by Erik Swarts, Market Anthropology

If you’re ridin’ ahead of the herd, take a look back every now and then to make sure it’s still there with ya.- Cowboy saying

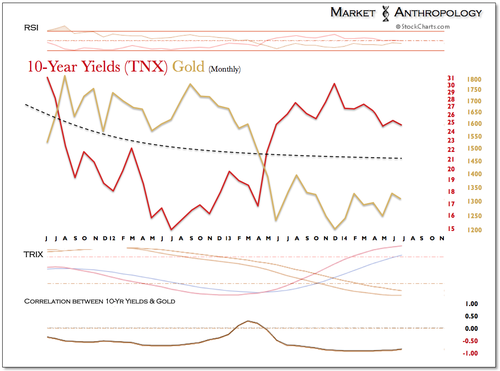

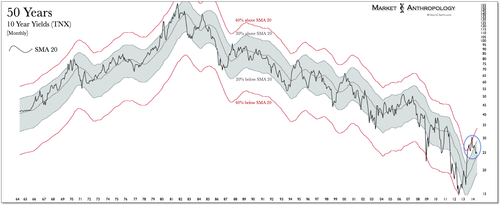

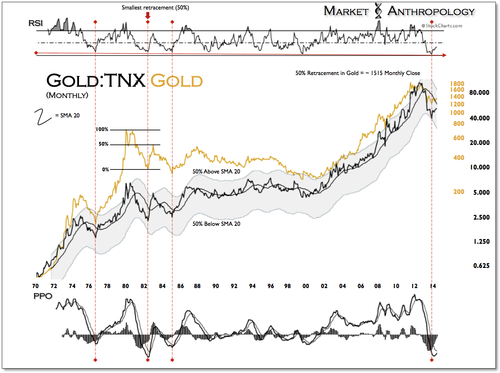

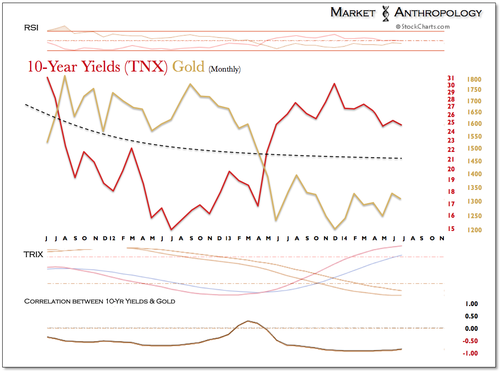

The Treasury market continues to ignore the sharp shouts of rising rates, even as some of its loudest cowboys attempt to call the herd back to the foothills of higher elevations. In as much as the market was susceptible to the cattle prod of the Fed or the pundit last year, the current run appears to have taken a different mountain pass and spread away from their disoriented handlers. How low long-term yields eventually go on this drive is up for debate, but we do believe they are still headed materially lower - which should maintain the gallop in precious metals and hard commodities as inflation firms and real yields wilt.

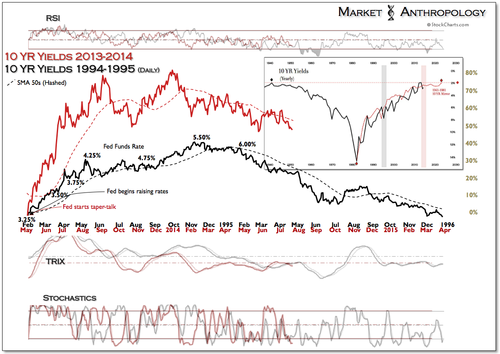

From our perspective, the next cut lower for 10-year yields appears to be on the nearing horizon as we skip and slide into the dog days of August. Throughout this year we have incorporated the historic performance study of the 1994-1995 Fed rate tightening cycle, which has provided the return trajectory from the relative historic extreme that most participants had ignored going into this year.

The long and short of things: we continue to favor long-term Treasuries and precious metals as we expect the leathered year-old saddle range to be broken in yields through the balance of summer, releasing another bull charge in gold.

Copyright © Market Anthropology