by Feifei Li, Philip Lawton, Research Affilitates

One of the basic tenets of finance is that investors are compensated for taking risk. For equity markets, that means that high volatility stocks are expected to outperform low volatility stocks. But that hasn’t happened. Low-risk stocks have historically outperformed high-risk stocks.

Will this low volatility effect persist? Renewed interest in low volatility strategies has led to higher demand for low volatility stocks, and high demand for low volatility stocks could conceivably eradicate the return premium once and for all. Nonetheless, the effect has proven robust across time periods and markets, and, unless contrarian investing paradoxically becomes the norm, there is good reason to believe that it won’t go away anytime soon.

Historical Record

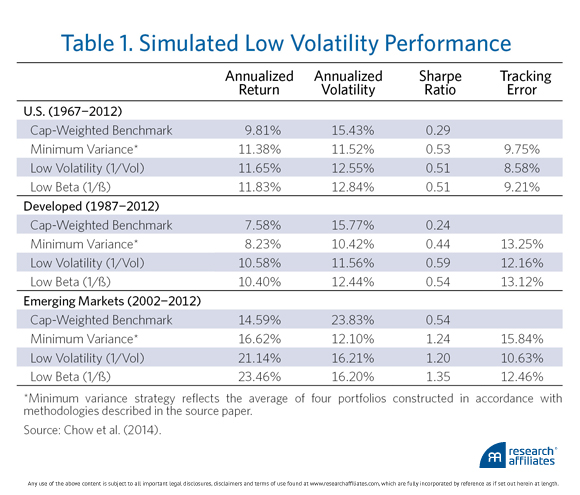

The low volatility effect has been known so long1 and studied so extensively that there is little danger it will be discredited as a statistical fluke or a by-product of incomplete or erroneous data. Low volatility stocks tend to trade at a discount to the broad market and, of course, to high volatility stocks; the magnitude of the discount is highly variable,2 but the low volatility effect has nonetheless been durable (see Table 1). The fact that simulated low volatility strategies have produced excess returns in many countries implies that the effect is deeply embedded in global capital markets.

The historical record, then, is reassuring. Nonetheless, we’ve all seen rapid, even cataclysmic, change in other situations. Institutional arrangements can break down, technological advances can disrupt the balance of power, regulatory reforms can impede capital flows or raise the cost of trading, and, in principle, people can learn from experience. Even if we resolutely assume that radical change is unlikely, we cannot offer an opinion on the continuance of the low volatility effect without understanding the conditions that have made it possible thus far.

Revisiting Risk and Return

Riskier assets have higher expected returns.

That statement might be considered too categorical in academic circles, but it is an article of faith in active portfolio management. Investors are rewarded by profits for risking their capital just as hourly workers are compensated by wages for committing their bodies and minds to economically productive activities. And, considering that wage-earners get more pay for putting in longer days, investors quite reasonably require higher rewards for taking on more risk. John Stuart Mill (1885, p. 107) vividly expressed the idea: “The profits of a gunpowder-manufacturer must be considerably greater than the average, to make up for the peculiar risks to which he and his property are constantly exposed.” Rates of return are a straightforward function of risk, and rational investors set their expectations accordingly.

The theoretical relationship between ex ante risk and expected return is so obviously a truism that it seems silly to write about it. But we bring it up here precisely because it “goes without saying.” The statement that one must accept higher risk to earn higher returns is axiomatic. It is, in fact, such a basic proposition that classical and neoclassical finance simply cannot be stretched or twisted to accommodate contrary observations. Calling the low volatility effect an “anomaly” implies it’s reasonable to hope for an as-yet-undiscovered explanation that is consistent with the standard model. Many researchers have stopped looking for such a fanciful resolution within the traditional framework of rational, utility-maximizing decision-making. They look to behavioral finance for answers.

End Investors’ Preferences

Behavioral explanations focusing on end investors generally turn on the observation that many market participants have a clear preference for risky growth stocks. Indeed, their partiality is so strong that, in addition to rejecting value stocks, they often drive the price of growth stocks to unrealistically high levels. In other words, many investors tend to shun the stocks that are out of favor—the value stocks in their opportunity set—and overpay for prospective growth. The outcome is predictable: Low-priced stocks, which are less volatile, outperform the more volatile high-priced stocks. The issue, then, is to make sense of a preference that often leads to self-defeating investment decisions.

A simple, direct explanation of the low volatility effect is that many investors willingly accept lottery-like risk in pursuit of better-than-average returns. In other words, many investors are given to gambling.3

According to Barberis and Huang (2007), probability weighting4 is a psychological mechanism by which investors rationalize their inclination to gamble on risky stocks. Unlike overstating the objective likelihood of an extreme event, probability weighting is not a cognitive error; it is a value function, and values are not true or false. By magnifying the tails of a distribution, probability weights model investors’ opposing preferences for avoiding losses and profiting from positively skewed, lottery-like payoffs. Investors with a strong penchant for gambling are likely to choose high-risk stocks with large potential payoffs over low-risk stocks with unexciting expected returns. And, as we have seen, that very pattern of behavior would tend to produce the low volatility effect.

A more subtle behavioral explanation of the preference for risky stocks is grounded in textbook finance. Various forms of financial leverage can boost rates of return. Many investors, however, are unable or unwilling to use leverage; for example, they may be subject to investment policy guidelines that prohibit borrowing, or they may not have access to low cost credit, or they may balk at the downside risk of a leveraged position. Risky stocks offer an outlet for leverage-constrained or leverage-averse investors who seek high returns.

The constrained leverage theory is supported by empirical evidence. Black (1972) found that a pricing model in which borrowing is restricted was consistent with test results, reported by Jensen, Black, and Scholes (1972, p. 4), which indicated that high-beta stocks have negative alphas and low-beta stocks have positive alphas. Frazzini and Pedersen (2014) showed that leverage-constrained investors have a predilection for riskier assets even though leveraging low volatility stocks would produce better results. Their study encompassed the global equity market as well as non-equity asset classes.

Investment Professionals’ Incentives

Portfolio managers investing clients’ assets have different motivations for avoiding loser stocks (which have recently fallen in price) and crowding into winner stocks (which have high positive price momentum).5 They notably include benchmark risk and its corollaries, business, and career risk.6

A compelling argument is that institutional portfolio managers are discouraged from overweighting low volatility stocks by an implicit mandate or explicit contractual requirement to maximize the information ratio relative to a cap-weighted benchmark. From the client’s perspective, placing a tolerance range around tracking error facilitates monitoring aggregate asset class risk exposures and evaluating individual managers’ performance.7 Unfortunately, however, it also promotes closet indexing.8 And, because cap-weighted indices favor the most popular stocks, closet indexing tends to sustain the low volatility effect.

Conducting a manager search and transitioning assets to another firm is costly and disruptive. Nonetheless, clients typically “de-select” managers who underperform the benchmark for three years. In consequence, managers face what David Tuckett and Richard J. Taffler (2012) call “real risk,” the risk of losing clients, bonuses, and ultimately their job due to underperformance.9 This is a powerful incentive to cling to the cap-weighted index.

Other investment professionals may also contribute to the low volatility effect. For instance, Hsu, Kudoh, and Yamada (2013) present empirical evidence that sell-side analysts tend to inflate earnings growth forecasts for more volatile stocks, especially if they have strong positive information about them.10 Given that investors overreact to analysts’ forecasts, Hsu and his co-authors conclude that sell-side analysts’ bias contributes to the market’s overvaluing high volatility stocks and thereby lowering their returns.

But Can It Last?

What grounds do we have for expecting low volatility strategies to continue producing excess returns in the future?

The increase in smart beta low volatility investing since the global financial crisis of 2007–2008 tells us that investors can successfully disavow the notion that the only way to get higher returns is to take more risk. But it is not easy for people to disclaim the faith of their fathers and act on the basis of a heresy. For many individuals, a strong need for social validation stands in the way of adopting a minority position (Lawton, 2013). In addition, changing the way we think tacitly implies owning up to a mistake—and, because admitting we were wrong threatens our self-esteem, it triggers crafty defense mechanisms. One of them is selective interpretation (“A benchmark is only a reference point”). Other coping strategies are denial, bad faith (knowing-but-not-knowing), and storytelling.

Tuckett and Taffler (2012) found, through extensive interviewing,11 that managers characteristically tell stories to explain their successes and failures. Stories about successful investments generally fall into the epic genre, sometimes with a romantic subtext: through perseverance and insight, the fund manager prevailed in a noble quest to find an undervalued security, championed buying it, and held it through many tribulations until the market acknowledged its inherent value. Stories about failed investments tend to evoke the tragic genre, recounting the protagonist’s undeserved misfortune at the hands of villains or malevolent fate. Tuckett and Taffler (2012, p. 67) observed that failures which are explained by plausible stories don’t appear to threaten the managers’ underlying investment beliefs. “This conclusion,” they said, “has an important implication: The market as a whole, fund managers, their investment houses, and their clients may have problems learning from experience.”

Long-Term Outlook

There will most likely be periods when investors’ demand for low volatility stocks will drive prices up and reduce the return premium to a level that makes the strategy unattractive. Over the long term, however, it is reasonable to expect low volatility investing to persist in producing excess returns. The intensity of investors’ preferences may vary, but chasing outlier returns from stocks that are in vogue seems to be a steady habit.12 Growing acceptance of smart beta strategies may put pressure on active management fees, but delegated investment management is almost certainly here to stay, and the probability of meaningful modifications to the structure of compensation schemes is remote. Finally, many people find it very hard to change their mindset, and they just don’t seem to learn from experience. For these reasons, the outlook for low volatility strategies remains promising.

Endnotes

1 The low volatility anomaly was first identified by Robert A. Haugen and A. James Heins in the late 1960s and early 1970s (Haugen and Heins, 1975).

2 See Li (2014); Garcia-Feijóo et al. (2013).

3 Dorn, Dorn, and Sengmueller (2012) tested the hypothesis that gambling outside the stock market is a substitute for equity investing. They found that retail investors are less likely to trade in the U.S. and German stock markets when multi-state or national lottery prizes are large.

4 Probability weighting was proposed by Tversky and Kahneman (1992) and has generated an extensive literature. Of particular note are Barberis (2013) and Bordalo, Gennaioli, and Shleifer (2013).

5 Jegadeesh and Titman (1993).

6 This is not to disregard or minimize investment professionals’ ethical obligation to put clients’ interests ahead of their firm’s and their own interests. The best ones know the profession’s standards of conduct and adhere to them. But we are focusing here on business and career pressures of which portfolio managers are undoubtedly aware when they make investment decisions under conditions of uncertainty.

7 See Baker, Bradley, and Wurgler (2011).

8 Brennan, Cheng, and Li (2012, pp. 2, 25) memorably state that, for institutional investment managers, the cap-weighted benchmark plays the role of the riskless asset in conventional portfolio theory.

9 See pages 34, 69, 81–82.

10 Hsu, Kudoh, and Yamada (2013) hypothesize that clients find it harder to detect forecast inflation for stocks whose growth is highly volatile; and clients are less likely to complain about overly optimistic growth forecasts for stocks that prove to be profitable investments.

11 In-depth qualitative interviews are an established means of conducting research in the social sciences. Tuckett and Taffler expound their methodology in Chapter 2 of their monograph (see especially pages 20–22). They also note that interviews conducted after “meaning saturation” occurs generally do not produce new insights; rather, they tend to reinforce points that other interviewees have already expressed. Meaning saturation conventionally occurs after as few as 15 to 25 interviews, but Tuckett and Taffler interviewed 52 qualified participants for this study.

12 We note in passing that excessive involvement with gambling is considered a behavioral addiction. Clark et al. (2013) relate insights from behavioral economics, including probability weighting, to the neurobiology of gambling.

References

Baker, Malcolm, Brendan Bradley, and Jeffrey Wurgler. 2011. “Benchmarks as Limits to Arbitrage: Understanding the Low Volatility Anomaly.” Financial Analysts Journal, vol. 67, no. 1 (January/February):40–54.

Barberis, Nicholas C. 2013. “Thirty Years of Prospect Theory in Economics: A Review and Assessment.” Journal of Economic Perspectives, vol. 27, no. 1 (Winter):173–196.

Barberis, Nicholas, and Ming Huang. 2007. “Stocks as Lotteries: The Implications of Probability Weighting for Security Prices.” NBER Working Paper w12396. Cambridge, MA: National Bureau of Economic Research. Available at http://www.nber.org/papers/w12936.

Black, Fischer. 1972. “Capital Market Equilibrium with Restricted Borrowing.” Journal of Business, vol. 45, no. 3 (July):444–455.

Bordalo, Pedro, Nicola Gennaioli, and Andrei Shleifer. 2013. “Salience and Asset Prices.” American Economic Review, vol. 103, no. 3 (May):623–628.

Brennan, Michael J., Xiaolong Cheng, and Feifei Li. 2012. “Agency and Institutional Investment.” European Financial Management, vol. 18, no. 1 (January):1–27.

Chow, Tzee-Man, Jason C. Hsu, Li-Lan Kuo, and Feifei Li. 2014. “A Study of Low Volatility Portfolio Construction Methods.” Journal of Portfolio Management, vol. 40 no. 4 (Summer):89–105.

Clark, Luke, Bruno Averbeck, Doris Payer, Guillaume Sescousse, Catharine A. Winstanley, and Gui Xue. 2013. “Pathological Choice: The Neuroscience of Gambling and Gambling Addiction.” Journal of Neuroscience, vol. 33, no. 45 (November 6):17617–17623.

Dorn, Anne Jones, Daniel Dorn, and Paul Sengmueller. 2012. “Trading as Gambling.” Available at SSRN: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2160996.

Frazzini, Andrea, and Lasse H. Pedersen. 2014. “Betting Against Beta.” Journal of Financial Economics, vol. 111, no. 1 (January):1–25.

Garcia-Feijóo, Luis, Lawrence Edward Kochard, Rodney N. Sullivan, and Peng Wang. 2013. “Low-Volatility Cycles: The Influence of Valuation and Momentum on Low-Volatility Portfolios.” Working Paper. Available at SSRN: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2310353.

Haugen, Robert A., and A. James Heins. 1975. “Risk and Rate of Return on Financial Assets: Some Old Wine in New Bottles.” Journal of Financial and Quantitative Analysis, vol. 10, no. 5 (December):775–784.

Hsu, Jason C., Hideaki Kudoh, and Toru Yamada. 2013. “When Sell-Side Analysts Meet High-Volatility Stocks: An Alternative Explanation for the Low-Volatility Puzzle.” Journal of Investment Management, vol. 11, no. 2 (Second Quarter):28–46.

Jegadeesh, Narasimhan, and Sheridan Titman. 1993. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” Journal of Finance, vol. 48, no. 1 (March):65–91.

Jensen, Michael C., Fischer Black, and Myron Scholes. 1972. “The Capital Asset Pricing Model: Some Empirical Tests.” In Studies in the Theory of Capital Markets, ed. by M.C. Jensen. New York: Praeger.

Lawton, Philip. 2013. “The Psychology of Contrarian Investing.” Research Affiliates (December).

Li, Feifei. 2014. “Timing Low Volatility Investments.” Research Affiliates (June).

Mill, John Stuart. 1885. Principles of Political Economy. Abridged edition. New York: D. Appleton and Company.

Tuckett, David, and Richard J. Taffler. 2012. Fund Management: An Emotional Finance Perspective. Charlottesville, VA: Research Foundation of CFA Institute.

Tversky, Amos, and Daniel Kahneman. 1992. “Advances in Prospect Theory: Cumulative Representation of Uncertainty.” Journal of Risk and Uncertainty, vol. 5, no. 4 (October):297–323.

Copyright © Research Affilitates