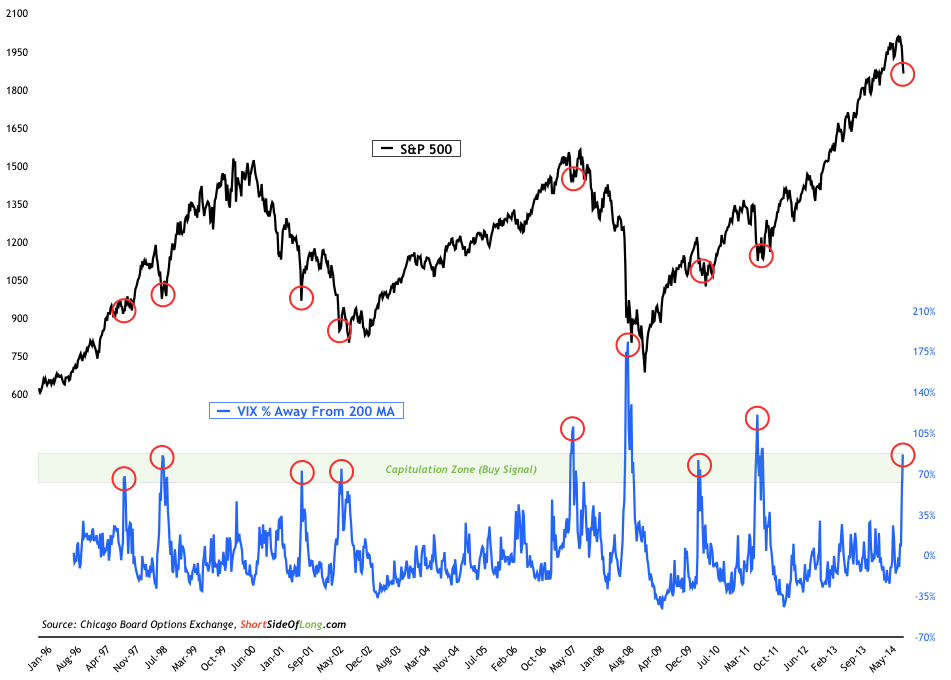

Chart 1: VIX tripled in the last few weeks & is extremely far from its mean

Source: Short Side of Long

Huge price action last night during the US market. I will do a proper write up soon, but here is a quick update since I am out of the office:

- US equities declined sharply on very high selling volume (SPY ETF), most likely indicating a short term wash out. VIX has tripled in the last few weeks and now stands over 70% above the 200 day moving average, usually a sign of an intermediate or major bottom. Crude Oil volatility spiked much faster then it did during the 2008 crash, signalling panic in the energy markets!

- Breadth is oversold in the US, and extremely oversold in Eurozone with only 6% of stocks trading above the 200 MA in the MSCI EU Index (similar to August & October 2011). Throughout the session some indicators would have made extreme oversold levels, but then we saw positive reversals in US small caps, US junk bonds, US energy & material sectors, US transport stocks, MSCI China & Russia indices, MSCI Germany and so forth. At the same time VIX put in a negative reversal too.

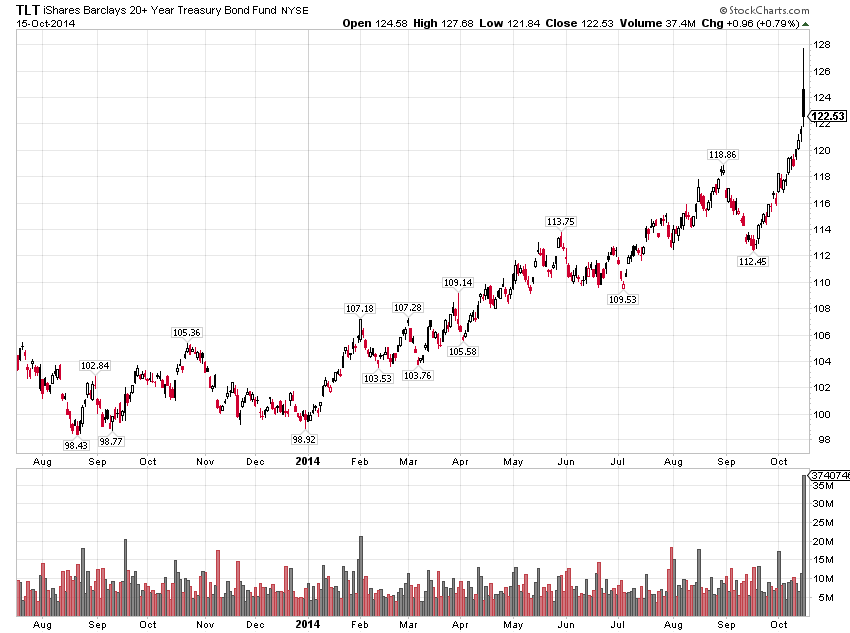

Chart 2: Could Treasury Bonds be forming an important top right now?

Source: Stock Charts

- Major moves occurred in safe haven assets such as Treasury Bonds, Gold and Japanese Yen. During the early stages of the US session, as the volatility spiked, Treasury Bonds went through the roof (yields dropped like a rock). A friend of mine told me that at first he thought a 10 Year Note at 1.87% was a misprint. There are 96% bulls on bonds and the asset class could be making a very important top right here, right now (more on that later)!

- Portfolio changes: Since Russell 2000 has been outperforming over the last few days, I decided to close my highly leveraged short positions early in the session. I have also closed my Japanese Yen long last night as well. I’ve now added to a Gold short with a stop above $1,250 (previous support could be resistance now). I expect Gold to break below $1185 support zone eventually.

- Portfolio recommendations: Apart from US small caps, I also recommended shorting MSCI Germany via EWG in the middle of September. This index is now extremely oversold and with a positive reversal last night, I recommend closing this trade. On the bullish side, MSCI China hasn’t dropped below the 200 day MA throughout the whole correction and could be a buy at a double bottom – I’m looking into it! I’m also thinking about buying more MSCI Russia positions too.

Copyright © Short Side of Long