by Ben Carlson, A Wealth of Common Sense

“The nature of human psychology is such that you’ll torture reality so that it fits your models, or at least you’ll think it does. To the man with only a hammer, every problem looks like a nail.” – Charlie Munger

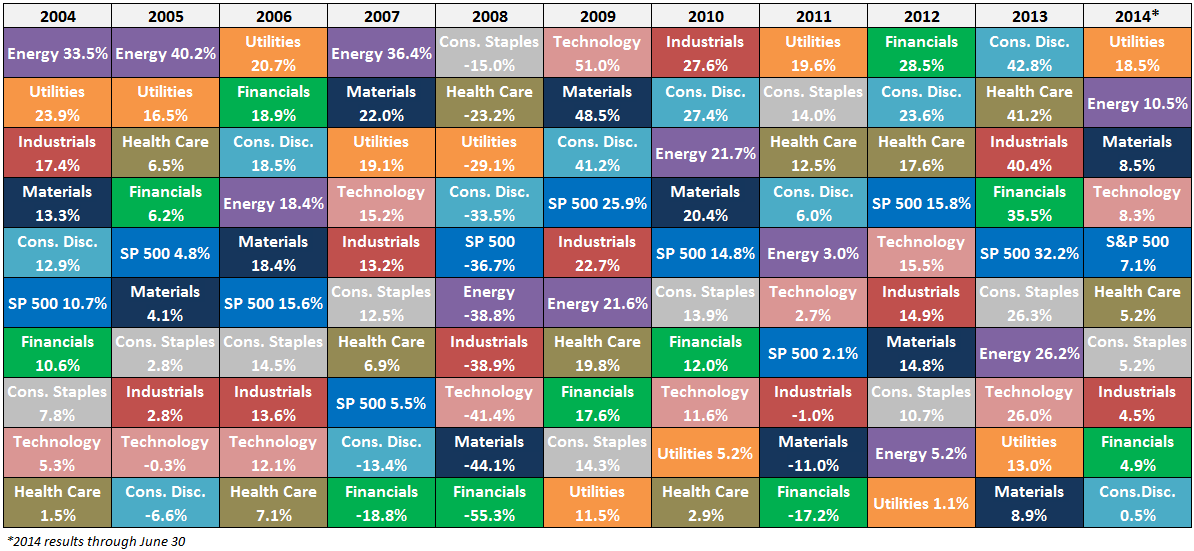

A few months ago I wrote a post about the S&P 500 sector quilt which you can see here updated through June 30, 2014 (click to enlarge):

Because of the wide range in sector returns from year to year I received a number of emails from people asking if I thought it made sense to simply own each of the individual sector ETFs and rebalance periodically to take advantage of this.

So I went back and looked at the numbers to see what an equal-weighted portfolio of these 10 S&P 500 sector ETFs would have looked like. From the beginning of 2004 through June 30 of this year the S&P 500 was up 7.7% per year. An equal-weighted portfolio of the sector ETFs rebalanced annually was actually up 9.2% per year, an annual outperformance of 1.5%.

(Wait why am I sharing this? I should be taking this idea to every fund company in the country and pitching a new equal-weighted sector ETF to play up the smart beta trend.)

Not bad. So that means this strategy is a no-brainer, correct?

As with any backtested results there are a plenty of caveats.

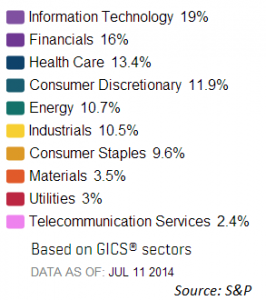

Here are the current sector weights in the S&P 500:

By running an equal-weighted portfolio of these sectors you are essentially saying you would like to overweight telecomm, utilities and materials and underweight technology, financials and healthcare.

While the current weightings are in no way static over time, some of these sectors are simply smaller industries while others play a larger role in the economy. And it’s difficult to predict with any certainty which ones will rise and fall in the future.

Certain areas like technology and financials have gotten far too large in the past and subsequently fallen back to earth, but there’s nothing that says any or all of these sectors will experience huge reversion to the mean as far as their weights go.

For example, utilities were one of the best performing sectors in this particular period, returning over 10% a year. But the utilities weight in the S&P didn’t really change much in that time staying right around 3% the entire time. Plus the performance was aided in large part by a drop in interest rates as utility stocks are primarily high dividend-payers because of the way the companies are structured (so lower rates made their dividends look more attractive).

This equal-weighted strategy was also lucky enough to underweight financials which have performed terribly since 2004 (basically a 0% return). Who knows if that will continue.

A few other considerations for this and all backtested strategies:

- How much tracking error from the index are you willing to accept with this strategy because there would be periods of over and underperformance?

- Is there a legitimate reason for this outperformance to persist?

- Does this backtest take into account taxes, fees and trading expenses?

- Would I have had the intestinal fortitude to stick with such a strategy and rebalance in the past?

- Would it have made sense at the time to invest this way without the aid of hindsight?

- Doe this strategy make sense going forward or is this a case of data-mining?

- Is the increased complexity of this strategy worth the extra work and potential stress that it will take to execute?

Of course there are ways to improve upon the performance of the S&P 500. But it’s not easy. Plus much of the historical data you see on many strategies look great on paper, but only in hindsight and were never implemented in actual portfolios in real-time.

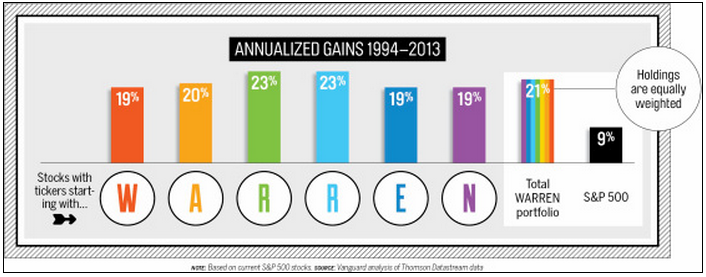

Vanguard had some fun with this a few months ago when they discovered that a portfolio of stocks chosen exclusively by the first letter in the ticker using the word “Warren” would have substantially outperformed the market. CNN Money’s Pat Regnier created this graphic on the WARREN portfolio:

Basically, if you’re going to tilt your investments away from any established index make sure your strategy (1) is based in reality, (2) takes into account net performance after all taxes fees and trading costs, not simply gross returns and (3) is a repeatable process you can use in the future over multiple investment cycles.

Even then you’re not guaranteed to outperform the S&P 500.

Source:

One weird trick that will help you beat the market like Warren Buffett (CNN Money)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense