The crowd’s been repricing Treasuries lately on expectations that deflation risk is on the rise… again. But there’s no sign of it in the latest economic reports for the US. Why the disconnect? Treasuries, for good or ill, reflect fear and greed for a global audience as well the folks in Peoria. As a result, America’s relatively upbeat macro profile is an afterthought these days for traders in the Treasury market. Is that about to change?

by James Picerno, Capital Spectator

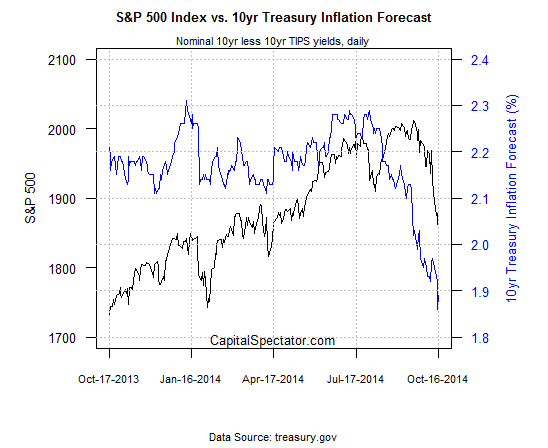

Only time will tell, although yields did manage to eke out a small rise yesterday (Oct. 16) while the Treasury market’s inflation forecast ticked up. That’s hardly a significant U-turn after a month of persistent yield declines. But for the moment, at least, rates are stable. Ditto for the implied outlook for inflation via the yield spread on the nominal 10-year Note less its inflation-indexed counterpart: 1.89% as of Thursday. That’s up a touch from 1.86% on the previous day, according to daily yield data at Treasury.gov. The stock market stabilized yesterday as well, with the S&P 500 rising incrementally by Thursday’s close.

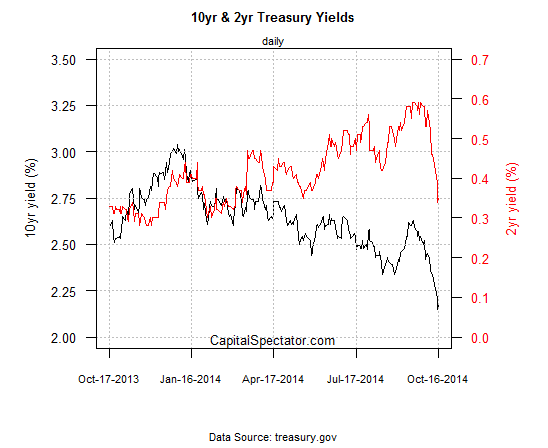

Yields generally took a breather from their recent declines, with the benchmark 10-year rate rising to 2.17% for Oct. 16. The 2-year Note, which is said to be the most sensitive measure of rate expectations, found firmer footing too, settling at 0.35% yesterday, up one basis point from the previous day.

It’s anyone’s guess if more of the same is coming. Meantime, it’s obvious that the latest pop in deflation fears is very much a Eurozone phenomenon. Will the pricing disease spread to the US? That’s a possibility, albeit one that looks fairly low for now. Meanwhile, the troubles in Europe are festering. As The Telegraph reports:

Yields on 10-year German Bund plummeted to an all-time low on 0.72pc on flight to safety, touching levels never seen before in any major European country in recorded history. “This is not going to stop until the European Central Bank steps up to the plate. If it does not act in the next few days, this could snowball,” said Andrew Roberts, credit chief at RBS.

The US, by comparison, continues to show a bias for moderate growth. In fact, yesterday’s updates on initial jobless claims and industrial production delivered surprisingly strong results. It’s debatable if the data signals stronger growth for the months ahead, but it’s clear that the US macro trend is betraying few signs of stress lately.

“Have we achieved full employment? Not yet. Are we getting closer? Absolutely,” according to Stephen Stanley, an Amherst Pierpont Securities economist, via Reuters.

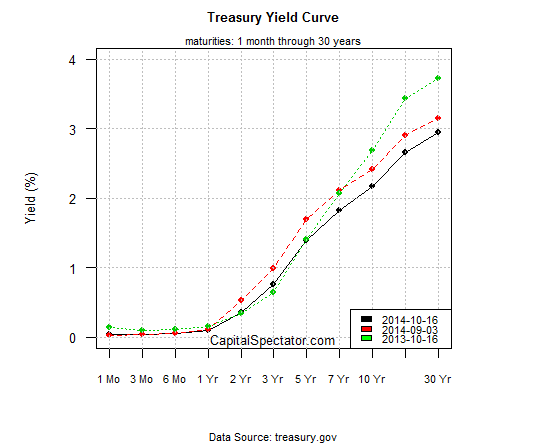

Nonetheless, the Treasury yield curve is a bit flatter these days. In the chart below, yesterday’s yields (black line) reflect a noticeable decline vs. rates for 30 trading days earlier (red line) for 2-year maturities up through 30 years. Given the encouraging economic data of late, that shouldn’t be happening. But US government bonds are denominated in the world’s reserve currency and so the yields reflect expectations via a global perspective, with an emphasis on Europe at the moment.

“The further dip in eurozone consumer price inflation fuels concern that prolonged very weak inflation could morph into deflation,” Howard Archer, chief European economist for IHS Global Insight, tells the International Business Times.

If so, US yields may stay low or perhaps dip even lower–even if America’s economic profile improves.

Copyright © Capital Spectator