Buffett’s Passive Can of Worms

by William Smead, Smead Capital Management

A great deal of confusion exists today about the merits of passive investing as compared to well-researched active management. An added layer of confusion arose in March when Warren Buffett explained that 90% of his widow’s money would be invested in a low-cost S&P 500 index fund. If this summer was a football game, 15-yard personal foul penalties would be thrown everywhere as experts piled on top of that announcement.

The latest foul comes from the recent Morningstar ETF conference where Nobel Prize winner, Eugene Fama, spoke. Here’s how ETF.com reported his speech:

Active management is a fallacy, and it’s completely unnecessary for markets to be truly efficient, Eugene Fama, best known for the efficient markets hypothesis, told a crowded room of investors, advisors and ETF issuers in Chicago today. True to form, Fama argued that passive investing is the only sensible way to go.

Why would we call a foul? First, not all fans of efficient market theory agree with Fama. William F. Sharpe, one of the founders of the capital asset pricing model said this in 2002:

Should everyone index everything? The answer is resoundingly no. In fact, if everyone indexed, capital markets would cease to provide the relatively efficient security prices that make indexing an attractive strategy for some investors.

Second, most participants on the active side believe that no more than 50% of the stock pickers will beat the market—the same percentage of students that get an above average grade in professor Fama’s classes. Academics like Fama posit that individuals aren’t capable of picking stocks/running a portfolio or figuring out who can.

Mr. Buffett’s 1984 missive called “The Super Investors of Graham and Doddsville,” told the story of a number of active managers who practice a version of value investing with intellectual support from Columbia School of Business classes taught by Buffett’s professor, Ben Graham.

Eugene Fama claims that Warren Buffett believes that nobody can form a portfolio and manage it successfully. Here is what he was quoted as saying:

“Warren Buffett is my hero. He is basically saying: ‘I can pick a company every couple of years, but if you are to form a portfolio, go passive,’” Fama said. “In the end, they realize that the game of doing something active is fraught with problems.”

What does Warren Buffett really say about this subject? Check in first with Charlie Munger, Buffett’s partner in investing:

Efficient market theory is a wonderful economic doctrine that had a long vogue in spite of the experience of Berkshire Hathaway. In fact one of the economists who won — he shared a Nobel Prize — and as he looked at Berkshire Hathaway year after year, which people would throw in his face as saying maybe the market isn’t quite as efficient as you think, he said, “Well, it’s a two-sigma event.” And then he said we were a three-sigma event. And then he said we were a four-sigma event. And he finally got up to six sigmas — better to add a sigma than change a theory, just because the evidence comes in differently. [Laughter] And, of course, when this share of a Nobel Prize went into money management himself, he sank like a stone.

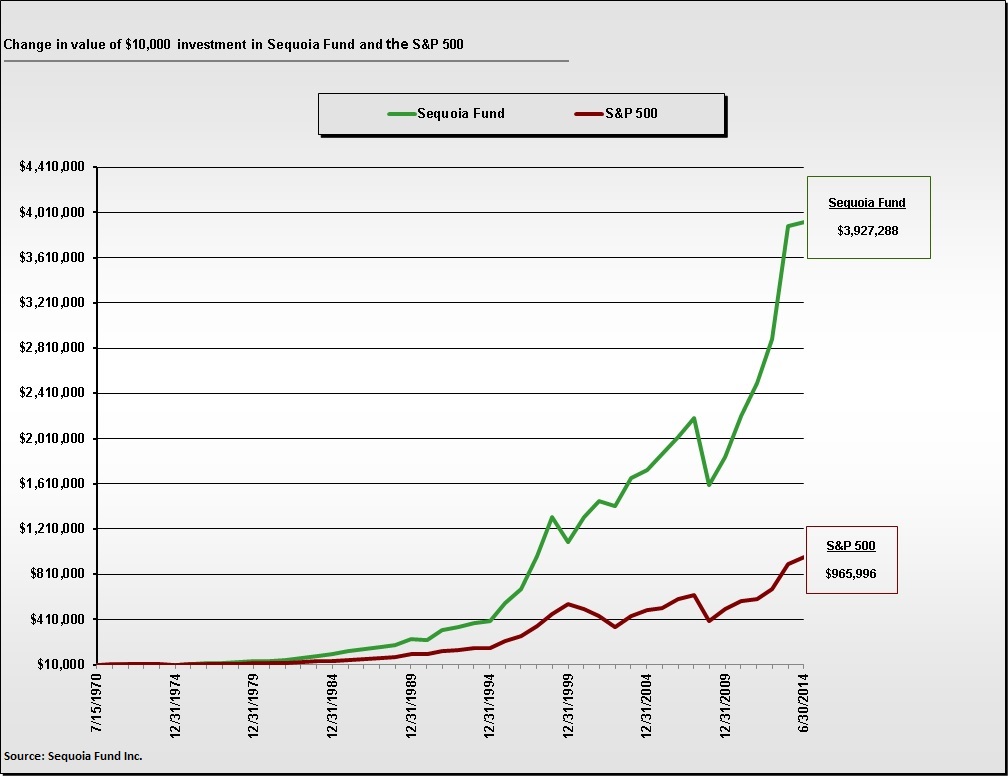

Buffett not only doesn’t agree with Fama’s paraphrase, he would be happy to provide Fama a list of value investing practitioners he thinks highly of today. Start with Todd Combs and Ted Weschler, who he has entrusted $10 billion of Berkshire Hathaway’s capital and they work directly for him. In 1984 he provided a list of the many Graham and Dodd investors who he knew had blown the efficient market hypothesis out the window. This included Bill Ruane, the manager of the Sequoia Fund. The fund was created in 1970 at the behest of Buffett. He’d known Ruane at Columbia and was highly confident that Ruane would pick stocks and run a portfolio successfully for his former partnership clients. Here is the comparison of Sequoia Fund to the S&P 500 Index from July of 1970 to June 30, 2014:

Lastly, it is ironic that Fama used a Morningstar event to twist the truth on this subject and draw penalty flags. Morningstar, one of the leading active management research firms, named Sequoia Fund it’s Manager of the Year in 2010. In another light, Warren Buffett effectively predicted Morningstar’s award 26 years before it happened! Warren Buffett can handle manager search quite well, but because he acknowledged value for passive investing in certain situations (just like William Sharpe), he has opened a can of worms. Buffett believes that value investors, who buy parts of a business at less than their intrinsic value, succeed. The opportunity to do so is created by the inefficiency of the stock market. As passive becomes a large part of equity ownership, there becomes a greater risk from ignoring meritorious value investing disciplines and active manager research.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management