by Don Vialoux, EquityClock.com

Pre-opening Comments for Friday October 10th

Editor’s Note: Next Tech Talk is released on Tuesday October 14th

U.S. equity index futures were mixed this morning. S&P 500 futures recovered from a sharp overnight selloff to approach near breakeven before the market opened

The Canadian Dollar rallied following release of the September employment report. Consensus was an increase of 20,000 versus a decline of 11,000 in August. Actual was an increase of 74,100. Consensus for the September unemployment rate was unchanged at 7.0%. Actual was a drop to 6.8%.

Microchip Technologies plunged $4.79 to $40.75 after reducing fiscal second quarter revenue and earnings guidance.

Halliburton (HAL $56.76) is expected to open higher after Societe Generale upgraded the stock from Hold to Buy.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/10/09/stock-market-outlook-for-october-10-2014/

Note the list of S&P stocks that are entering their period of seasonal strength. Also note comments on U.S. equity markets following the end of Quantitative Analysis.

Interesting Charts

Volatility in U.S. equity markets continues to escalate. ‘Tis the season!

Selected sectors are responding to greater volatility by reaching multi-week lows. For example, TAN is now down 22% from its early September high and broke to a 9 month low.

StockTwits Released Yesterday

Action by S&P stocks to 10:30 AM: Quietly bullish. GPS broke support. 7 stocks broke resistance including 4 utilities: $CMS, $FE, $PPL, $WEC.

Bearish technical action by S&P 500 stocks has taken over to 1:30 PM 9 stocks broke support this afternoon

Financials are particularly hard hit this afternoon. 5 stocks broke support: $BEN, $CMA, $GNW, $LNC, $MET.

Technical Action by Individual Equities

By the close, sixteen S&P 500 stocks had broken support and seven stocks had broken resistance.

Among TSX 60 stocks, Encana and TransAlta broke support. None broke resistance

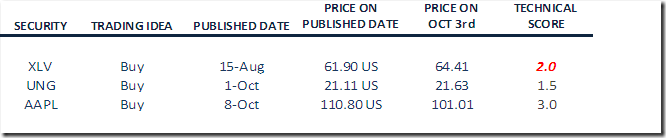

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

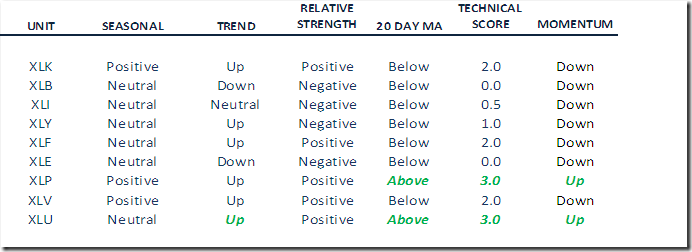

Summary of Weekly Seasonal/Technical Parameters for SPDRs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade from last week

Red: Downgrade from last week

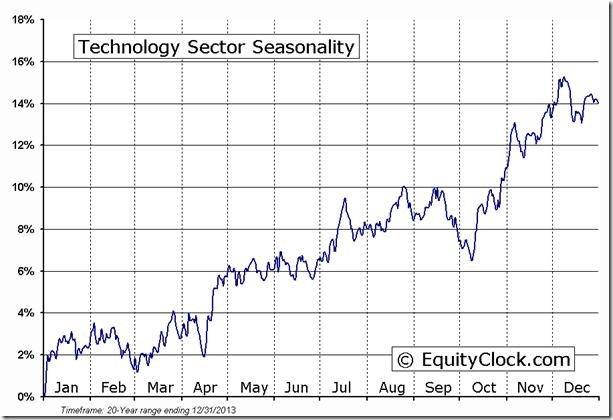

Technology

· Intermediate trend remains up (Score: 1.0)

· Units remain below their 20 day moving average (Score: 0.0)

· Strength relative to the S&P 500 Index remains positive (Score: 1.0)

· Technical score remains at 2.0 out of 3.0

· Short term momentum indicators are trending down, but are oversold

· Seasonal influences have just turned positive

Materials

· Intermediate trend remains down.

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 0.0 out of 3.0

· Short term momentum indicators are trending down, but are oversold.

Industrials

· Intermediate trend remains neutral

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 0.5 out of 3.0

· Short term momentum indicators are trending down, but are oversold.

Consumer Discretionary

· Intermediate trend remains up

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 1.0 out of 3.0.

· Short term momentum indicators are trending down, but are oversold.

Financials

· Intermediate trend remains up.

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 2.0 out of 3.0.

· Short term momentum indicators are trending down, but are oversold.

Energy

· Intermediate trend remains down

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 0.0 out of 3.0.

· Short term momentum indicators are trending down, but are oversold.

Consumer Staples

· Intermediate trend remains up.

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score increased to 3.0 from 2.0 out of 3.0.

· Short term momentum indicators are trending up.

Health Care

· Intermediate trend remains up.

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 2.0 out of 3.0.

· Short term momentum indicators are trending down.

Utilities

· Intermediate trend changed to up from neutral on a move above $43.27

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive.

· Technical score improved to 3.0 from 1.5 out of 3.0

· Short term momentum indicators are trending up.

Adrienne Toghraie’s “Trader’s Coach” Column

|

What System is Right for Me?

By Adrienne Toghraie, Trader’s Success Coach

Are you in a state of limbo trying to decide on

what system or methodology in trading is right for you?

There are so many “want to be traders” who are not trading or not to the level they want to be in trading because they cannot make up their mind, go from strategy to strategy or are a constant student of the markets. For those of you who are in these states of search, here are some ideas:

· Read life stories about traders and determine with whom you identify

· Listen to webinars and listen to questions being answered or ask the right questions

· Go to trader conferences and learn from others what questions to ask

If you have already done this type of preparation and are still battling your decisions, consider the following:

· If you have a full-time job, I would suggest Swing Trading, because of your time

constraints.

· If you have emotional issues dealing with pulling the trigger, you might consider

longer-term time frames. The more trades you take the more you will stir up your

emotions.

· If you have the time and money to trade and get bored easily, then I would suggest

Day Trading. However, if you have not handled psychological issues that deal with

following your rules, these issues will only get worse until you handle them.

Other honing in on other success strategies:

· Pick any one stock, group of stocks or one commodity and stick with it until you can make a profit. In

doing this you will gain discipline, learn lessons along the way and build confidence.

· Choose one person to mentor with and only work with their particular strategy. Even if their strategy

ultimately is not the strategy you use, the process will teach you valuable lessons about discipline and trading itself. What I have found is that any strategy you initially follow will ultimately turn into a set of rules that evolves as you become more proficient.

· Work on your discipline in any area of life by being consistent with an intention to become better at

whatever endeavor you choose. This is one of the best ways to train yourself in what will ultimately be the most important part of your trading.

Inch Worm

If your life activities are overwhelming for you, choose one thing a day that will get you towards your goal. If it is reading a chapter, listening to a CD or working on your business plan, each action multiplied by a month’s worth of actions are 30 steps closer to becoming a trader. This kind of discipline was what enabled me to complete thirteen books. And this kind of discipline is what has enabled many of the people that I have worked with over the years to go from student to part-time trader to professional trader.

Conclusion

Taking action is the first step towards any journey. The next step is specializing by choosing what is viable and comfortable for you. Stick with this until something else emerges, and just by this process, you will know the next action to take.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Visit www.TradingOnTarget.com

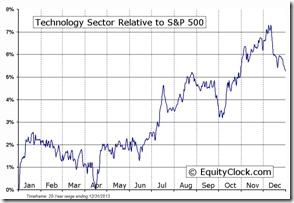

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

TECHNOLOGY Relative to the S&P 500 |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC October 9th 2014

Copyright © EquityClock.com