock to its Best Ideas list.

Abbott Labs gained $0.26 to $42.50 after Deutsche Bank upgraded the stock from Hold to Buy.

Amgen added $0.10 to $157.29 after Nomura upgraded the stock from Neutral to Buy.

Whirlpool (WHR $168.06) is expected to open lower after Sterne Agee downgraded the stock from Buy to Neutral.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/10/28/stock-market-outlook-for-october-29-2014/

Brooke Thackray on BNN Television

Following is a link to Brooke’s top picks:

http://www.bnn.ca/Video/player.aspx?vid=478282

Interesting Charts

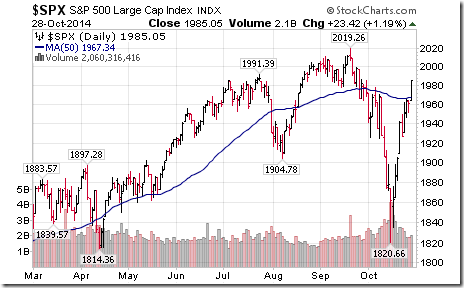

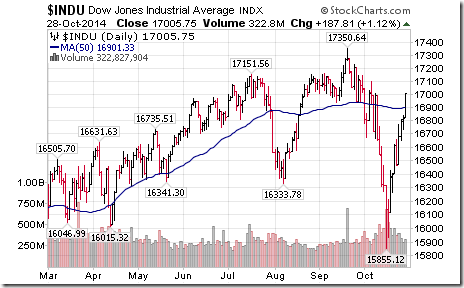

More confirmation that the October 15th low by U.S. equity indices was an intermediate low and ultimately will be the low for the four year Presidential cycle! The S&P 500 Index, Dow Jones Industrial Average and Russell 2000 Index moved above their 50 day moving average.

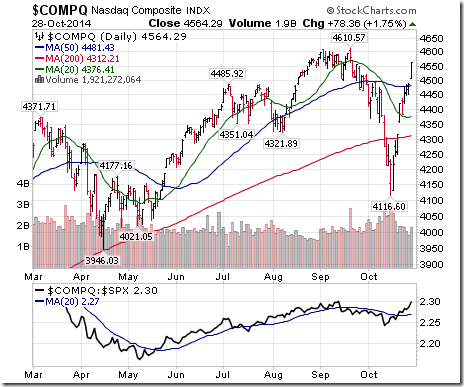

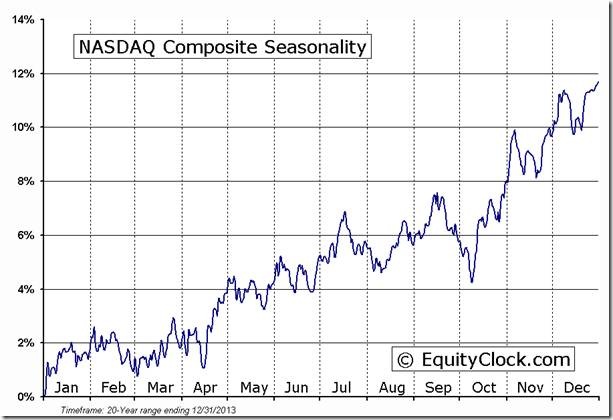

The technology heavy NASDAQ Composite Index led U.S. big cap equity markets on the upside yesterday. ‘Tis the season!

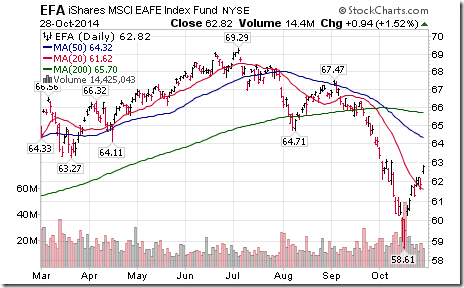

Equity markets of developed countries outside of the North America were stronger than the U.S. equity markets

StockTwits Yesterday @equityclock

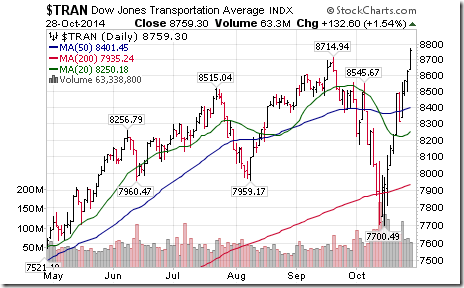

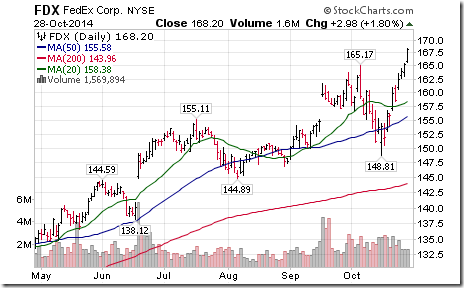

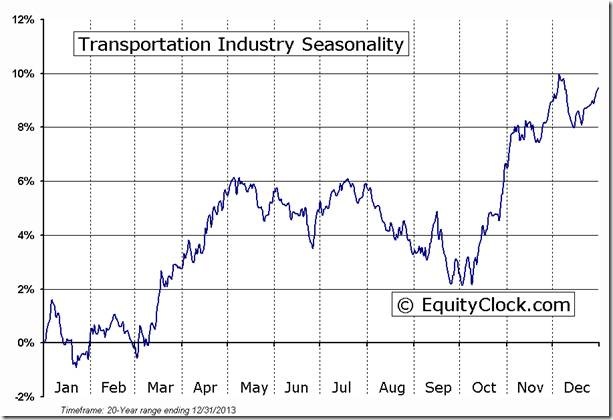

Dow Jones Transportation Average and $IYT break to an all-time high. Helped by strength in $FDX.

‘Tis the season for the Dow Jones Transportation Average to move higher!

Technicals by S&P stocks to 10:45: Bullish.13 stocks broke resistance: $AN,$DRI, $KORS, $NWL, $HIG, $VNO, $SYK, $WAT, $ITW, $LMT, $TXT, $CRM, $VZ

Stocks breaking support to 10:45 due to disappointing reports: $COH, $KSS, $FCX

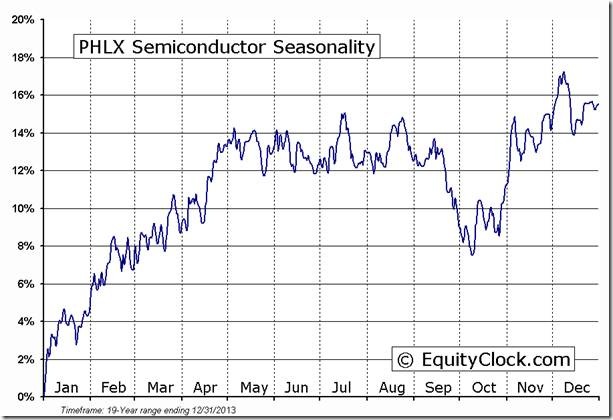

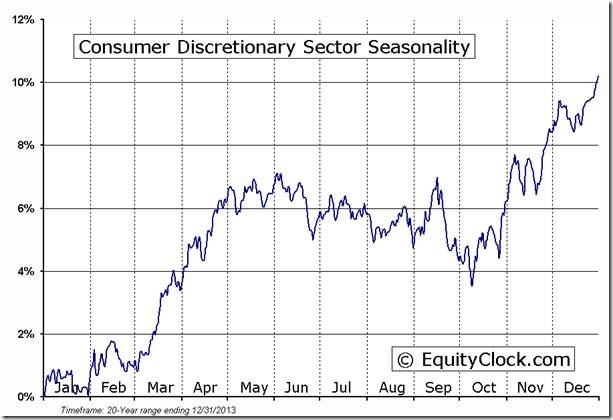

U.S. stocks entering seasonal strength today: $HL, $ R, $MAS, $HPQ, $BDX. Sectors: U.S. Semiconductors and Consumer Discretionary.

Technical Action by Individual Equities

By the close, 22 S&P 500 stocks broke resistance and three stocks broke support. Notable on the list of stocks breaking resistance were Consumer Discretionary stocks (AN, AZO, DRI, KORS, NWL).

Among TSX 60 stocks, Telus broke resistance.

Seasonal/Technical Alert on the S&P 500 Index

Following is a link:

Seasonal/Technical Alert on the TSX 60 Index

Following is a link:

FP Trading Desk Headlines

FP Trading Desk headline reads, “Natural Gas producers could pay off this winter despite price weakness”. Following is a link:

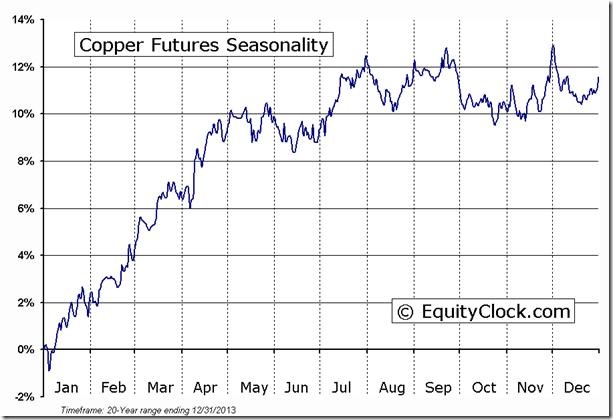

FP Trading Desk headline reads, “Why bearishness on copper looks extreme”. Following is a link:

Adrienne Toghraie’s Trader’s Coach Column

|

Trading Buddy

By Adrienne Toghraie, Trader’s Success Coach

Over the years I have heard from traders countless times that they would like to trade with someone. While they might have an idea of why they need or want a trading buddy, they might not be aware, or want to be aware of other reasons as well such as:

· They are insecure about their own theory and hope to find someone who has a better strategy for entering or exiting a trade.

· They want someone to teach them.

· They want to teach others to either justify what they are doing or learn by teaching.

· They have been used to working as a team in other work environments and they enjoy that interaction.

· They need verification from someone else that their strategy is viable.

· They just do not want to be lonely.

· They want others to take the responsibility of the trade.

Having a trading buddy can be the best or the worst decision that you make for your trading. On the negative side:

· They might not have an agenda that is matched with yours.

· They could be very distracting and confuse you with different views.

· They add their own psychological distractions to the mix of your struggles.

On the positive side, a trading buddy could be exactly what you need to get the best out of your trading and yourself.

Where to find a Trading Buddy

When you isolate yourself behind your computer, you sometimes do not realize that there are people who are just like you who are looking for you as well. Here are some ideas for finding the right match:

· Trading sites

· Webinar rooms

· Local trader clubs

· Seminars

· Trading conferences

· School where you received your training or from your trading mentor

Screening a potential Trading Buddy

Ask for exactly what you think you are looking for:

· Strategy

· Skill level

· Education

· Location

· Temperament

· Time you want to make contact

And, of course let them know about you.

Where to meet

While it could be ideal to have a person work in your environment and under the parameters that you choose, there are some other choices that can be even better for both such as:

· Working off of a separate computer at your home on Skype with a camera.

· Talking on the phone at specified times during the day.

· Meeting the person on a daily or weekly basis.

Conclusion

Working with someone as a trading buddy can be just what you need to take your trading to the next level. Even if it is just for a short period of time, it will give you enough experience in working with someone else to decide if you want different parameters, a different type of person, or you may find that working alone is ultimately the way you want to be with your trades.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Next one is Tuesday, November 25th at 4:30 pm ET

Email Adrienne@TradingOnTarget.com

Visit www.TradingOnTarget.com

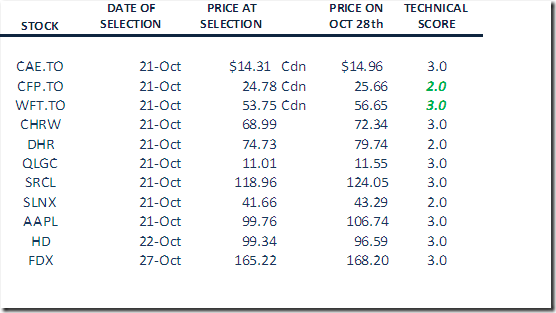

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

PCL was deleted when its technical score fell below 1.5

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC October 28th 2014

Copyright © EquityClock.com

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/a1170d32c8fae8362a03f7a77fdad0f8.png)