by James Paulsen, Chief Investment Strategist, Wells Capital Management

Perhaps for the first time in this recovery, “investor complacency” has become a problem. Until the last couple years, the primary legacy of the Great 2008 Recession was an economic recovery and stock market dominated by fears. With investors hoarding cash and high-quality bonds while waiting for another imminent Armageddon, complacency was never a problem. During the last couple years, however, the S&P 500 Index has risen in a very persistent and methodical manner to a significant new all-time high above 2,000. While this market action has not produced wild optimism among investors, it has arguably resulted in the greatest sense of calm and hope about the future than at any other time in this recovery.

Although investor behavior is far from giddy today, sim- ply by moving investor attitudes from fear to calm may have elevated complacency risk much more than most appreciate. This note updates a complacency indictor we developed many years ago and shows that despite recent stock market turbulence, investor complacency remains at a historically high level. While this indicator does not necessarily suggest the bull market is in immi- nent jeopardy, it does hint at the possibility more stock market volatility is still forthcoming.

Consistency and volatility

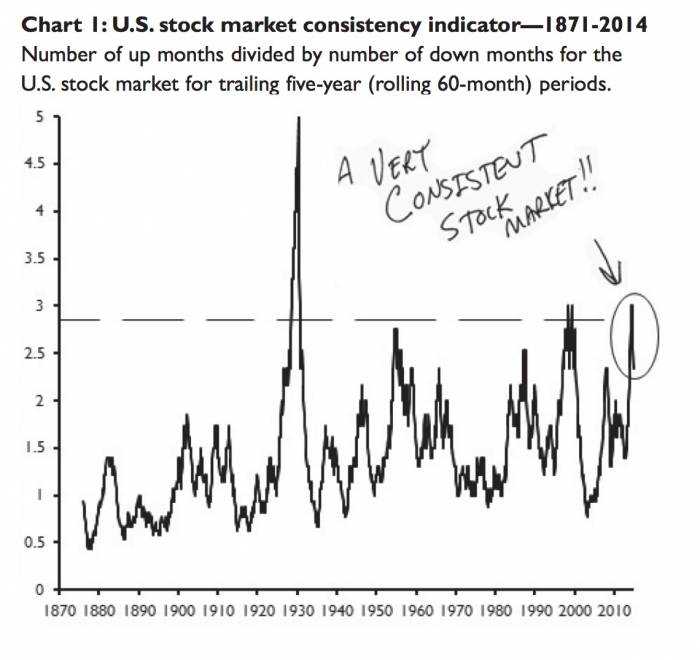

Our stock market complacency indicator is the product of two stock market characteristics—consistency and volatility. The history of these two stock market aspects is illustrated in Charts 1 and 2. In our view, complacency is primarily from the stock market becoming too consis- tent (i.e., it just goes up about everyday) and too stable or predictable (i.e., there are few volatile shocks which keep everyone awake and reflecting on risk).

Chart 1 measures stock market consistency. It divides the number of up months for the stock market by the number of down months. In the last five years, up months have outpaced down months by about 2.5 to 3 times. Since 1870, there have only been three other periods (i.e., in the late 1920s, in the late 1950s, and in the late 1990s) when the stock market has proved more consistent. Consistency breeds complacency. Since the S&P 500 first broke to new all-time highs in early 2013, who isn’t getting use to record stock market closes?

Read James Paulsen's complete update below:

Copyright © Wells Capital Management