by Ben Carlson, A Wealth of Common Sense

“Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market.” – Warren Buffett

A good starting point to gauge investment performance is to compare your results against a simple buy and hold portfolio.

While there are certainly ways to improve the performance of buy and hold, there are many more ways to make it much worse. You have to determine if the effort and actions you take with your portfolio strategy are worth it when compared to this simple (but not easy) alternative.

Investors generally fare much worse than buy and hold so this is an important decision for the average investor to consider.

When you hear about the average long-term gains of 9-10% in the stock market you must remember that those returns contain every single type of market environment. That means high valuations, low valuations, high interest rates, low interest rates, high inflation, low inflation, bubbles, recessions, booms, busts and everything in-between.

It’s an all-inclusive number that contains the good and the bad.

The anonymous blogger at the Brooklyn Investor shared their thoughts on this recently:

In order for people to have earned 10%/year in the last 100 years, you had to own it through the depression, through war and peace, when p/e’s were 7x and when p/e’s were 30x. The point is that most people would not have been successful getting in and out of the market and doing better than 10%/year, even if you used market valuation levels (instead of economic forecasts). 10% returns were not earned by being fully invested at 7x p/e, 50% invested at 15x p/e and 0% invested at 25x p/e or anything like that.

Another way to illustrate this is if you look at something like Berkshire Hathaway. BRK has gone down 50% three times in the past (or maybe more). Once in the early 1970′s, once in 1999 and then again during the recent crisis. Of all the investors who owned BRK in 1970, how many have done better than the 20% or so return of the stock over the years by getting in and out of it in order to avoid the 50% drawdowns? There may be some who were able to improve on that buy and hold. But I doubt that there are too many people, even if they used very good valuation methods to time the sales and repurchases.

So that’s sort of the way to look at the market. As long as you have faith in the U.S. and the system at work here, you can look at the stock market in the same way. Most people who sound clever now telling us what the market is worth and getting in and out accordingly is probably not going to outperform the market over time. They will look good temporarily when the market goes down, though.

Obviously, there are important factors to consider for even the simplest portfolios — time horizon, risk tolerance and spending needs to name a few. But with the correct perspective and a long-term mindset, to get even average market returns requires living with periodic drawdowns.

It’s an unavoidable byproduct of earning a risk premium…even for the world’s greatest investor.

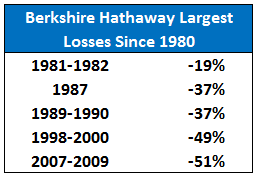

The Brooklyn Investor’s commentary on Buffett led me to do some digging into the largest Berkshire Hathaway losses. I went back to 1980 and here’s what I found:

Roughly every 6-7 years, Buffett’s investment vehicle suffered a rather large crash in its stock price. Yet since 1980 the stock compounded at a rate of 21% per year, good enough to double your money every three-and-a-half years.

Any example involving Buffett is a bit extreme, but it shows that earning higher returns in the stock market come with a price. And these losses are very similar in magnitude with what you can expect from the overall market at times. The same is true of any investment that offers the potential for larger long-term gains.

Investors are constantly asking themselves, “How can improve my investment performance?”

This is a worthy objective when it entails improving your behavior or process.

But what most people should be asking is, “How can I not do any worse?”

Can you create much better results than a buy and hold strategy? Yes, of course. It’s very possible but not necessarily easy (mostly because of psychological reasons).

But can you do much worse than buy and hold?

Definitely. And it’s very easy.

Source:

What to do in this market II: Gotham Funds (Brooklyn Investor)

Further Reading:

Buffett in the Down Years

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs