by Roger Nusbaum, ETF Strategist, AdvisorShares

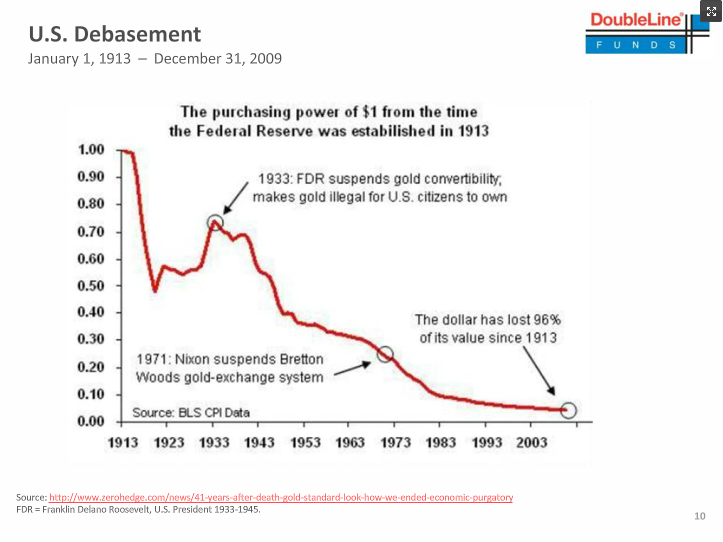

Jeff Gundlach from DoubleLine Funds gave an interesting presentation (you’ll need to register through the DoubleLine home page) a couple of weeks ago about currency debasement of the US dollar which should, by Gundlach’s reckoning, be bullish for gold.

The first slide captures the last 100 years but Gundlach goes into detail on the call about this pattern repeating many times through the course of history.

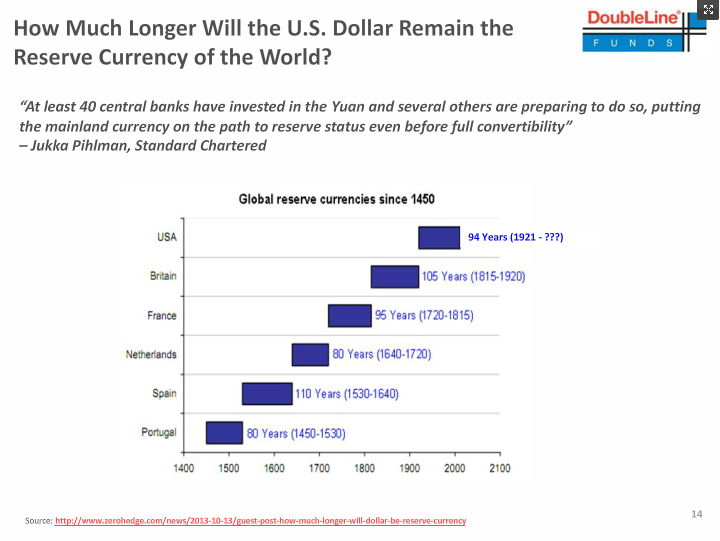

Also relevant to Gundlach is the history of global reserve currencies; currencies don’t keep that status very long and the US dollar is well within the time frame where something could change.

The scope here is not to try to predict a monumental change in the global currency market (the Chinese renminbi is a controlled currency and the euro concept has proven to be very flawed and there aren’t any other currencies anywhere near big enough to be the global reserve) so much as to isolate the point that Gundlach is making which is that currency debasement should be favorable for the price of gold.

Copyright © AdvisorShares