I have to apologise for the late post. I was meaning to do Part 3 of this article as soon as possible, but I have taken out my wisdom teeth (all 4) two days ago. I currently feel like my jaw is broken during a bar fight or something haha!

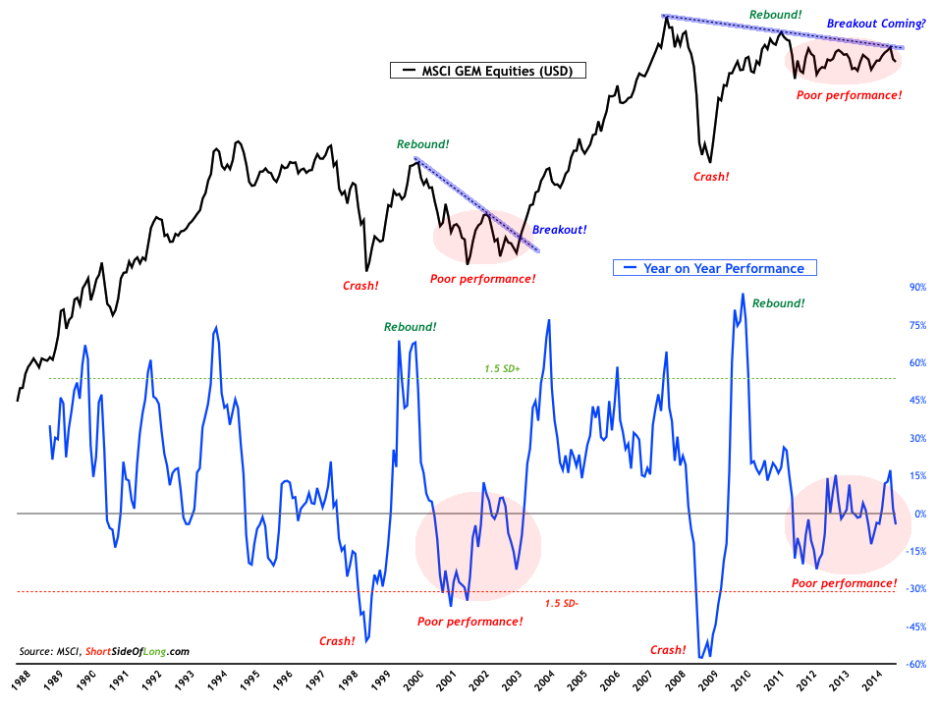

Chart 1: S&P 500 has rebounded from short term oversold conditions…

Source: Fin Viz

Over the last two posts, which started last Thursday morning Asian time, we concluded that the S&P 500 was short term oversold and had an above average probability of bouncing. Well, the index squeezed bears very hard as it retracted the whole fall in October. Unless you had a great entry point in middle of September (right at the peak), you are most likely not profiting from being a bear right now. In the comments section I wrote that:

I see many traders who refused to notice a spike in ETF volume and a spike in the VIX, staying short with average entry points. I also see many traders trying to re-short S&P 500 every single day since the rebound started one week ago.

In Part 2 of the article, I asked a key question connected to underlaying conditions and fundamental developments that should be on all investors minds right now. That question is – has the market just overreacted to Fed ending the QE program or is there a real slowdown occurring that could drag the global economy into another recession?

Personally, I believe that the market has overreacted to Fed’s plan of ending the QE program. The market has rebounded as soon as a few members of the FOMC stated that maybe it would be wise to extended the QE program for awhile. The bears seem to be super surprised at the recent rebound, so they must be failing to understand how addicted the market has become to liquidity. As soon as the punchbowl is taken away, emotions run wild like a little kid throwing a tantrum.

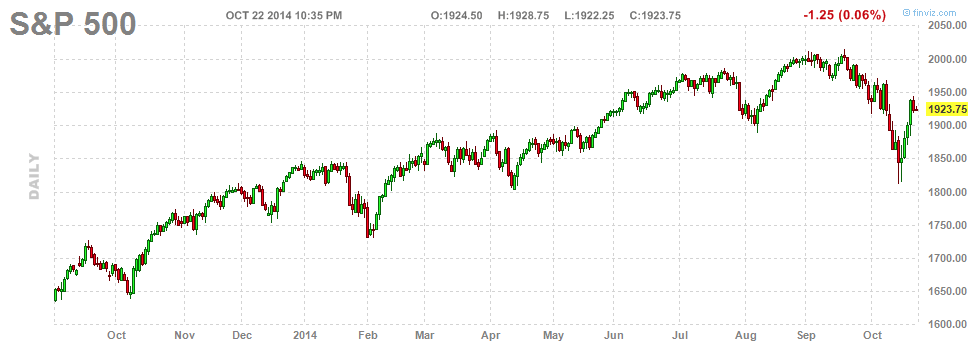

Chart 2: S&P has been through an amazing performance in recent years

Source: Short Side of Long

However, the underlaying conditions aren’t that simple. Economic activity and financial markets are currently in divergence, but they do have a strong link. Assuming the Federal Reserve does decide to end the QE (at least for awhile), the market could once again begin to decline. If asset price valuations sell off more rapidly this time around, it could actually impact the confidence within the main economy.

Let us not forget that S&P 500 has gone through a tremendous bull market over the last five years. In Chart 2, we can clearly see that 5 year rolling compound return hit 2 standard deviations above mean over the last 140 years (data thanks to Robert Shiller). Bull markets in 1929, 1936, 1987 & 2000 achieved 3 standard deviations, then went through major crashes.

Whether or not we are in store for something similar is beyond my crystal ball powers, but my view here is that US equities will most likely suffer below average historical returns, after just going through above average historical returns. Assuming US equities underperform for awhile, where should stock investors go?

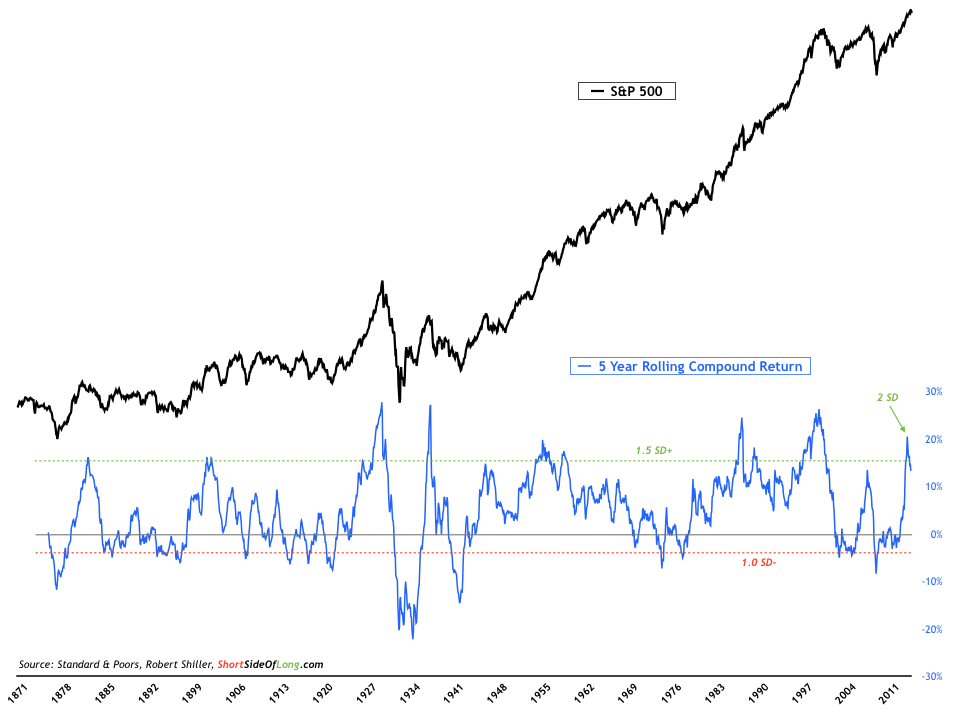

Chart 3: EM stocks trying to make a comeback after poor performance!

Source: Short Side of Long

While US stocks don’t offer great value, that doesn’t mean all stock markets are made equal. Personally, I am closely following Emerging Market indices such as China. GEM equities seem to be going through a similar under performing cycle right now to what we saw during middle to late 1990s. Let me explain:

- The Asian Financial Crisis in 1997/98 crashed the MSCI EM Stock Index, which was followed by strong rebound before a period of prolonged under-performance. Eventually a breakout occurred and GEM stocks caught up with a powerful bull market.

- In recent years we went through a Global Financial Crisis in 2007/08, that also crashed the MSCI EM Stock Index. And in similar fashion, prices went through a strong rebound. Since May 2011, emerging markets have be under-performing.

Could a breakout in GEM stocks be around the corner? I am not so sure, but I am watching it very closely. A major risk here includes further appreciation of the US Dollar, which tends to put pressure on Emerging Market equities, as local currencies sell off. The other risk is a possible major top in the US equity market (refer to Chart 2), which would drag down all global stock markets one way or another.

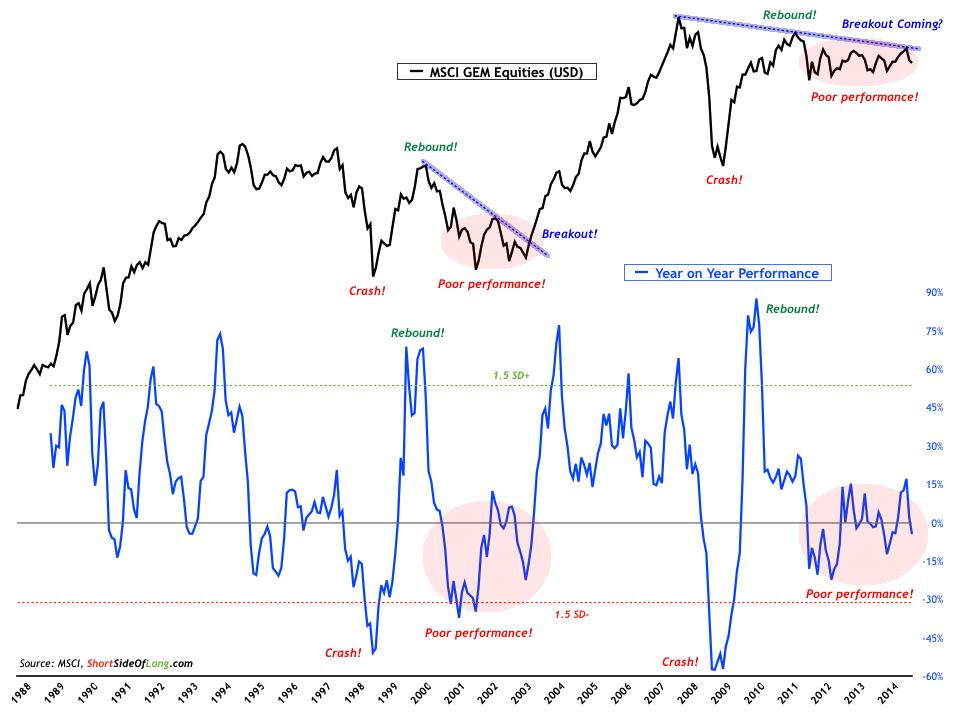

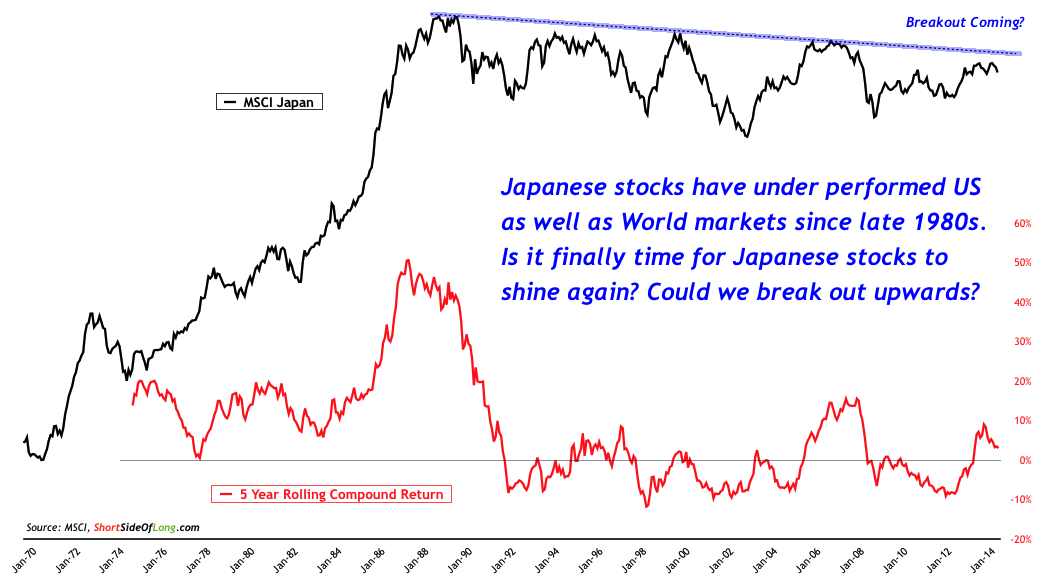

Chart 4: Japanese stocks priced in US dollars are ridiculously cheap!!!

Source: Short Side of Long

However, not all foreign stock markets feel the pressure as the local currency devalues against the greenback. One should consider the fact that a weak Yen could actually help propel Japanese stocks into a new secular bull market. This market is ridiculously cheap and has been under-performing for as long as I have been alive on this planet. One of these days that will change, so the question here is has the time finally come for the Japanese shares to shine? Keep a close out on this one!

Copyright © Short Side of Long