by Cam Hui, Humble Student of the Markets

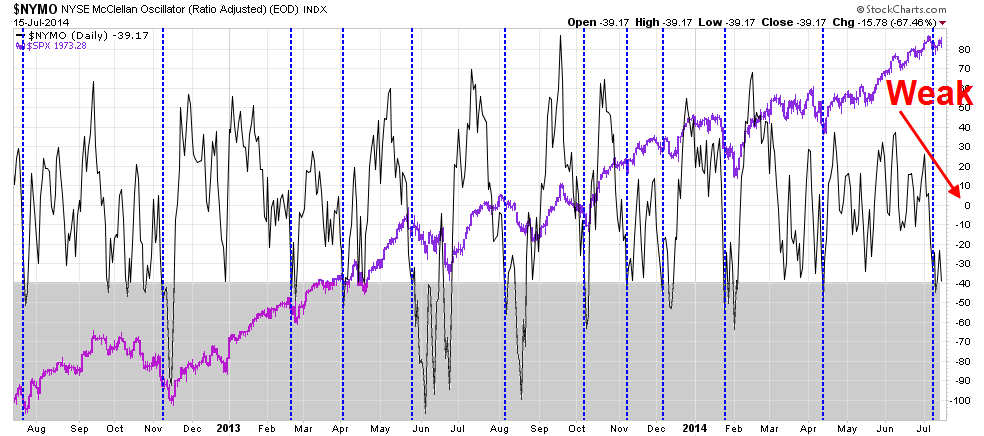

This is a quick short-term note for swing traders and not addressed to intermediate or long-term investors. I took a look at the NYSE McClellan Oscillator (in black) after the close today and I was surprised to see how weak the reading was:

Such weak breadth readings are more consistent with markets that are pulling back, not with a market that came within a few points of all-time highs today. As well, when I analyze the absolute levels of the McClellan Oscillator over the last two years, these levels are more typical of the bottom of minor corrective periods (shown as vertical lines) or the start of a minor pullback.

Given these kinds of negative divergences, the weight of the evidence suggests that US equity markets are likely to see a minor (1-2%) pullback in the next week or so. Nevertheless, I remain bullish on an intermediate term basis (see my recent post The good stock market mania).

Copyright © Humble Student of the Markets